Prices

December 29, 2016

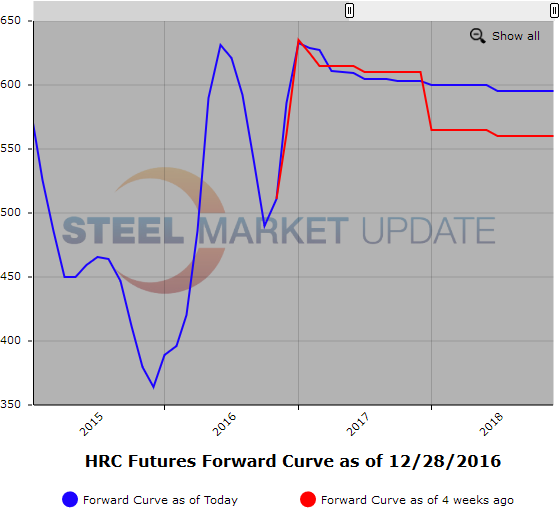

Hot Rolled Futures: Thin Trading Due to Holiday Week

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel Futures

HR futures have been quiet going into the holiday week as reflected both in the curve values and in the spot market.

Futures volumes for the past week have been mainly in the early 2017 periods with 10,120 ST trading. The bulk of the deals going through have been calendar spreads with steep backwardated transaction prices. Q1’17 HR traded @ $626/ST and Q2’17 HR traded @$600/ST. The trade prices reflect a very bearish view between Q1’17 and Q2’17.

Bids have been thin of late but perhaps another price hike will bring them back. The question is how long will this supply constrained push higher last given some near term demand concerns on the horizon.

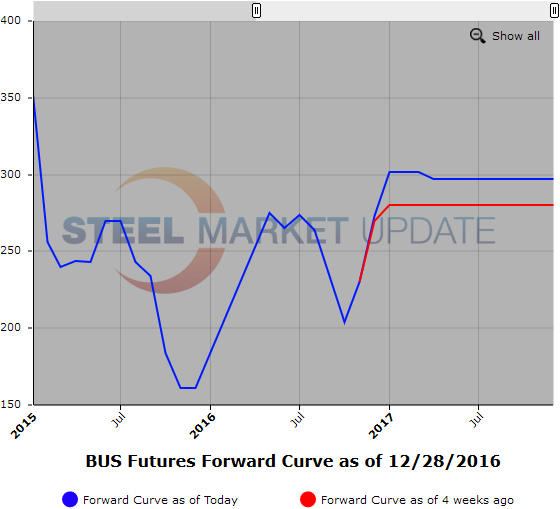

Market participants are waiting for the next mill price increase announcement which has been bolstered by early market chatter that BUS prices will increase $40/$50 per GT and the fact that the mills have basically captured their last price increase.

HR indicative curve

Spot $599

Q1’17 $630

Q2’17 $610

Q3’17 $605

Q4’17 $603

Wishing you & yours all the best for 2017!

Below are two graphs showing the history of the hot rolled and busheling scrap futures forward curves. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.