Prices

November 4, 2016

SMU Analysis of September/October Foreign Steel Import Data

Written by John Packard

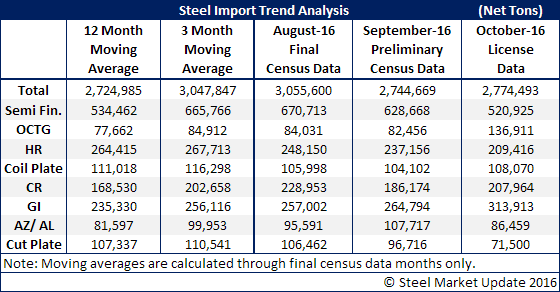

Imports of foreign steel came in at 2,744,669 net tons for the month of September based on the U.S. Department of Commerce Preliminary Census Data while October is trending at almost the exact same number with 2,774,493 net tons of foreign steel import license requests as of the 1st day of November.

When comparing the key products followed by Steel Market Update we found slabs to have averaged 607,000 net tons over the past three months (August, September and October) using the data supplied by the US DOC to date. The 607,000 ton number is above the 12 month moving average.

Hot Rolled Imports Expected to Drop Significantly in Coming Months

Hot rolled coil has been trending lower and we are seeing a combination of the dumping suits coupled with falling domestic steel prices (prior to October) and higher foreign prices have tempered the price spread and willingness of foreign producers to ship steel here. We are seeing a large shipment of Turkish hot rolled during the month of October as 55,386 net tons of licenses were requested. However, SMU sources are advising that in the next few months the Turkish tonnage will shrink, if not vanish, due to higher prices being available in Europe. The second big item for hot rolled is the fact that POSCO out of Korea has stopped shipping HRC to USS/POSCO on the west coast. Korea averaged 94,000 net tons per month during the months of July, August and September. In October that number dropped to 8,000 net tons (based on license data). In SMU opinion, if you eliminate Korea and Turkey from the HRC market the numbers of hot rolled imports have to move lower.

Europeans Replacing Vietnam Cold Rolled Exports/CR Imports Expected to Continue at High Levels

Cold rolled steel imports at 186,174 net tons for September (preliminary census data) and expected to be 208,000 net tons in October (based on license data) continue to exceed the 12 month moving average for CRC.

When looking at the cold rolled, the import numbers are not going down in the same way that we are seeing in hot rolled. It is SMU opinion the reason for this is the higher than normal spread between HRC and cold rolled base prices in the domestic (USA) market. In normal markets the spread is $100-$120 per ton. For many months now that spread has grown to $200+ per ton. The wider spread means there is more room for foreign mills to sell CR into the US market and still make money.

So, what we are seeing is an influx of European mills poised to take the place of the Vietnamese who are being pressured out of the market (at least temporarily) due to the circumvention suits filed by the domestic steel mills. Vietnam has 41,000 net tons of CRC licenses for the month of October which is higher than what we saw in September and could well be the final surge we see due to orders having already been produced or on the water at the time of the circumvention filing. SMU expects Vietnamese CR exports to taper off within the next couple of months. They should remain muted until there is a better understanding of the risks associated with the circumvention suit.

We are seeing a number of European mills increasing their exposure on cold rolled exports to the United States. Turkey has gone from essentially no tons one year ago to a 10,000+ ton per month supplier (20,000 net tons of licenses for October). Other European suppliers of note: United Kingdom, Netherlands, Germany, Sweden and Italy are all 5,000+ tons per month suppliers over the last couple of months.

We are also seeing significant growth in cold rolled exports out of Australia and Thailand. Both countries were insignificant suppliers one year ago. In the case of Thailand they began supplying CRC to the U.S. market in February 2016. They have been an inconsistent exporter but we expect Thailand to become more popular at the expense of the Vietnamese. Thailand exported 13,500 net tons of cold rolled to the U.S. in September (no licenses for October).

Galvanized Vietnam Still 2nd Largest Exported but for How Long?

Galvanized imports continued to be close to both 12 month and 3 month moving averages in both September and October. September tonnage was reported by the US Department of Commerce as being 264,794 tons and the DOC also reported licenses for GI were 313,913 net tons. The 12MMA is 235,000 net tons and 3MMA is a little higher at 257,000 net tons.

Vietnam with 53,674 net tons of exports of galvanized to the United States during the month of September and 40,000 net tons of licenses request for October continues to be the second largest GI supplier behind Canada. SMU expects this to change in the coming months as the effects of the circumvention suit risks kick in pushing Vietnamese tonnage out of the market. At least for a period of time until the risks associated with Vietnamese products are fully understood by buyers and traders.

Galvanized, like cold rolled, is another product where the spread between the hot rolled base price and that of GI is much wider than the normal $100-$140 per ton we have seen for many years. This wider than normal spread is assisting in keeping foreign countries interested in sending galvanized into the U.S. markets. This is one reason why countries like Taiwan and Uttam out of India can afford to pay the duties placed on them by the US Department of Commerce and continue to ship GI to the U.S.

So what countries will most likely absorbed the Vietnamese tonnage? We are seeing significant tonnage out of Brazil which had 16,500 net tons of exports of GI to the U.S. in September and has another 33,000 net tons of licenses for October.

UAE (United Arab Emirates) tonnage continues to grow with 5,500 net tons of license requests for the month of October. Also coming on is Thailand which shipped zero GI tonnage to the United States until September 2016 when 4,000 net tons came in. Another 4,000 tons of Thai material has been requested for October. Traders are telling SMU that Thailand is the “hot” spot for traders to go to find possible replacement tons for the Vietnamese.