Prices

November 17, 2016

The Relationship between the Price of Scrap and Three Useful Benchmarks

Written by Peter Wright

Often with steel related economic statistics it’s useful to compare a given data stream with others which may or may not be causally related. This usually puts the steel data into context and shows whether a direction change is for real. In this piece we are comparing the price of Chicago shredded scrap with the IODEX price of iron ore delivered North China, the value of the US Dollar, and the price of oil in Cushing, Oklahoma.

![]() The price of ore and the value of the US $ have a direct causal effect on scrap prices. There is not a causal relationship between scrap and oil but they are both global commodities with a highly correlated price ratio. Comparison with these benchmarks has enabled us to signal whether the price of scrap is out of line either on the up or down side. The price of Chicago rose by $30 in November to $228/gross ton, down from $334 in January 2015.

The price of ore and the value of the US $ have a direct causal effect on scrap prices. There is not a causal relationship between scrap and oil but they are both global commodities with a highly correlated price ratio. Comparison with these benchmarks has enabled us to signal whether the price of scrap is out of line either on the up or down side. The price of Chicago rose by $30 in November to $228/gross ton, down from $334 in January 2015.

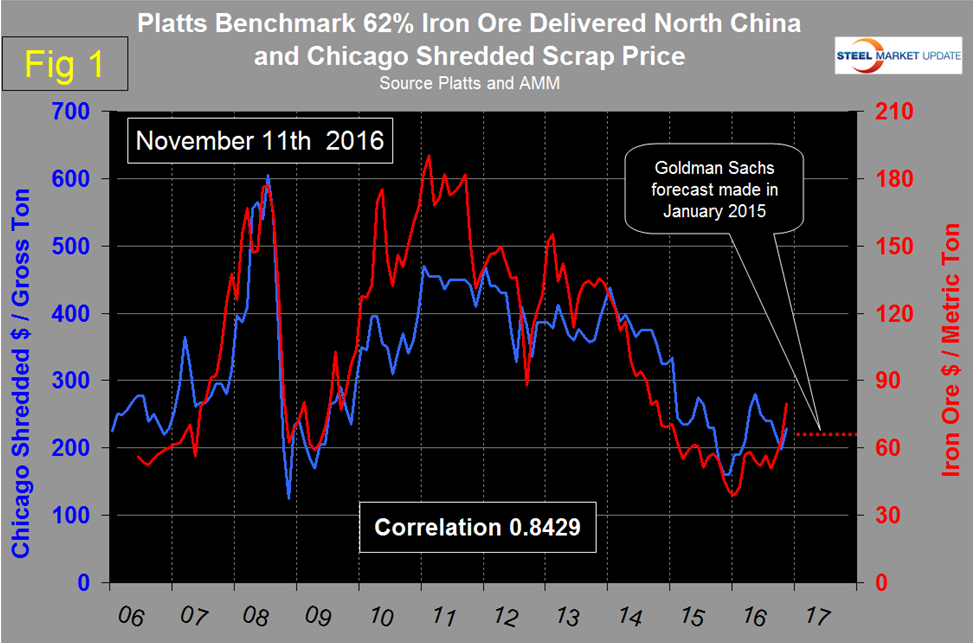

Figure 1 shows the IODEX (62% Fe delivered N. China) and the price of scrap through November 11th.

