Government/Policy

November 14, 2016

WTO Dismayed by Quantity of Trade Restriction Measures

Written by Sandy Williams

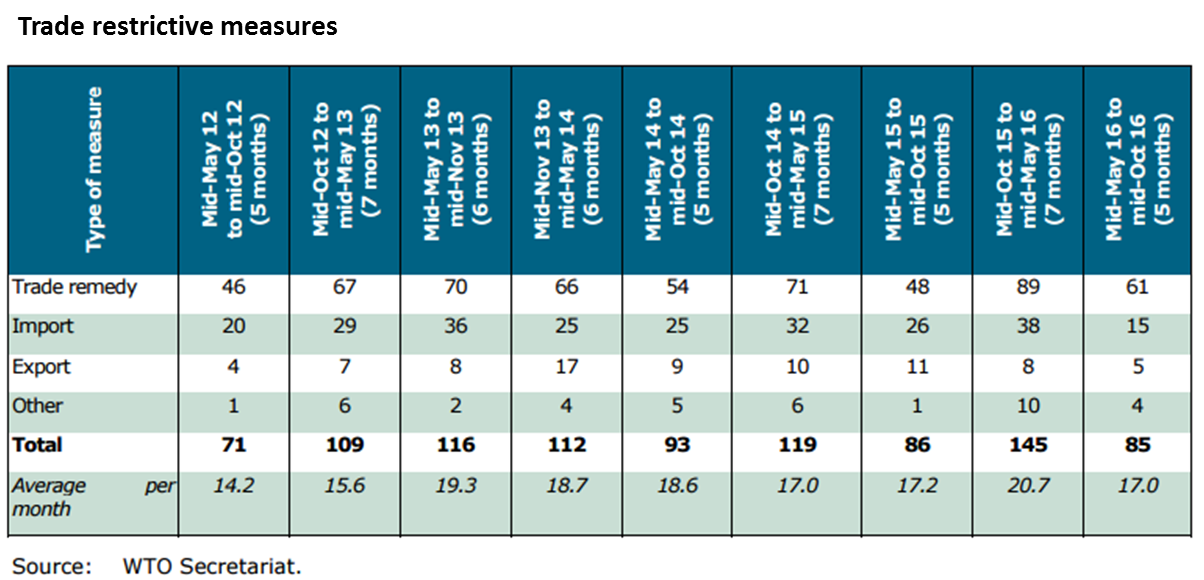

The World Trade Organization said 85 trade-restrictive measures were implemented by G20 economies from mid-May to October 2016, approximately 17 measures per month. The number is a slight decline from 21 per month reported in the previous reporting period but continues to be high compared to the roll-back of existing trade-restrictive measures. During the reporting period only 66 of the 151 trade measures applied actually facilitated trade.

Trade remedy investigations (AD/CVD investigations) represented 72 percent of the trade restrictive measures. During the reporting period 61 trade remedy actions were initiated and only 36 existing ones were terminated.

Trade restrictive measures include investigations of antidumping, countervailing and imposition of safeguards and other measures that restrict imports and exports.

Commenting on the report, Director-General Roberto Azevêdo said:

“The continued introduction of trade-restrictive measures is a real and persistent concern. Tangible evidence of G20 progress in eliminating existing measures remains elusive.

“It is clear that the financial crisis has had a long tail and that the world economy remains in a precarious state. Many people are struggling with unemployment or low paying jobs and are concerned about broader changes in the economy. These concerns demand a concerted response from governments and the international community. “

Metal products, (in particular steel), chemicals, plastics and rubber have initiated the most antidumping and countervailing measures during the review period.

