Prices

December 1, 2016

Hot Rolled Futures: Q1 '17 Trades at $625

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Interesting futures markets in steel lately. Today Q1’17 HR traded at $625/ST, 1,200 ST/mo. Also Jan/Feb’17 HR traded at $625/ST, 500 ST/mo. The market remains $625/ST bid for Q1’17. Balance of year bids are tapering off to $600/ST. Last Cal’17 trade was executed at $615/ST last Friday. Futures volumes this past week totaled 12,380 ST. Open Interest is 17,214 contracts or 344,280 ST.

The velocity of the rise in HR futures prices has left many folks surprised. The swift move higher can be attributed to a lack of selling liquidity. Importers who are typically futures sellers have been quiet because of reduced trade due to higher tariffs. Also natural long physical players have been slow to adopt futures.

Concern that there is still upward momentum and that further supply shortages are possible have motivated buyers to push up HR futures in early 2017 along with the prospect of further mill price increase announcements in the new year. The gap between Dec’16 $562/ST bid and Q1’17 bid at $625/ST is wider than we normally find between Dec and Jan. It has typically been about $30/$35 wide for the turn of the year.

Scrap

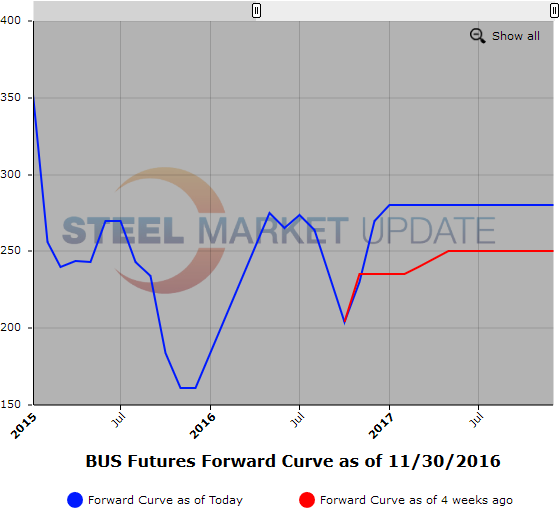

In the BUS futures contract we are $280/GT bid for 1H’17 with offers coming in at $300/GT. The spread between the near date LME steel scrap futures and the CME BUS futures has narrowed as the BUS has been pulled higher by the HR futures and natural buying interest and the CFR Turkish scrap has traded off $10/15 in the Dec/Jan’17 period due to stagnant spot and lack of cargoes.

Below are two graphs showing the history of the hot rolled and busheling scrap futures forward curves. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.