Prices

November 3, 2016

Hot Rolled Futures: Limited Trading Activity

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel – HR futures

The Hot Rolled futures market this past week has been characterized by limited trading activity. There have been numerous buying inquiries this past week but the market is devoid of sellers. Those sellers that are about, are way above the current settlement values.

The futures curve in Cal’17 has been relatively flat for the past week about $30 above the levels of the recent price increase announcements.($525/ST)

The last futures transactions of note occurred last Friday when Jan/Feb’17 traded at $520/ST [$26.00/cwt] and Mar/Sep’17 traded at $525/ST [ $26.25/cwt]. A few Jan’17 and Feb’17 contracts have traded at $535/ST.

The current open interest in HR futures is 16,864 contracts or 337,280 ST. The bulk of the open interest remains in the nearest 8 futures months. There is small open interest in Calendar 2018.

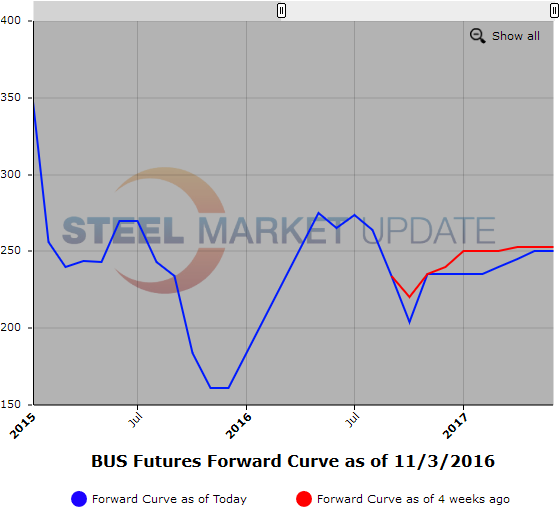

Scrap- BUS Futures

Preliminary market expectations for November 2016 BUS settlement are for a $20/40 price rise, and about the same in December. Nov/Dec’16 traded at $235/GT this week. Current level in Jan/May’17 $235/$270 per GT. What a difference a week makes. Last week Cal’17 BUS was offered at $250/GT on 500 GT per month.

The price drivers which could potentially translate to higher BUS prices:

-Big price push higher in obsolete grades due to crimped supplies

-Pinched supplies of prime scrap due to unusual seasonal idling of automotive plants

-HR mill lead times moving out

-HR mill price increase announcements with more expected to follow

-The tight inventory environment appears to be increasing the volatility of price movements

-Increased non-domestic demand for scrap pushing prices higher

Below are two graphs showing the history of the hot rolled and busheling scrap futures forward curves. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.