Prices

February 9, 2017

Shorter Lead Times, Auto Inventories Affecting Futures Markets

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

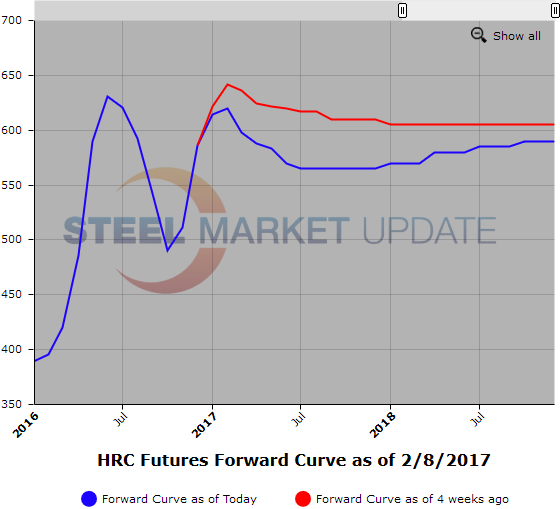

HR futures consolidate in quiet trading week as the market absorbs the anticipated first decline in the HR index since the $2 decline on January 4th. With spot prices reportedly trading at lower than advertised pricing, market participants are trying to gauge the index lag. Couple of drivers adding caution to this market: softening lead times and growing auto inventory levels which are currently well above the ideal 65 days of supply.

This past week nearby futures months declined slightly while the 2H’17 rose fractionally. Jun/Jul’17 prices moved the most this week as they declined just over $5/ST leaving the Q2’17 still valued $15 above 2H’17. Bids have been sporadic and sellers have been patient which explains the lighter trade volumes. Focus will clearly be on next week’s index to gauge velocity of price changes and domestic scrap prices.

Another modest volume week as 11,366 ST of HR futures have traded this past week in most periods in calendar 2017. Recent trades: $593/ST[$29.65/cwt] traded in Mar/Apr’17 this past Thursday along with $580/ST[$29.0/cwt] traded in May/Jun’17. Friday Jun/Oct’17 traded at $570/ST[$28.5/cwt] in 2,500 ST and Jun/Aug’17 traded at $568/ST [$28.40/cwt] in 2,960 ST. Monday Aug’17 traded at $567/ST[$28.35/cwt] and 2H’17 traded at $565/ST[$28.25/cwt]

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

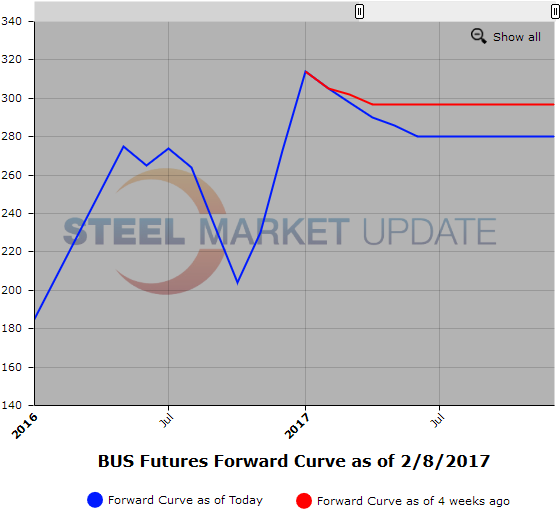

Scrap

LME scrap prices have stalled the last day or two as the market waits for higher cargo trade prices for verification of next move higher. Markets waiting to see if the return of Turkish domestic steel demand will create a bump in scrap demand from Turkey. The index last reported at $249/MT with March futures $260/$270 per MT. The slight contango remains out through year end ($260/$275 per MT).

Interestingly BUS last week was reportedly expected to follow the export scrap market lower but has bucked the trend and is expected to come in slightly lower to flat to last month. A number of dealers are also looking for prices to move higher in March. How quickly market sentiment can change. Additional rolling capacity being added in Central and south regions could bump scrap demand and potentially pressure prices.

Nearby BUS interest has been tepid as levels too high for buyers and not high enough for sellers given current scrap volatility. Market has been more focused on farther out dates. Current offers in 2H’17 BUS coming in around $285/290/GT, and in Cal’18 at about $280/GT.

The arbitrage between HR and BUS is now offered at $300 ton for ton for 2H’17 through Cal’18.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.