Prices

December 8, 2016

Hot Rolled Futures: Consolidating Gains

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

John Packard asked me to speak about a question from a service center representative asking if futures coming off recent highs was just a pause in the run up or something indicative of weakness.

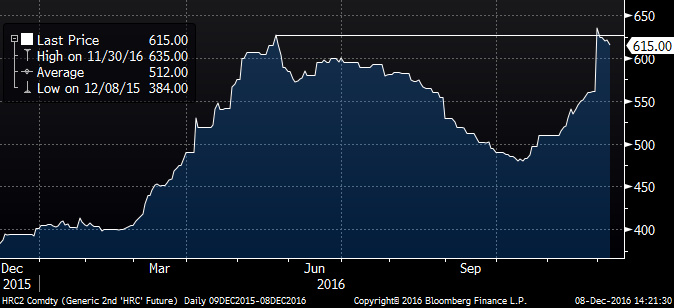

CME Midwest HRC 2nd Month Rolling Future

First, as I’ve written previously, don’t read too much into the CME HRC futures market. Second, lets examine why prices reached $632.5/t. In investing, there is a concept called the “liquidity premium,” which means if one is willing to provide liquidity, as a market maker for instance, they will receive a higher return over time doing so in a relatively less liquid instrument. The HRC Midwest futures consistently lack sell side liquidity, mostly due to the lack of producer’s providing a source of supply. Since the HRC futures market is a relatively illiquid product, buyers sometimes have to pay much higher than they otherwise would to discover a price where another participant is willing to sell. Thus sellers of HRC futures should receive a liquidity premium.

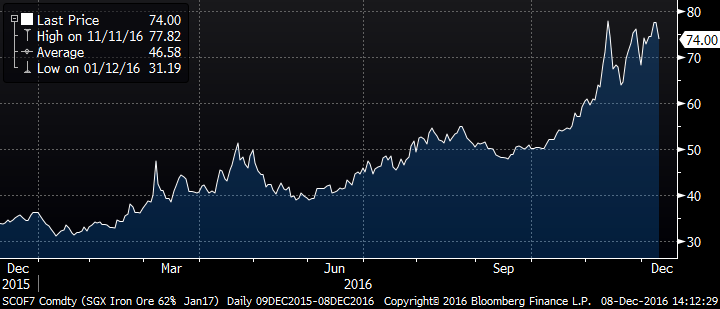

Last week, Q1 Midwest HRC futures traded up to $632.5/st, but the reason for that print had less to do with HRC and more to do with iron ore. Iron ore futures traded into the high 70s and one market participant entered a trade where they bought HRC futures and sold iron ore futures against it. Iron ore futures are more liquid than HRC futures and the individual was willing to pay up for the HRC futures in order to put the spread trade on. There have been few sellers of HRC futures for weeks now so the “spreader” had to entice a seller of the HRC futures by bidding $632.5 for Q1.

January SGX Iron Ore Futures

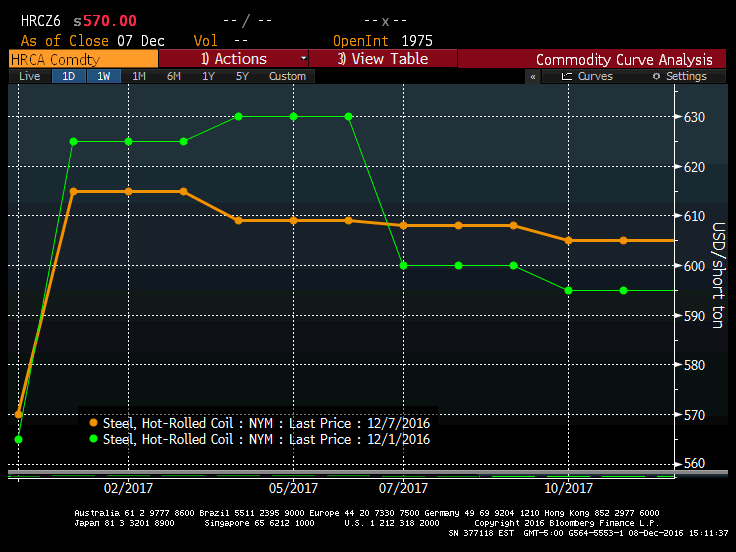

A popular axiom in the steel industry is “if prices aren’t going up, they’re going down,” but again don’t read too much into the HRC futures price coming off their highs. In reality, prices were over extended and since that high print have settled into levels where have become more comfortable participating. Volume has started to pick up with prices consolidating in the $615-$620 range for Q1 and $605-$610 range for the rest of 2017. 19,500 short tons traded in the past week.

CME Midwest HRC Futures Curve

Looking back at the HRC futures chart, the high print did break above the previous high set last May. This might prove to be the start of a price breakout as the lack of import pressure and strength in raw materials looks set to continue.

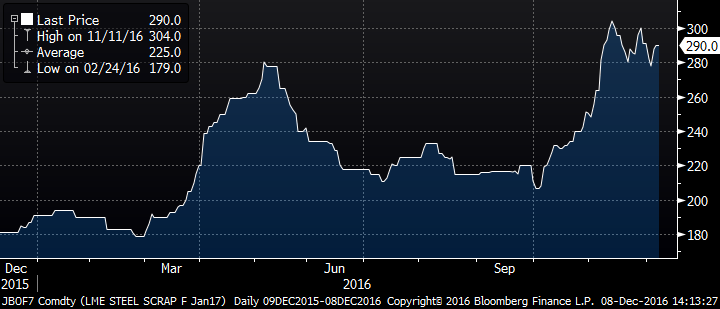

January LME Turkish Scrap Futures

An improving ISM PMI, strong auto sales and improving construction data against a backdrop of low inventory levels across the industry could provide the foundation for a long term rally.

Perhaps “Trumponomics” and the nascent rally in oil prices due to OPEC’s recent decision to cut production will add fuel to the fire.

US Oil and Gas Rig Count

Of course there are always a number of issues that could stall and reverse the rally, but none of these look to be an imminent threat.

So to answer the service center guy’s question, yes this is probably just a pause.