Prices

November 22, 2016

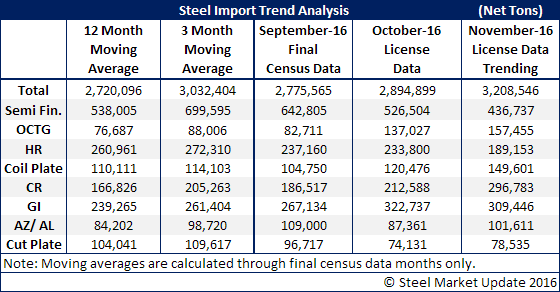

November Foreign Steel Imports Trending Toward 3 Million Ton Month

Written by John Packard

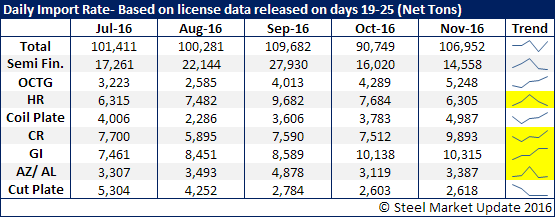

November foreign steel import license requests picked up since this time last week and the month is now trending toward a 3.0 million plus net tons of imports. We believe the total is slightly over-stated due to the Thanksgiving Holiday and that the long weekend will scale back the pace over the coming days and that the ultimate import level will be closer to what we are seeing for October.

What is disappointing (from a mills perspective) has to be the galvanized and cold rolled license requests for November.

Galvanized is trending toward a 300,000+ net ton month. We told our readers last week to watch the Thailand tonnage and as of today (Tuesday, November 22nd) they have already requested over 15,000 net tons of GI import licenses. Thailand shipped their first GI orders to the United States in September of this year. Another country to watch is The Netherlands which has 13,000 net tons of licenses for November or about twice what they said they were going to ship during the month of October.

Cold rolled is also on pace to reach 300,000 net tons of license requests during November. Vietnam continues to be the main supplier with 60,000 net tons of license requests. Turkey also has some large tons for November as they have 35,000 net tons of license requests. Thailand is becoming a supplier for CR as well with 8,600 net tons requested so far this month.