Market Data

February 1, 2017

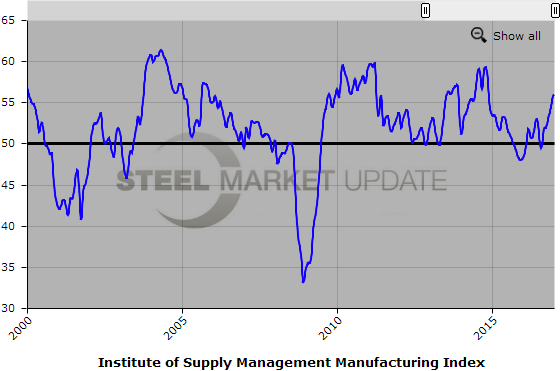

ISM PMI Shows Business Growing

Written by Sandy Williams

The ISM Report on Business indicates expansion of economic activity in the U.S. manufacturing sector and a 92nd month of growth for the overall economy.

The Institute for Supply Management report showed the January manufacturing PMI at 56 percent, an increase of 1.5 percentage points from December. Almost all of the components of the PMI increased in January. New orders gained 0.2 point to register 60.4 percent while production was up 2 percentage points to 62.4 percent.

Supplier deliveries slowed somewhat in in January at a reading of 53.6, up from 53.0 in December. In the case of supplier deliveries a score above 50 indicates slower deliveries while below fifty indicates faster deliveries. The backlog index registered at moved up 0.5 percentage points to 49.5 but remained in contraction for the seventh consecutive month.

Inventories of raw materials continued to contract in January but gained 1.5 percentage points to register at 48.5. Primary metals, fabricated metal products and transportation equipment were among the five industries reporting higher inventories in January. Customer inventories declined a half percent to register at 48.5 in January which indicates customer inventories were considered too low for the fourth consecutive month. Fabricated metals and transportation equipment industries reported customer inventories as being too high in January.

The Prices Index gained 3.5 points to register 69 percent indicating rising prices for raw materials. Raw material prices have increased for 11 straight months.

Employment levels made gains in January. The index rose 3.3 percentage points to 56.1.

The import index registered 50 percent from 50.5 in December indicating no change from December. New export orders grew for the 11th consecutive month, remaining in expansion at 54.4 percent although slowing by 1.5 points from December.

Respondents had the following comments:

- “Demand very steady to start the year.” (Chemical Products)

- “January revenue target slightly lower following a big December shipment month.” (Computer & Electronic Products)

- “Business looks stronger moving into the first quarter of 2017.” (Primary Metals)

- “Sales bookings are exceeding expectations. We are starting to see supply shortages in hot rolled steel due to the curtailment of imports.” (Machinery)

- “Year starting on pace with Q4 2016.” (Transportation Equipment)

- “Business conditions are good, demand is generally increasing.” (Miscellaneous Manufacturing)

- “Conditions and outlook remain positive. Raw material prices are stable resulting in stable margins. Asset utilization remains high.” (Petroleum & Coal Products)

- “Steady demand from automotive.” (Fabricated Metal Products)

Below is a graph showing the history of the ISM Manufacturing Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.