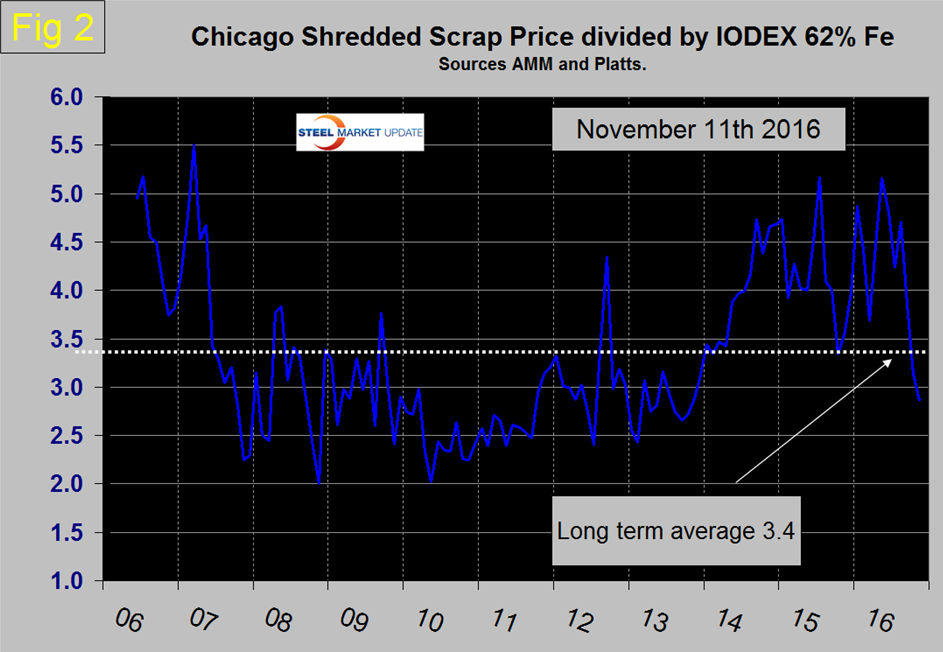

The correlation since January 2006 has been 0.8429. In the period 2007 through 2009 the correlation was 0.9182 but the relationship became decoupled in 2010 and 2011 when the big 3 ore cartel began to eliminate long term contracts. An oversupply of iron ore caused a less dramatic decoupling in the other direction, up to last month, when they came almost exactly in line. In November as the price of both commodities increased, iron ore moved ahead. We have superimposed the Goldman Sachs forecasts on this graph. In January 2015 GS forecast the price would be $70 in 2017. The latest IODEX price from Platts was $79.70 on November 11th. The ore price has advanced by 56 percent since August 19th and is up from $39.01 on January 11th. In the long term, Chicago shredded has been 3.3 times as expensive as the IODEX on average with quite a wide spread in each direction. For four years through December 2013 scrap was priced high on a historical basis compared to ore. Throughout 2014 scrap became increasingly uncompetitive and in July this year reached a high of 5.2x the IODEX (Figure 2).

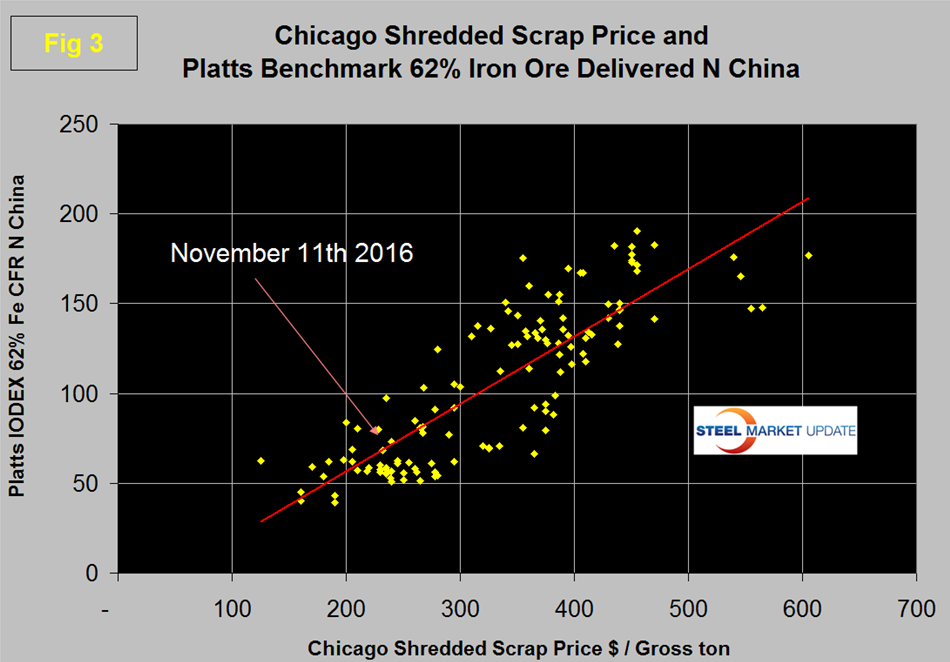

The recent price changes for scrap and iron ore have reduced the ratio to 2.86, the most advantageous for scrap in three years and suggesting that scrap has some upward potential. The World Steel Association data indicates that China has 93 percent BOF and 7 percent EAF as a mix of steel production processes. When the price of iron ore was advantageous, China, with its high dependence on the BOF process, was able to disrupt the global scrap market by selling low priced semi-finished. This is no longer attractive. Figure 3 is a scatter diagram of scrap and ore and where we are this month.

