Prices

January 12, 2017

Strong Week for Ferrous Futures

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

This week, China announced plans to close all illegal substandard steel production by the end of this June. According to Macquarie research, “industry estimates suggest total capacity from this type of furnace is as high as 110-120 million tons per year, although their capacity utilization is generally low, only 30-50% last year.” Iron ore futures have rallied to new short-term highs with February SGX (Singapore Exchange) futures closing at $78.25/t.

The upside price risk associated with plans for more aggressive capacity curtailment of Chinese steel production, similar to actions taken against coking coal miners last year, is something that every member of the U.S. steel and manufacturing industry should be aware of. Especially considering the ultra-low inventory levels reported across the MSCI Service Center, ISM PMI and Durable Goods reports.

The division of the N.D.R.C. making this statement also promised further production curtailment plans to be announced prior to the Chinese New Year coming up this January 28th. The report explained the Chinese government’s plan to reduce steel overcapacity by continuing to shutter capacity through 2017 and then enter into a two year industry wide consolidation.

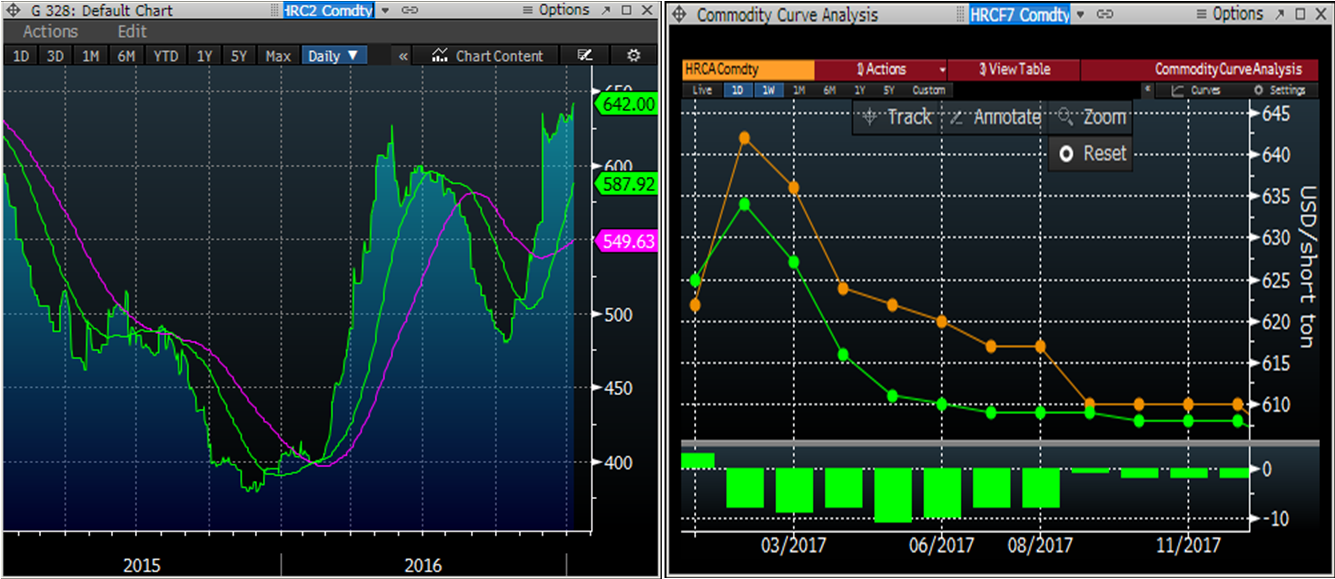

Strong economic fundamentals, domestic steel mill price hike follow through and rallying raw materials are pushing Midwest HRC futures prices to new recent highs. Today, 1400 short tons of February futures traded at $644/st while 1400 short tons of March traded at $634/st. Most of the curve has shifted higher this week. Open interest continues to contract; now at only 265,500 short tons.

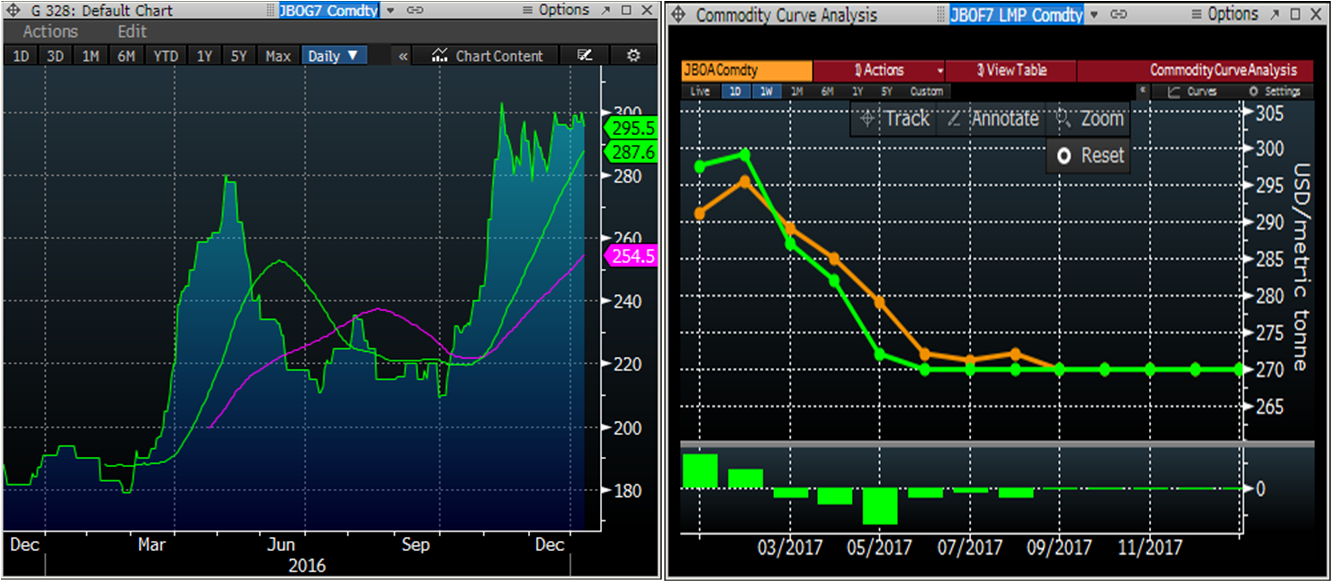

January was a strong month for scrap prices. LME Turkish Scrap remains range bound between $280 and $300/mt. The front of the curve fell slightly while Q2 saw gains. With almost 14 months under its belt, the LME Scrap future is booming with open interest as of Monday reaching 283,900 mt.