Prices

January 12, 2017

Scrap Exports from the US through November 2016

Written by Peter Wright

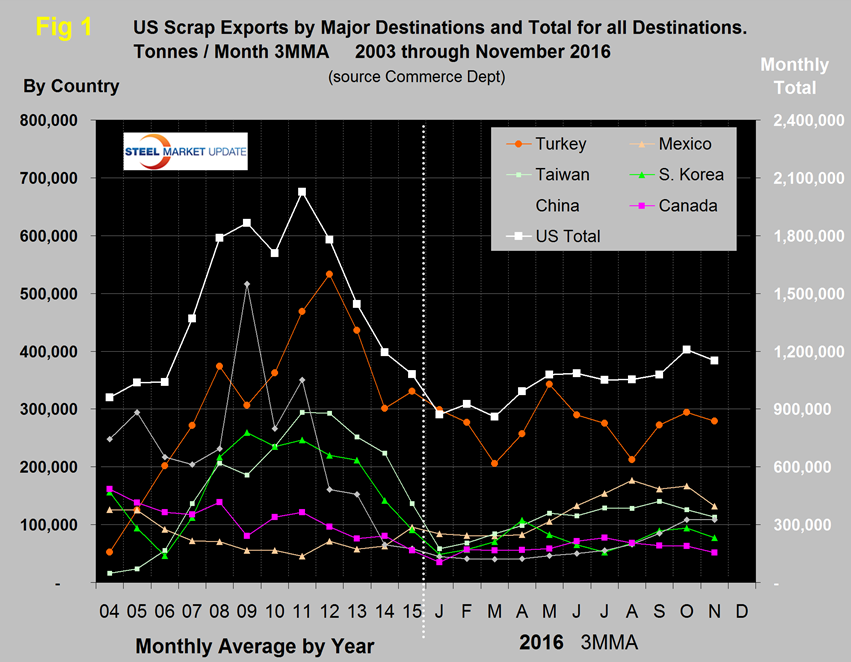

In the first eleven months of 2016, total ferrous steel scrap exports were 11,428,000 tonnes, down by 11.8 percent from the first 11 months of 2015. The tonnages shown in Figure 1 are based on three month moving averages for 2016 and on the annual monthly average for previous years.

