Prices

February 5, 2017

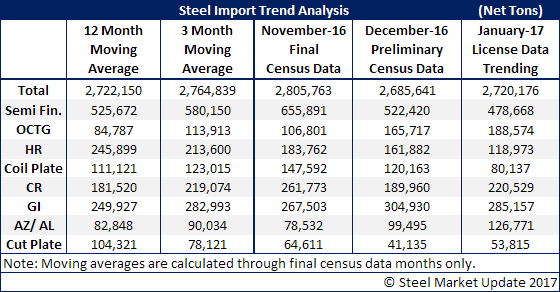

January Foreign Steel Import Trend at 2.7 Million Tons

Written by John Packard

The U.S. Department of Commerce provided updated license and census data which indicates foreign steel imports are trending lower. December imports of foreign steel are totaling 2,685,641 tons while January is trending toward 2.7 million tons based on license data through the end of the month.

Items that are trending lower are:

Semi-finished steels of which the majority are slabs headed for the domestic steel mills. The December tonnage is down to 522,420 tons and January is trending slightly lower at 479,000 tons (net tons). The twelve-month moving average (12MMA) is 525,672 tons while the three-month moving average (final census data only) is 580,150 tons.

Hot rolled has been trending lower with 161,882 tons in December and January trending toward 119,000 tons. The 12MMA is 245,899 tons and 3MMA is 161,882 tons.

The three flat rolled products that are of concern to the domestic steel mills are cold rolled, galvanized and Galvalume.

Cold rolled imports in December totaled 189,960 tons and the January trend is for CRC imports to exceed December with 220,529 tons. The 12MMA is 181,520 tons and the 3MMA is 219,074 tons.

Galvanized imports for December totaled 304,930 tons which is approximately 100,000 tons greater than December 2015. The January foreign steel import trend is for GI to reach 285,000 tons which is about 60,000 tons greater than January 2016. The 12MMA is 249,927 tons and 3MMA is 282,993 tons.

Galvalume (other metallic) imports have been rising with 99,495 tons in December and January poised to go as high as 127,000 tons. The 12MMA is 82,848 tons and 3MMA at 90,034 tons.

Both Coiled Plate and CTL (cut-to-length) plate imports are shrinking.

Items that are trending higher are:

OCTG – oil country tubular goods which had 165,717 tons imported into the U.S. in December and we are looking at even more tons (188,000 tons) during the month of January.