Prices

December 6, 2016

October & November Foreign Steel Import Analysis

Written by John Packard

Today, the U.S. Department of Commerce released Final Census Data for October 2016 as well as license data for November and early December. Since there have only been 6 days of licenses collected for December we are going to ignore that data for now and will report on December next week.

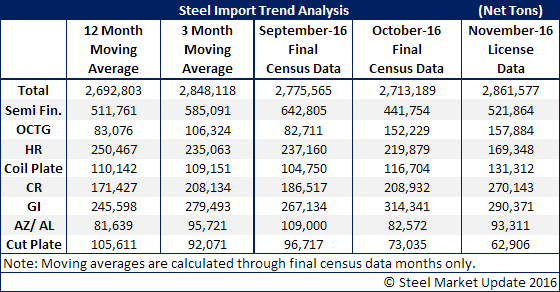

October foreign steel imports totaled 2,713,189 net tons, slightly below September’s total. November license data continues to suggest a 2.8 million net ton month. Here is what the totals by product look like as of December 6, 2016:

Steel Market Update (SMU) was asked earlier today at the HARDI conference if we could share some of the countries still shipping galvanized steel to the United States.

Every Tuesday around 5 PM Eastern Time the U.S. Department of Commerce publishes import license data as well as preliminary census and final census data for the current month as well as the previous 14 months on their website. This data is available to the public.

From that data we have discovered that these are the countries shipping at least 10,000 metric tons of galvanized to the United States on a monthly basis (at least over the past few months):

Canada, Vietnam (still), Taiwan, Brazil, Korea and I am going to add India which ships every other month about 21,000 metric tons.

Those countries averaging 5,000 metric tons but less than 10,000 metric tons:

Turkey, South Africa, Netherlands, Japan, Mexico, United Arab Emirates and lately Thailand. Thailand is an up and coming country having not being a supplier to the U.S. prior to September 2016.

For a listing of the countries averaging less than 5,000 metric tons go to the US DOC SIMA site to review the data.