Prices

November 30, 2016

October Raw Steel Production Improves but is Still Too Low

Written by Brett Linton

The American Iron & Steel Institute (AISI) recently reported final U.S. raw steel production estimates for the month of October 2016. The monthly estimates are different than the weekly estimates we report in our Tuesday issues; the AISI bases the monthly estimates on over 75 percent of the domestic mills reporting vs. only 50 percent for the weekly estimates.

Total raw steel production for the month of October was reported to be 6,885,339 net tons with 4,730,552 tons being produced by electric arc furnaces (EAF) and 2,134,787 tons produced by blast furnaces. October raw steel production was reported to be 65,740 tons or 1.0 percent greater than the previous month but 329,985 tons or 4.6 percent lower than the same month last year.

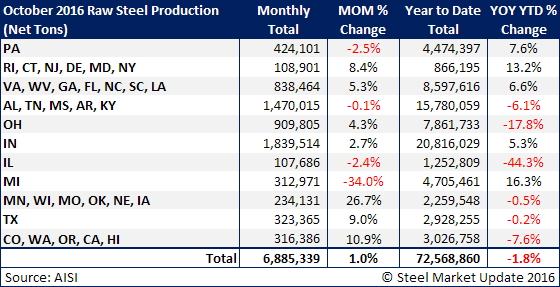

Compared to the first ten months of 2015, 2016 year-to-date (YTD) production is down 1.8 percent to 72,568,860 tons. The table below shows that 6 of the 11 state-groups reported decreased YTD production compared to the same period last year.

The capacity utilization rate for the month of October 2016 was reported to be 65.4 percent, down from 68.0 percent in September and down from 68.1 percent reported in October 2015. The yearly capacity utilization rate is now 71.1 percent, down from 71.8 percent in September and down from 71.7 percent in October 2015. Readers should be aware that there has been a reduction in available steel capacity from 2015 to 2016, making the capacity utilization rate higher in 2016 for the same amount of steel produced in 2015.

SMU Note: An interactive graphic of our raw steel production history can be seen in the Analysis section of our website here. If you need help logging into the website or navigating through it, please contact us at info@SteelMarketUpdate.com or 800-432-3475.