Canada

November 17, 2016

Canadian Distributor Flat Rolled Shipments/Inventories Decline in October

Written by Brett Linton

Canadian shipments for all steel products in the month of October were 356,600 net tons, a decrease of 3.8 percent from the month before and a decrease of 6.1 percent from October 2015. Inventories at the end of the month stood at 1,080,600 tons, down 3.2 percent from last month and down 11.2 percent from the same month one year ago.

The daily average receipt rate for October was 16,035 tons per day (20 day month), down from 16,114 tons per day in September (21 day month). Total October receipts were 17,700 tons lower than the September figure. According to the MSCI, total steel product inventories stood at 3.0 months at the end of October, unchanged from the month prior.

Flat Rolled

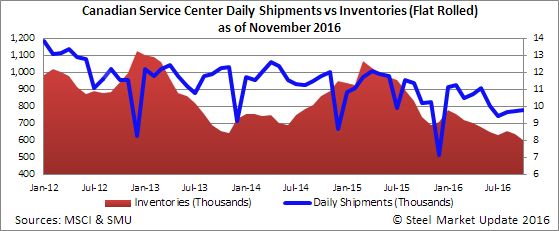

Canadian shipments of flat rolled products for the month of October were 195,800 tons, a decrease of 3.8 percent from September and a decrease of 8.3 percent from the same month one year ago. Inventories at the end of the month were 604,700 tons, down 5.4 percent from last month and down 18.1 percent from the same month one year ago. The daily receipt rate for October was 8,080 tons per day, down from 9,010 tons per day in September. Total tonnage received was 161,600 tons, down from 189,200 tons the month before. Flat rolled inventories stood at 3.1 months in October, unchanged from September.

Plate

Canadian shipments for plate products in the month of October were 63,600 tons, a decrease of 3.6 percent from the previous month and a decrease of 13.7 percent from October 2015. Inventories at the end of the month were 195,800 tons, down 2.3 percent from last month and down 3.1 percent from the same month one year ago. The daily average receipt rate for October was 2,945 tons per day, up from 2,552 tons per day the month before. Plate inventories ended the month at 3.1 months, up from 3.0 months the month before.

Pipe and Tube

Canadian shipments for pipe and tube products in the month of October were 46,100 tons, a decrease of 6.1 percent from the month before and a decrease of 2.7 percent from the same month last year. Inventories at the end of the month were 123,700 tons, down 0.2 percent from last month and down 7.9 percent from the same month one year ago. The daily average receipt rate for October was 2,290 tons per day, up from 2,148 tons per day the month before. Total months on hand for pipe and tube inventories stood at 2.7 months, up from 2.5 months at the end of September.