Prices

January 26, 2017

Hot Rolled Futures Settle Up $28/Ton

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As the Flack Global Metals director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Markets website www.FlackGlobalMetals.com.

Note that Flack Steel has changed their name to Flack Global Metals as a way to reflect recent acquisitions that include Consolidated Metal Products and JD Steel Products. You can learn more about Flack Global Metals and their use of the futures markets by visiting their website or reading their press release here.

LME Turkish scrap futures have been tumbling in the past week. Today’s index print of $236 is down 17% in two weeks! This rout has been pressuring domestic scrap prices lower and is something to pay close attention to.

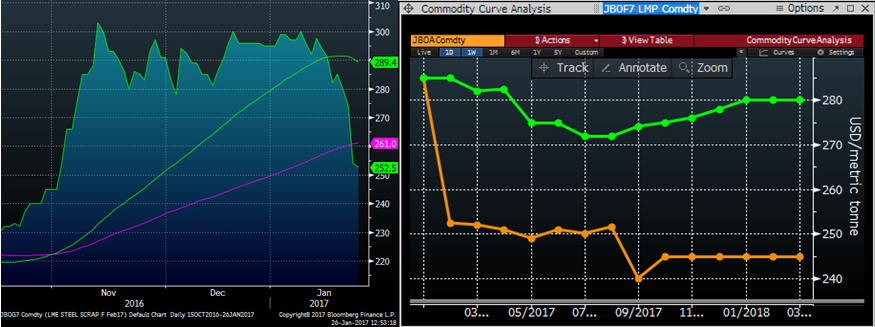

The chart on the left is the LME February Turkish scrap future while the chart on the right shows the Turkish scrap curve (orange) versus the scrap curve one week ago (green).

Paradoxically, the SGX iron ore prices reached new recent highs with the February future’s price closing at $82.46/t. The iron ore futures curve, on the right, gained vs. last week.

This divergence is interesting and how the two raw materials will influence the other could be a major driver for the Midwest HRC price in the short term. Especially, considering China will close for two weeks to celebrate the Chinese New Year starting tomorrow.

On the domestic front, January CME Midwest HRC futures settled the month at $614/st, up $28/st or 4.7% MoM. Some of the domestic steel indexes have printed higher this week with the SBB Platts index printing and maintaining $630. February Midwest HRC futures closed at $630/st last night. The curve didn’t move much for the week with only a slight week-over-week gain in April and May.