Market Segment

December 27, 2016

Chinese Steel Market Analysis for Week Ending December 25th

Written by John Packard

The following analysis of the steel markets in China is from Beijing Metal Import & Export Co.,Ltd and is being reproduced by Steel Market Update with permission:

Please allow us to update China steel market (Dec 19 – Dec 25, 2016) as usual as following:

In the past week, China steel market had a heavily drop.

Along with the cancellation of first air pollution red alert of this year, market was expecting to reach its highest level as all the main steel mills still kept increasing their EXW prices [Ex Works].

On Dec 19, Heibei Group and Benxi steel released new prices. Details as follows:

Heibei Group:

HRC/HRP/CRFH/CRC up RMB600/MT (VAT included)

GI/PPGI up RMB500/MT (VAT included)

Benxi Steel:

HRC/GI up RMB500/MT (VAT not included)

CRC up RMB600/MT (VAT not included)

Pls note VAT is 17%.

On Dec 21, Shagang also increased EXW prices, WR/De-bar in coils up RMB150/MT, De-bar in bundle up RMB100/MT (VAT included).

On same day Hebei Group issued new prices for WR and Debar for 3nd ten days of Dec, WR up RMB50/MT, De-bar in coils up RMB80/MT but made unchanged for De-bar in bundle.

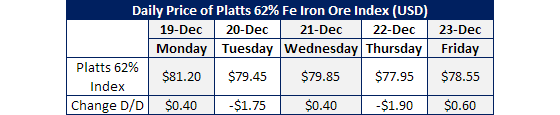

Actually market was out of most traders’ expect, Spot price of Billets dropped total RMB270/MT in one week and Platts 62% Iron ore index dropped to below USD80/MT again. We mentioned before that market is up to real demand, the irrational rise of the price can’t make market last long time. Mill ‘s EXW prices of few steel productions already higher than spot prices even Shagang’s prices of 2nd ten day of Dec, 2016 was made unchanged, but Shagang still choose to increase the prices of the 3nd ten days of Dec, 2016.

Below price details of Platts 62% index and spot Billets for your information:

Commodity future market also dropped in last week.

But we noticed that the prices of 3nd ten days of Dec from Shagang/Hebei Group was not so big, and spot price of Billets went up by RMB20/MT on Sunday. Some traders said heavy drop within short period is in order to next increase as they thought winter plan of steel purchase is coming. As far as we know some traders already canceled their purchase plan because of high market level.

We will pay high attention to Shagang/Heibei Group new prices of first ten days of Jan 2017 as this will give market a deeply effect.