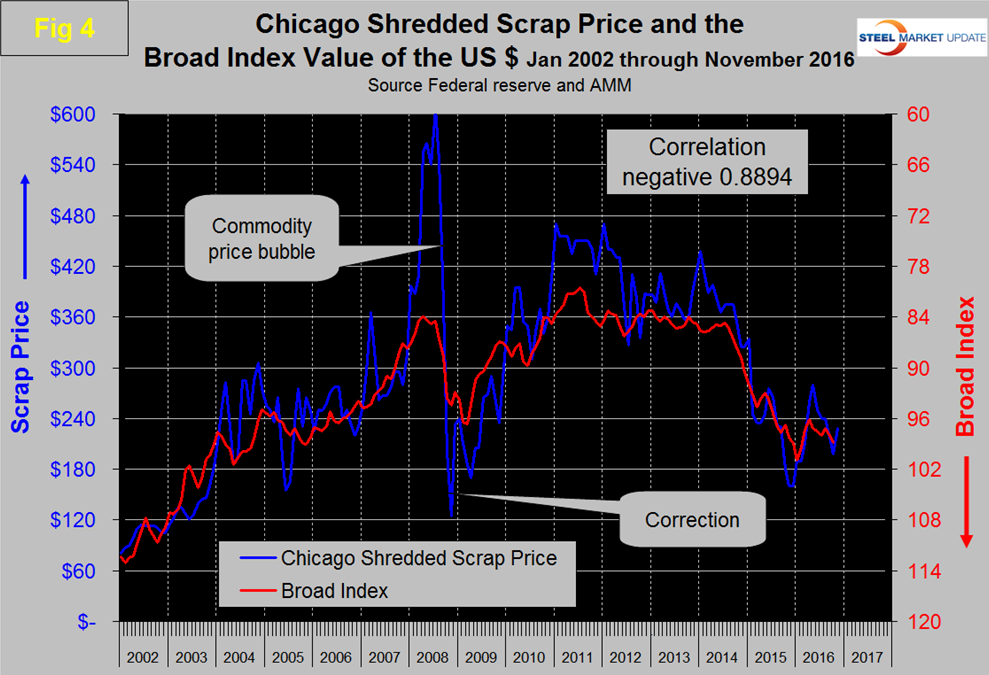

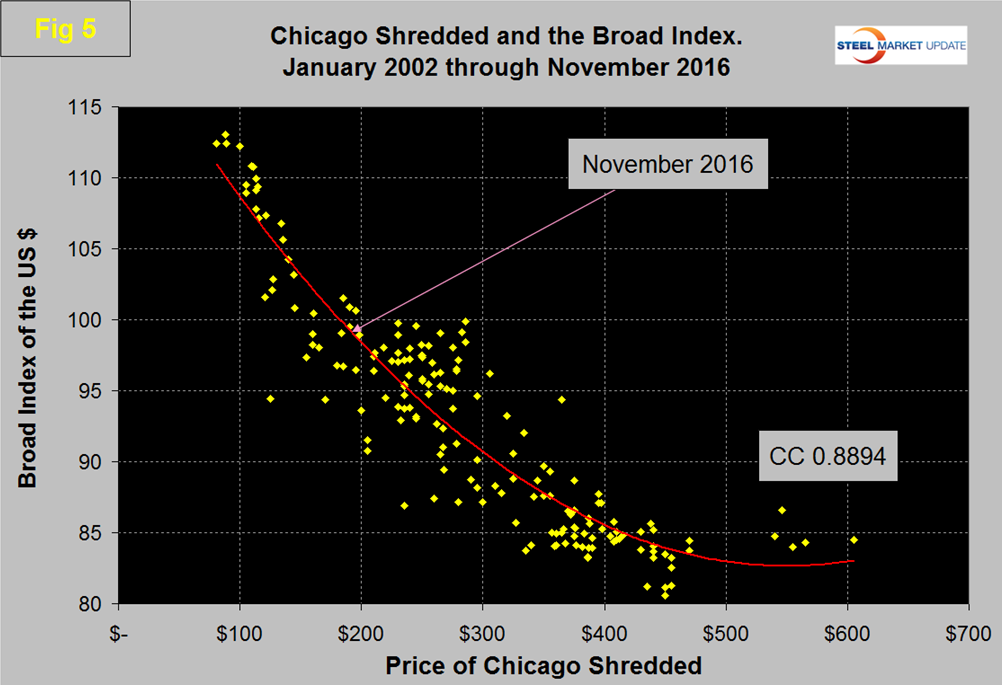

Figure 4 shows the scrap/US $ relationship which has a 0.8894 negative correlation since January 2002.

An appreciating $ has a negative influence on the price of global commodities, of which scrap is one. At the present time by this benchmark, scrap is slightly over valued though there is as yet no November index for the US $. Figure 5 shows a scatter diagram of scrap and the dollar and where we are today.