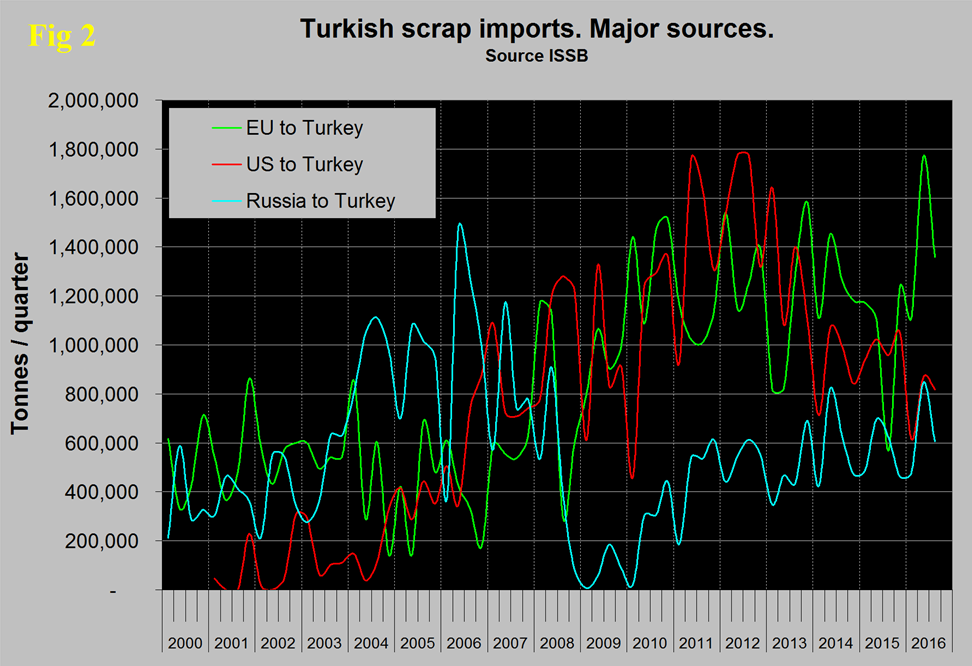

The graph shows that exports declined for four consecutive years, 2012 through 2015 continuing through the 1st Q of 2016 and have picked up since then. Exports in the single month of November were 1,123,000 tonnes with Turkey taking the most volume with 286,000 tonnes. There has only been one month since March 2015 in which Turkey wasn’t the major destination. On January 12th AMM reported that there had been no shipments to Turkey since December 16th as their buyers focused on more affordable European material. Figure 2 shows the historical shipments into Turkey from the US, the EU and Russia quarterly since 2000. As the Euro has weakened, the EU has taken an increasing share and has surpassed the US for most of the last three years.

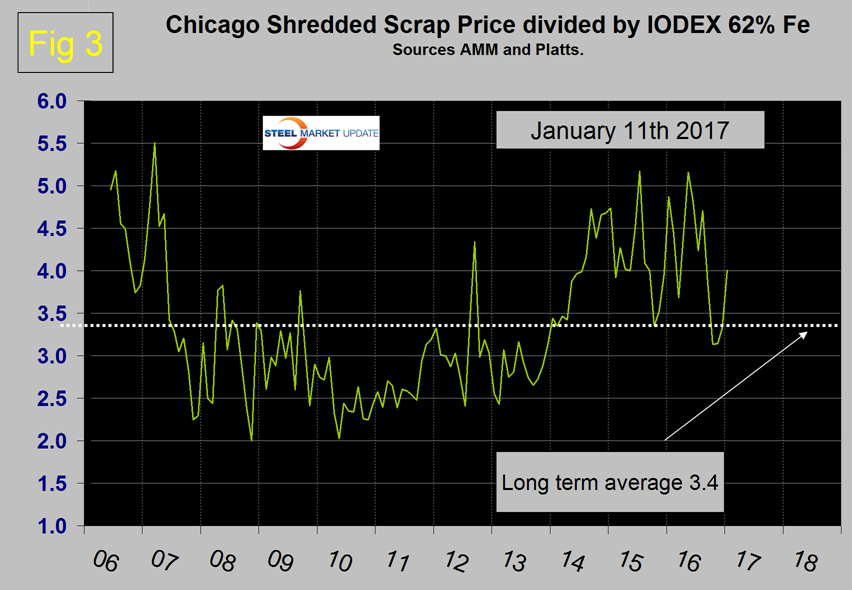

The global price and volume of scrap trade is affected by the scrap to iron ore price ratio which has been on a roller coaster since late 2013. Figure 3 shows this ratio as the price of Chicago shredded divided by the price of 62 percent Fe ore fines delivered North China.

This ratio was highly advantageous to the integrated producers for most of 2015 and 2016 but in the 4th Q of 2016 fell below its long term average. January has seen a recovery to 4.01. The point is that when the ratio was high it was advantageous for Turkey’s EAF mills to buy semi-finished out of China rather than to operate their own furnaces. According to the Turkish Steel Producers Association the capacity utilization rate of Turkey’s EAFs dropped by almost 10 percent to 51.7 percent in 2015, as Turkish BOF capacity utilization increased by 6.5 percent to 95.5 percent. The discrepancy between the iron ore price and the price of scrap made BOF production more attractive. China has the same situation except that their industry is 93 percent BOF and they flooded Turkey and others with low cost Chinese slabs and billets.

US scrap exports to the major Far Eastern buyers YTD were down by 6.2 percent year over year as the depreciated Yen allows Japan to pick up share in that region. Exports to Canada were up by 6.2 percent YTD and up by 18.9 percent to Mexico. Countries exceeding a million tonnes YTD through November were India (1.07m), Mexico (1.36m), Taiwan (1.2m), and Turkey (2.86m). South Korea fell out of this club in 2016 and is down by 27.5 percent YTD.

Scrap export prices are reported by the AMM every week for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. In the 3 months October 5th through January 11th the East coast price was up by $81.50 to $278 and the West coast was up by $62 to $265.