Overseas

December 1, 2016

Chinese Export Steel Prices are in Limbo

Written by John Packard

Today is Monday, please allow us to update you on the China steel market (Nov 21 – Nov 27, 2016) as usual as follows:

In the past week, the market still kept rising heavily. It is out of our expectations as many non-market factors pushed spot prices to stand at very high levels.

1. China government sent two teams to Heibei and Jiangsu provice to check the execution of cut steel capacity. China planned to cut total 45 million tons steel production in 2016 and it’s reported that they already achieved the aim and Government is planning to cut total 55 million tons in 2017. Another pressure from the government is environmental protection, and some steel mills in the Shandong province started to stop production last Friday.

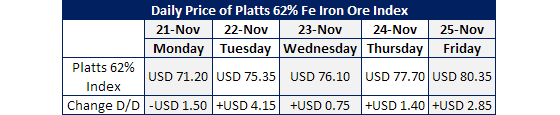

2. The futures market heavily affected the spot market. Iron ore prices stood above $80 again last Friday and China steel mills were screaming that China will have to crack down the price of iron ore or there will be no margin due to high costs.

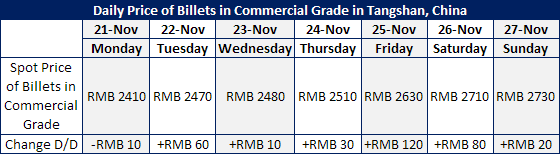

3. Steel mills EXW prices still stood on high levels. Hebei Group and Shagang all were unchanged for their EXW prices for November 3-10 but other smaller steel mills still kept increasing spot prices. Billets spot price increased by total RMB 200/MT only in two days! This forced mail steel mills stared to stop to offer last Friday.

We think the China steel price stood at a non-reasonable high level but that the market will not drop heavily in the coming months. The first reason is that the Chinese Spring Festival will come earlier than before and traders normally will buy some cargo for stock before the Spring Festival. Also mills will collect money from their long-contract customers and should give banks the annual credit report in order to get credit line for next year. We can’t hope steel mills to low down their EXW prices sharply in December of this year.

Below are price changes of billets and iron ore just for your information:

Just got news that Guofeng increased RMB200/MT for strips and Billets up RMB50/MT before this report is released.

For export offers, sorry we can’t give indication today as prices are not stable and are changing every day.