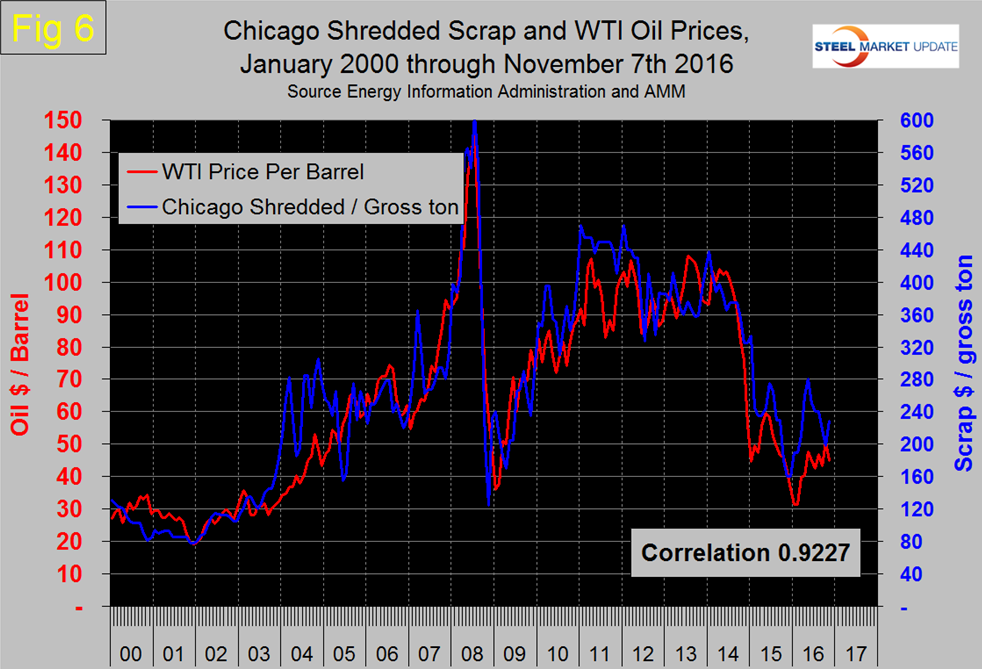

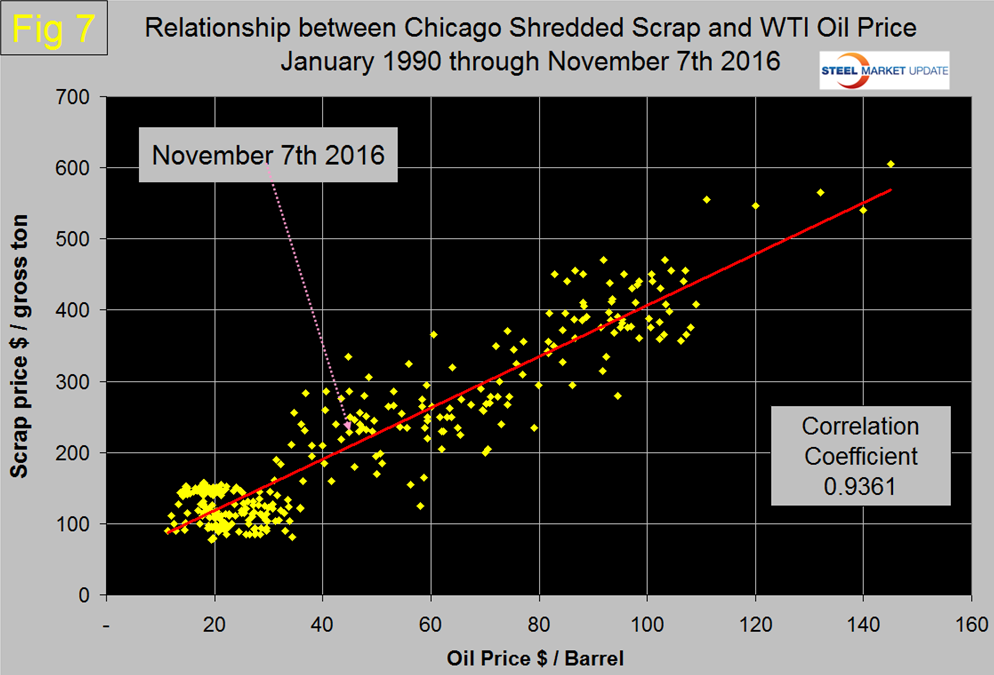

Figure 6 shows the scrap/oil (West Texas Intermediate) relationship through November 7th with a correlation of 0.9227 since January 2000 and 0.9361 in the 26 years since January 1990.

Both scrap and oil are global commodities but we estimate the world oil market to be about 50 times the size of the scrap market measured in US dollars. The long term tendency has been for scrap to come back into line with oil when it deviates to either the high or low side thus providing a strong buy or hold signal which also has merit for rolled steel products. Oil briefly moved over $50 last month but by November 7th had fallen back to $44.88 as published by the Energy Information Agency. It was clear in May that scrap was due for a correction and that happened through October when the two came exactly into line. Figure 7 is a scatter diagram for scrap and oil prices since January 1990 and where we are today.

As of now scrap is overpriced compared to both oil and the Broad Index but underpriced compared to the IODEX value of iron ore. We think the probability is that, based on these three benchmarks, the November scrap price is about right with no potential for a major move in the next month or two.