Prices

November 26, 2016

SMU Steel Survey Results: Foreign Steel

Written by John Packard

In the past foreign steel imports have been a key component to the health of the domestic manufacturing base in the United States. Foreign steel helps keep U.S. steel mill pricing reasonably competitive with the world steel markets. The domestic steel mills do not have the ability to produce all of the steel needed when we are in a “good” market which would be 125-140 million tons. Over the years, the U.S. receives approximately 22 to 33 million net tons of foreign steel per year.

Since the Great Recession we have not yet seen a “good” steel market, yet we continue to receive more than 24 million net tons of foreign steel and more. This has been good for end users but very damaging to the bottom lines of the domestic steel mills.

During the past 18 months the domestic steel mills have been attempting to plug the dam by building a trade induced wall around the United States by filing antidumping and countervailing duty complaints as well as a Section 337 complaint against China and a circumvention complaint against China/Vietnam. The net result should be fewer foreign tons coming into the U.S. market.

It will also spark higher price volatility said Gaurav Chhiddar of Cargill at our 2016 Steel Summit Conference at the end of August.

For that reason SMU reports on license data for foreign steel imports on an almost weekly basis. We report on various products as well as the total foreign steel exposure we are seeing.

During our surveys which are conducted twice per month we probe manufacturing companies and service centers (as well as trading companies) what their experiences are as it relates to foreign steel.

We first ask what percentage of our manufacturing and distributor/wholesaler respondents are actively buying foreign steel. In last week’s survey we found 66 percent of the manufacturing companies and 78 percent of the service centers are buyers of foreign steel.

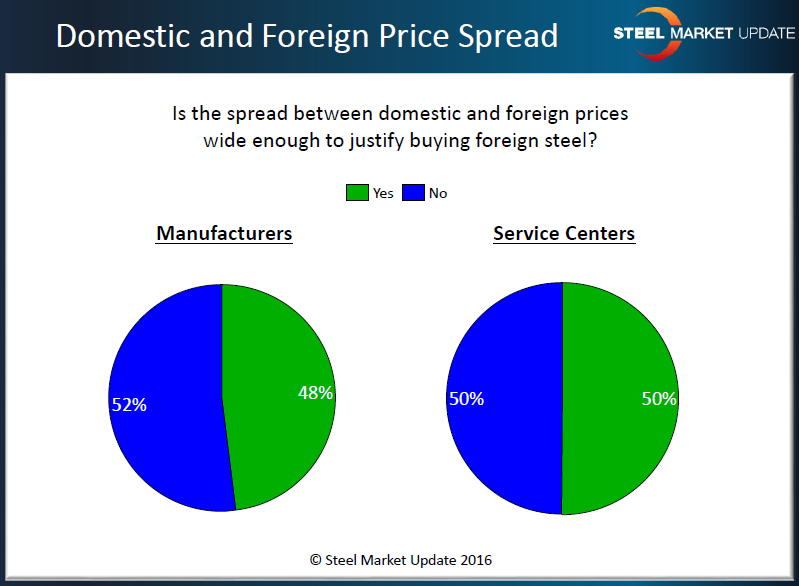

Right now our respondents are split as to the competitiveness of foreign steel pricing compared to domestic steel. We asked both groups, is the spread between foreign and domestic steel prices wide enough to justify buying foreign steel? The results are below:

The 50/50 split is down from a high of 82 percent for both manufacturers and service centers reporting foreign as being priced well enough to justify buying off-shore material as recently as early to mid 3rd Quarter. As the percentage declines we should see a drop in foreign steel imports in the coming months.

We found that again when we asked if the manufacturing companies or service centers were placing new orders for foreign steel right now. Manufacturing companies reported only 31 percent of the respondents as still buying foreign steel and only 28 percent of the distributors/wholesalers reported buying new foreign steel.

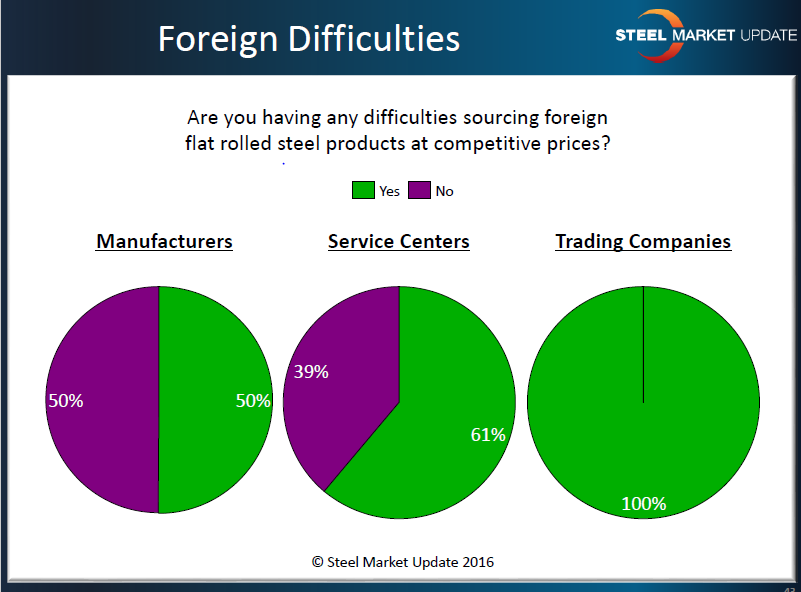

Besides pricing we found that availability is also an issue in sourcing foreign steel. We asked the manufacturing companies, service centers and the trading companies if they were having any difficulties in sourcing foreign steel at competitive prices. We thought you might find the results interesting:

As you can see 50 percent of the manufacturing companies, 61 percent of the distributors and 100 percent of the trading companies reported difficulties in sourcing competitively priced foreign steel.

We also asked the trading companies if they are seeing a spike in requests for quotes from domestic buyers (17 percent of the traders said yes).

Traders: Are foreign steel prices rising from their suppliers? 100 percent responded yes.

Eighty-three percent of the trading companies reported that they were confident orders could be gotten at the new price levels.

Sixty-seven percent of the traders reported having foreign offers withdrawn recently due to uncertainty related to the trade suits. Eighty-three percent of the traders reported the Circumvention of Duties suit against China/Vietnam has caused them to cancel or delay orders out of Vietnam.