Prices

November 10, 2016

Hot Rolled Futures: $1000 Per Ton HR? It's Possible!

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

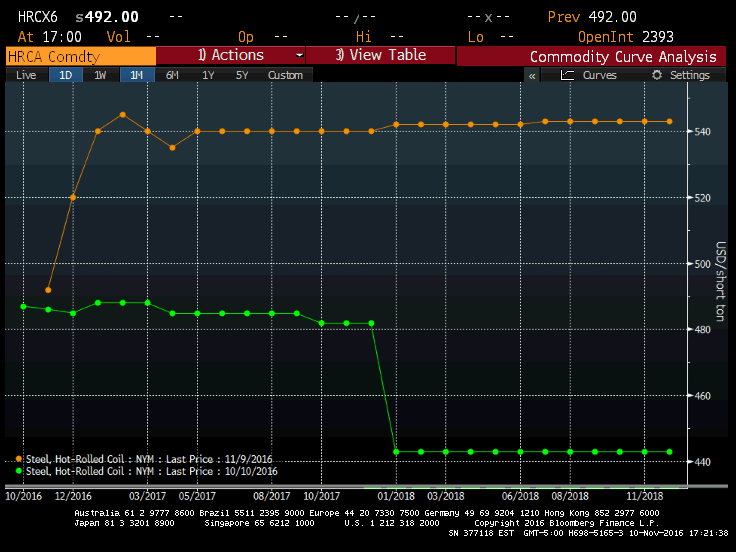

The futures market has been on hiatus for a couple weeks as NO ONE was willing to sell futures. Finally, this week there has been some light volume (5,120 st) trading mostly at $540/st. The lack of a serious supply side participant(s) in the HRC futures market is a problem folks! The iron ore futures market owes much of its success to BHP Billiton’s early participation in selling forward tons giving the contract some escape velocity. (Subliminal message 1). It sure would be great to see any of the domestic mills get involved and support the futures market.

This lack of sell side liquidity is the worst I have seen it since I began at Flack Steel four years ago. I don’t plug “The Feldstein” much, but this week I highly recommend going to blog.flacksteel.com to read it. The headline is BE PREPARED TO WAIT FOR STEEL and it discusses how the industry is excessively short steel. One of the major issues discussed as to why there could be another physical short squeeze is the low inventory levels seen across the industry. Perhaps the lack of offers in the futures market is in part influenced by these low inventory levels. (Subliminal message 2) Perhaps Big River will be the first mill to openly sell HRC futures as Koch Industries, famous for combining physical commodities and trading operations, is an investor in the mill.

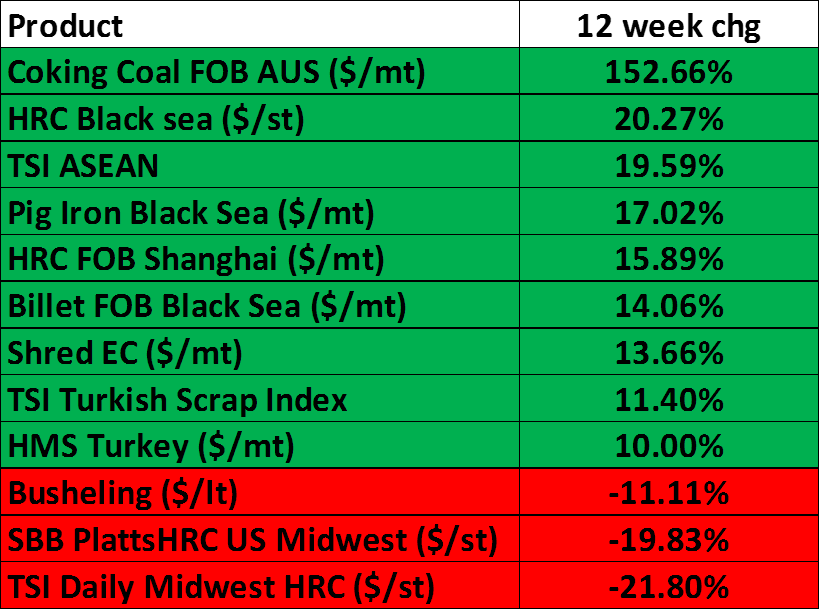

Another reason for the bullish thesis in this week’s “The Feldstein” is the epic rallies driving raw materials and finished prices higher in China, Asia and Europe. Look at these 12 week moves below!!

What a divergence between the U.S. and rest of the world!! This rally has crushed the U.S. vs. ROW price differential. Perhaps the lack of attractive import deals is another reason for the lack of offers in the futures market.

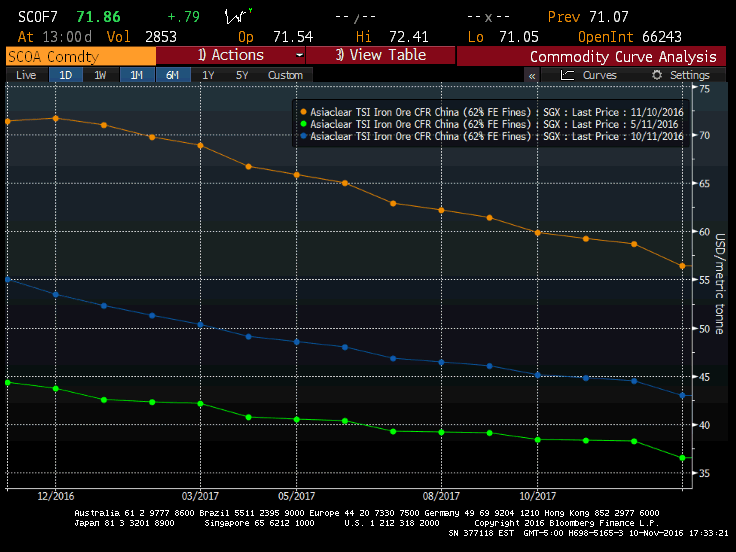

Below is the iron ore futures market which saw a $74 index print today. The chart below shows the curve’s settlements as of today, one month and six months ago. This is another surprising rally adding to the rapidly rising cost of making steel.

Donald Trump won the Presidency and Britain is leaving the EU. Don’t believe the hype…anything is possible in 2016! HRC $1000???? It can be done.