Market Segment

February 14, 2017

Chinese Steel Market Analysis for the Week Ending February 12th

Written by John Packard

The following analysis of the steel markets in China is from Beijing Metal Import & Export Co.,Ltd and is being reproduced by Steel Market Update with permission. We edited the original copy to assist our readers in understanding what the group is trying to relay to us. Here is what they had to say (edited version):

Please allow me to update China steel market (Feb 06 – Feb 12, 2017) as usual as following:

We mentioned in our last weekly report that China’s central bank surprised the market on the first working day (Feb 03,2017) of the year of the Rooster by raising lending rates to banks, a 10 basis point rise in the interest rate of open-market operations. This policy was obviously out of market expect [unexpected], causing the Futures Market to dropped heavily [decline]. But I also said the decease would not last a long time as the Futures market dragged the spot market to fall and the main steel mills still kept their EXW prices unchanged.

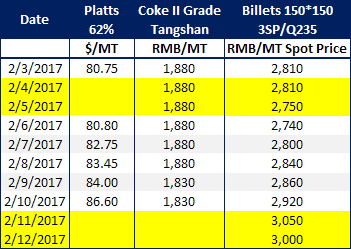

As I expected, spot market turned firm beginning last Tuesday. Iron Ore Platts 62% index already stood at USD86.6/mt which is highest price from Jan 01,2016! Billets touched RMB300/mt last Saturday. Today morning Futures market still very firm so trust Billets price will get to [go] above RMB3100 today or tomorrow. Below daily prices of Platts 62% index / Coke / Billets for your information.

Market is very firm, I think the reasons as following:

1: Futures market turned firm and still on firm trend.

2: Main steel mills like Shagang/Hebei Group issued new prices for 2nd ten days of Feb and new prices give big support to spot market. Shagang’s prices was unchanged but Shagang gave RMB120/mt subsidized price to agencies for the shipment of third ten days of January and first ten days of February; Heibei Group increased Wire Rod/Debar by RMB150/mt.

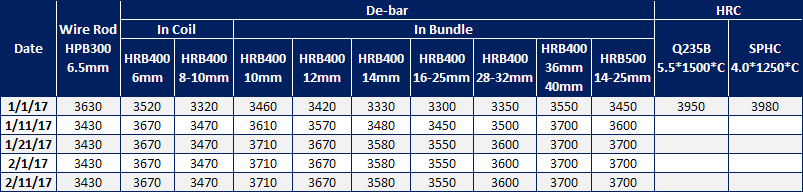

Below RMB prices list of Shagang just for your reference, please note prices are for domestic market, VAT included. (Click to enlarge)

3: Transactions is turning more active. During the Chinese Spring Festival, spot stock was turned bigger than before [higher], traders need to low down [reduce] their stock in order to get cash and book new cargo from mill, hence market was expecting to go up so they can sell cargo at a good price level.

Maybe you are asking how long the increase will last? Personal idea is that it will not last long time! As mentioned in our last weekly report, coke price dropped by RMB50/mt again in last week. Compared to Iron ore, coke price already give big pressure to market. Every time Coke drops market will follow. Also in fact Shagang lowed down [lowered] their EXW prices (Shagang gave RMB120/mt subsidized price to agencies for the shipment of third ten days of Jan and first ten days of Feb, hence traders’ cost was lowed down).

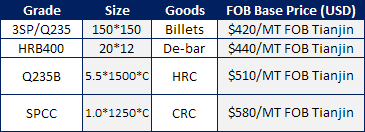

For export, below our offer TODAY just for your reference. KINDLY PLS NOTE MARKET CHANGES VERY FAST, OUR OFFER WILL BE ADJUSTED ACCORDING TO MARKET LEVEL.