Prices

January 17, 2017

January Import Trend: No Pull-Back

Written by John Packard

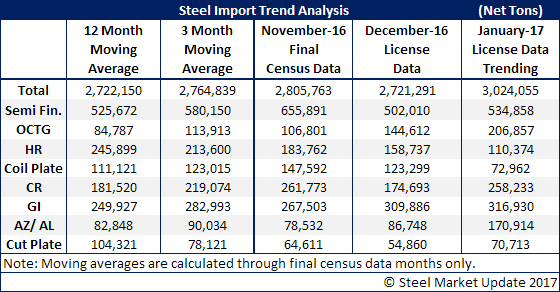

Late today the U.S. Department of Commerce released updated foreign steel import license data for the months of December and January. Since we are now half way through the month our interest is mainly with the month of January as we are trying to determine if there is any pull-back in flat rolled steel tonnages.

In the case of hot rolled the answer appears to be yes, tonnages are trending much lower than the 12 month moving average as well as the three month moving average. As of the 17th of January HRC imports are trending toward just over 100,000 net tons.

When looking at cold rolled and coated steels we continue to get different results.

Cold rolled imports are trending toward exceeding both the 12 month and 3 month moving averages. At the moment CR is trending toward exceeding 200,000 net tons and could be up 50,000 to 75,000 tons above December levels.

When looking at the countries exporting CR to the United States on first blush those affected by dumping suits and circumvention challenges seem to be ignoring the duties/possible ramifications associated with complaints filed by the steel industry. Vietnam already has requested 45,000 net tons of import licenses for January. If this pace continued for the balance of the month Vietnam would set a record for the most tons of CR exported to the United States during the past 14 months (which is what the SIMA site shows). Vietnam is on pace to be the biggest supplier of foreign cold rolled doubling what is on pace to come from Canada and Mexico combined…

Vietnam also continues to ship galvanized to the United States (circumvention suits be damned) with 11,000 net tons of license requests in for January (in December Vietnam requested 20,000 net tons of licenses).

Countries affected by AD/CVD orders such as Taiwan (12,700 net tons), Korea (17,200 net tons) and India (12,200 net tons – assumed to be Uttam which has a lower rate than the other Indian mills).

The net result is galvanized imports are on pace to exceed 300,000 net tons which would be above both the 12 month and 3 month moving averages. It would also be the second month in a row as the December license data is suggesting a 309,000 net ton month.

Then we look at “other metallic” most of which is Galvalume steels. License requests as of the middle of January already exceed almost every full month over the past fourteen months. I will let the data speak for itself.

Why is this happening? Our opinion is the domestic mills have left the door wide open by expanding the spread between hot rolled and cold rolled/coated steels. When you combine that with the value of the U.S. dollar then there is plenty of room to absorb any duties.