Market Data

January 3, 2017

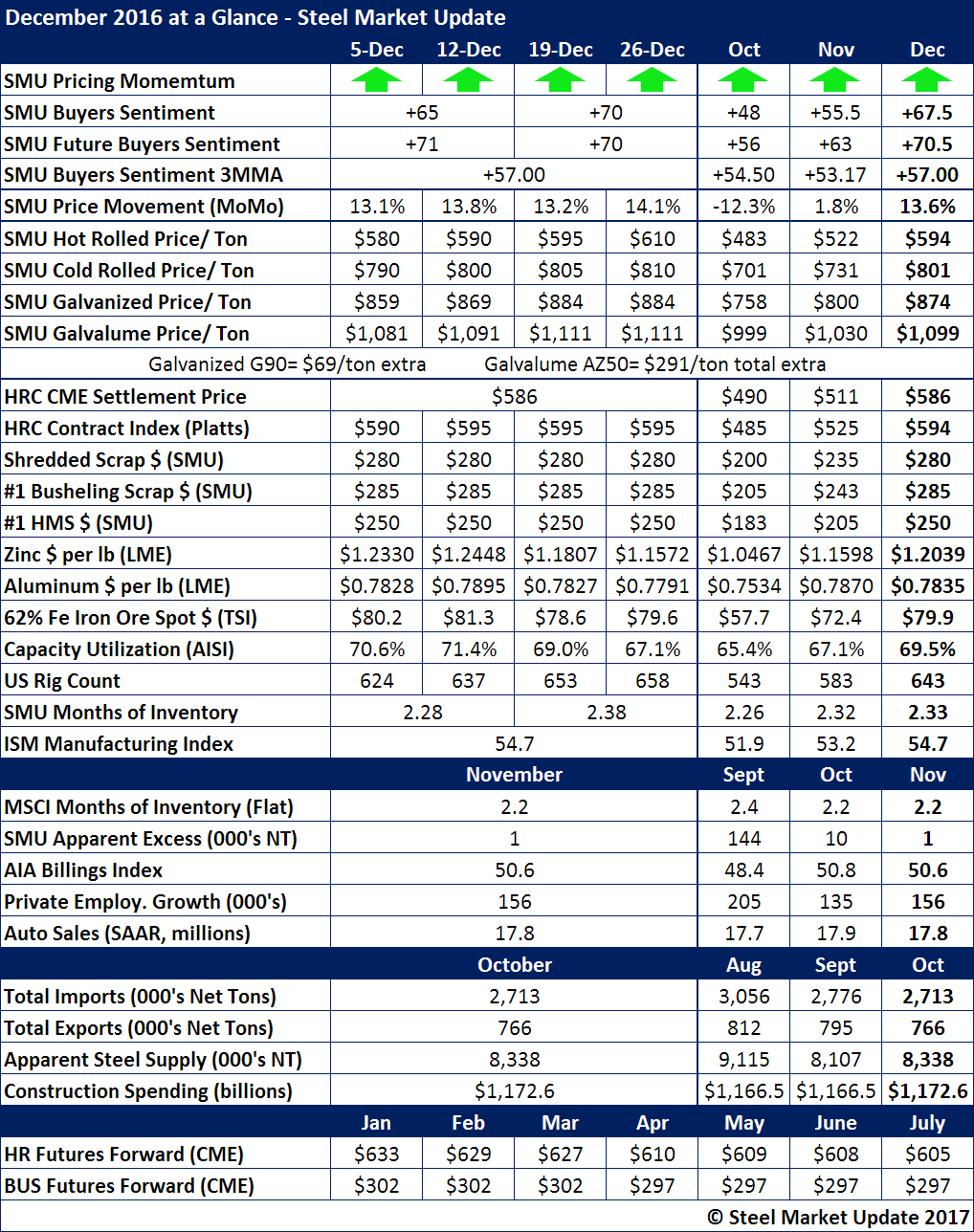

December 2016 at a Glance

Written by John Packard

The last month of the year was a strong one based on the data we just reviewed and have shared with you in the table at the end of this article.

SMU Price Momentum Index finished both the month and the year pointing toward higher prices in the coming 30 to 60 days.

Our Sentiment Index also finished strong for the month and both single data points and our three month moving average are trending higher.

Flat rolled prices have been moving higher in each of the past three months. Our $594 per ton average for the month of December was the same as Platts and slightly higher than the $586 per ton number that the CME Group settled HRC futures on.

Many of the steel inputs such as iron ore and scrap were higher in December than the prior months. This included zinc which averaged almost $0.05 per pound more than what we saw for the month of November. Iron ore averaged $79.9/dmt for the month and all of the scrap items saw increases of at least $40 per gross ton.

Rig counts (energy markets) rose and averaged 643 rigs which is 60 rigs better than November and 100 rigs better than October.

Inventories remained tight at the domestic steel service centers with MSCI reporting flat rolled at 2.2 month’s supply and SMU reporting our Apparent Excess as only being 1,000 tons. The lower inventories will keep pressure on the mills to increase prices.