Prices

December 29, 2016

2016 Flat Rolled Steel Pricing Review

Written by John Packard

We are but a few days away from the beginning of the New Year. We thought it prudent as we plan for 2017 that we take a look at what transpired with flat rolled steel prices over the course of the past 12 months. Because the market “bottomed” in December 2015 we have expanded our price scope slightly to incorporate that event into our 2016 scenario.

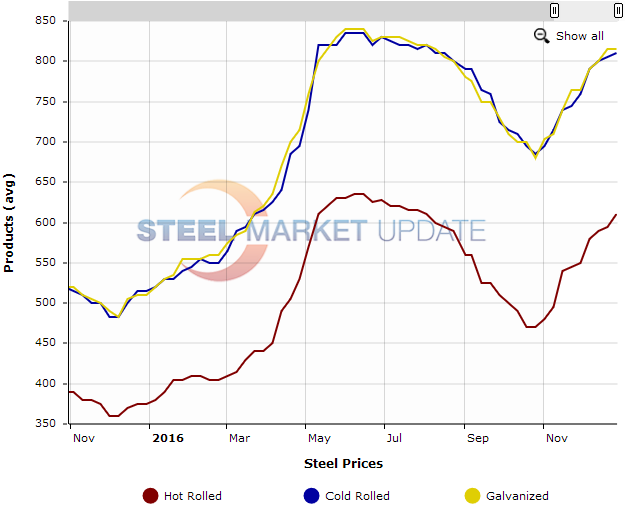

Our graphic (see below) begins with hot rolled prices being $390 per ton ($19.50/cwt) and cold rolled (blue line) at $515 per ton base ($25.75/cwt) and galvanized at $520 per ton ($26.00/cwt). The spread between hot rolled and cold rolled was $125 per ton ($6.25/cwt) with galvanized being $130 per ton ($6.50/cwt). These were the typical spreads seen during 2015.

In early December the domestic steel mills began raising prices and the flat rolled steel service centers latched on to those announcements as a way of stopping the bleeding (selling steel at a loss) and a way to improve their margins and the value of their inventories.

Flat rolled steel prices rose slowly with hot rolled averaging $410 per ton (+$50 from the December low of $360 per ton) and cold rolled $565 per ton base (+$82 from December low of $483 per ton) while galvanized averaged $575 per ton base (+$92 per ton from the December low of $483 per ton). There was clearly more strength in the cold rolled and coated products than hot rolled which continued to struggle with a weak energy, agriculture and heavy equipment markets. This was the beginning of the trend for wider spreads between HRC and CRC/coated base prices in the spot markets.

It didn’t take long before the spread reach and then exceeded $200 per ton ($10.00/cwt) between hot rolled and cold rolled/coated products. On May 10th we saw the spread reach +$195 on cold rolled (HRC @ $610 with CRC at $820 and galvanized at $800). By October 25th the spreads were +225 on cold rolled and +230 on galvanized.

As 2016 is coming to a close we are seeing prices as having rebounded to their May 10th price levels with hot rolled at $610 per ton ($30.50/cwt), cold rolled $810 per ton ($40.50/cwt) and galvanized at $815 per ton ($40.75/cwt) base price averages.

The averages for the calendar year 2016 are: Hot Rolled = $503.73 per ton, Cold Rolled = $685.

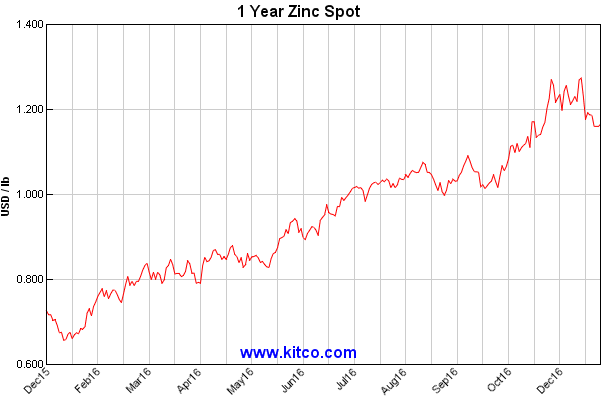

We had another significant event occur that directly impacted coated steels: on November 14th NLMK USA became the first U.S. steel mill to adjust zinc coating extras to reflect the higher cost of zinc which had gone from the low $0.60’s per pound to slightly above $1.10 per pound when the announcement was made. Zinc continued to move higher reaching $1.27 per pound in mid-December 2016. Since the 15th of December zinc prices have returned some of their gains and is currently trading around $1.14 per pound.

Steel Market Update has an analysis of the adjustments to the coating extras at various steel mills which can be accessed by our members on the SMU website.

With hot rolled not reacting to the strengthening order books and low service center inventories the same way as cold rolled and coated steels we have seen the +$200 per ton spread remain in effect for the entire second half 2016. The extra $80 to $100 per ton has keep the doors open for foreign imports on these products while hot rolled imports and import offers have become much fewer and harder to consummate deals due to the narrow foreign HRC to domestic HRC price spread.

As we enter 2017 Steel Market Update opinion is for flat rolled prices to continue to move higher. We do not project steel prices but the trend and momentum are clearly on the side of the domestic steel mills. The questions for 2017 and how strong the market may become are tied to demand and how strong a spike will we see during the 1st Quarter 2017?