Prices

January 8, 2017

SMU Survey: Higher Steel Prices Coming in New Year

Written by John Packard

The steel buyers and sellers of steel who responded to our first flat rolled steel market trends survey of the New Year foretold the move by AK Steel to raise flat rolled steel prices late on Friday.

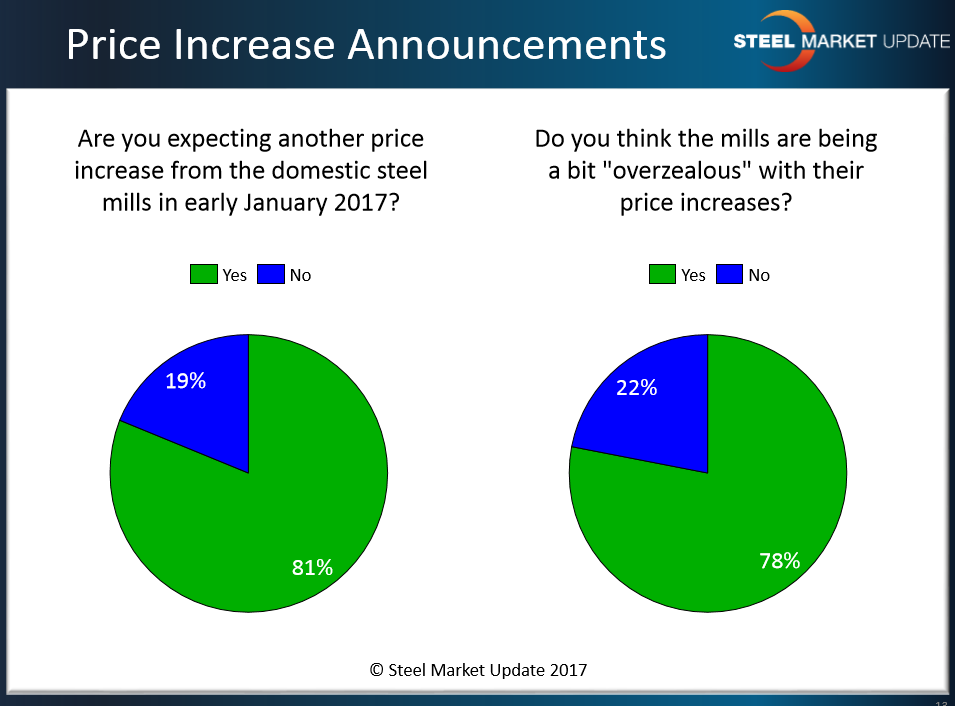

Eighty-one percent of the respondents reported that they were expecting another flat rolled steel price increase (the 5th in the current market cycle) early in January 2017. At the same time, 78 percent of those responding felt the domestic steel mills were being a bit “overzealous” with the pace of the increase announcements.

Comments Made by Those Responding to Price Increase Question

“Order books are strong, lead times extending, inventory levels are in check, little to no imports and raw materials pricing is headed up = more price increases.” Steel mill

“I anticipate the mills will continue to push increases and then we will see another slide in the market similar to 2016.” Manufacturing company

“They never know when to stop.” Manufacturing company

“Lead times are still short. Depends on what scrap does this month.” Service center

“Possible – Plate has increased $190/t since Nov 07, 2016 – If demand increases – Scrap goes up – Inventories need replacing – lead- times stay out – I would expect to see another increase in the next 30 – 45 days. The stars need to align.” Service center

“Although this is not a good idea – stability would be significantly better for the market.” Service center

“Uncertain at this time. With no real activity during the holiday week it will take some time to see what is happening in the marketplace.” Supply house

Comments Made to Question about Steel Mills being “Overzealous” with their Increase Announcements

“They need to be careful they do not raise prices to the point where the steel purchasers market will limit purchases to supply definite orders for end user products. Lead times will be critical in this equation.” Supplier to the Industry

“Insufficient import competition helps the cause.” Trading company

“Not yet [being overzealous]. They realize that they are able to get another increase. No imports. Input costs are up.” Service center

“Time will tell if the mills have to cut prices as they did in 2016. What comes around goes around.” Manufacturing company

“The mills just continue to repeat past history.” Manufacturing company

“Business is business and you take what you can when you can and give back when you need to.” Service center

“Very much so! Had one supplier give me a price $3.00/cwt. over their announced price increase and the response I got was because we can right now!” Service center

“NO [not overzealous], they know to make money when they can.” Manufacturing company