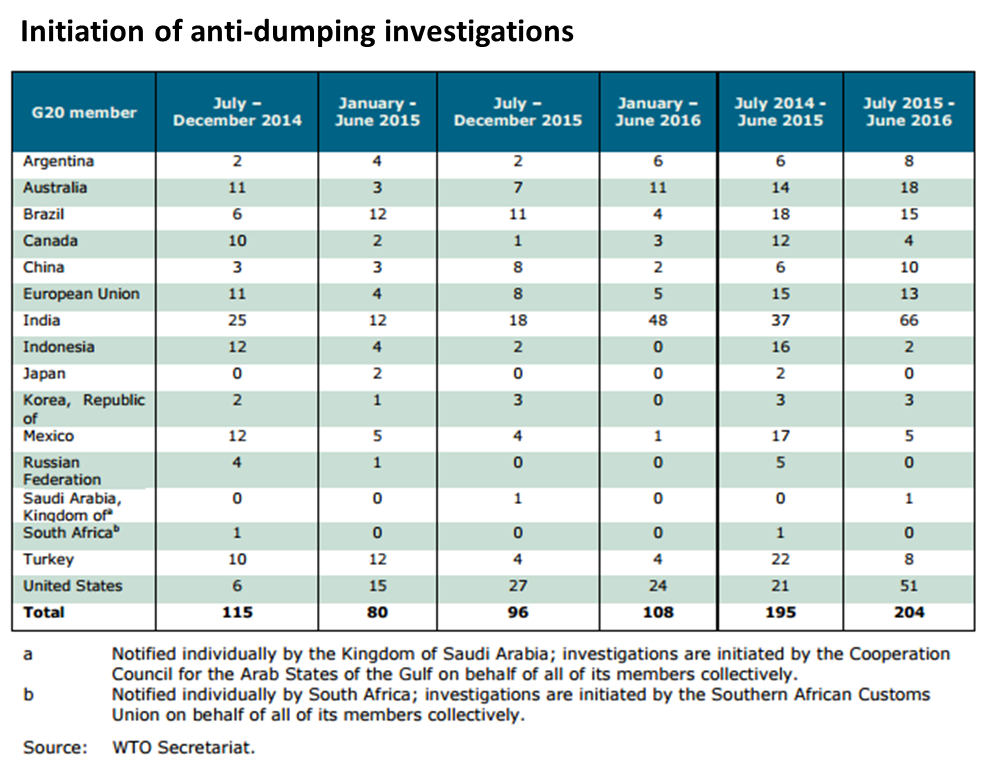

Out of 399 antidumping investigations filed by G-20 members from July 2014 through June 2016, 163 involved metal products and 95 of those involved steel products. Seventeen different steel products were the subject of antidumping investigations.

From July 2015 through June 2016, the United States initiated 51 antidumping investigations, compared to 21 investigations in the prior year period. Of the 51 U.S. antidumping cases, 39 were steel investigations.

Wrote the WTO in its report, “China continues to be the most frequent target of investigations on metal products with 24 investigations during July 2015 – January 2016, followed by the Republic of Korea with ten and Japan with eight. The United States initiated 39 investigations in this sector during July 2015 – June 2016, followed by India with 15 investigations and Australia with 11. Since July 2016, the metals sector has continued to account for a high proportion of initiations.”

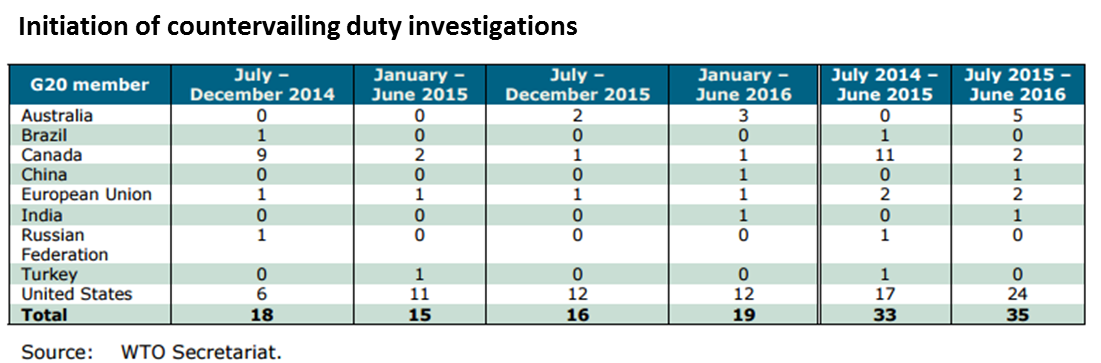

The United States initiated by far the most countervailing investigations during the two year period, with 41, followed by Canada with 13. Of 68 total G-20 CVD investigations initiated during the two year period, 43 were in relation to metal products. Steel products accounted for 39 of the CVD metals investigations and were concurrent with anti-dumping investigations on the same product.

China was the target of one third of the trade remedy initiations between January 2008 and June 2016 followed by Korea with 7 percent. G20 members targeted each other’s products in approximately 70 percent of the total initiations.

The number of safeguard measures initiated and imposed has increased in the past two reporting years, particularly in the steel sector, raising concerns among WTO members. Safeguard measures are emergency temporary restrictions in response to a surge of imports.

Said the WTO, “This Report has shown that it is imperative that G20 economies — collectively and individually — redouble their efforts to deliver on their commitment to refrain from taking new protectionist measures and roll back existing ones. This is particularly the case given the recent reiteration by G20 Leaders of their opposition to protectionism on trade and investment in all its forms.

“G20 Leaders also need to work together to ensure that the benefits of trade are spread more widely and are better understood. A failure to make the case for inclusive trade could pave the way to increased protectionism in the future.”

The members of the G20 are Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, United Kingdom, United States, and the European Union.