Market Data

November 1, 2016

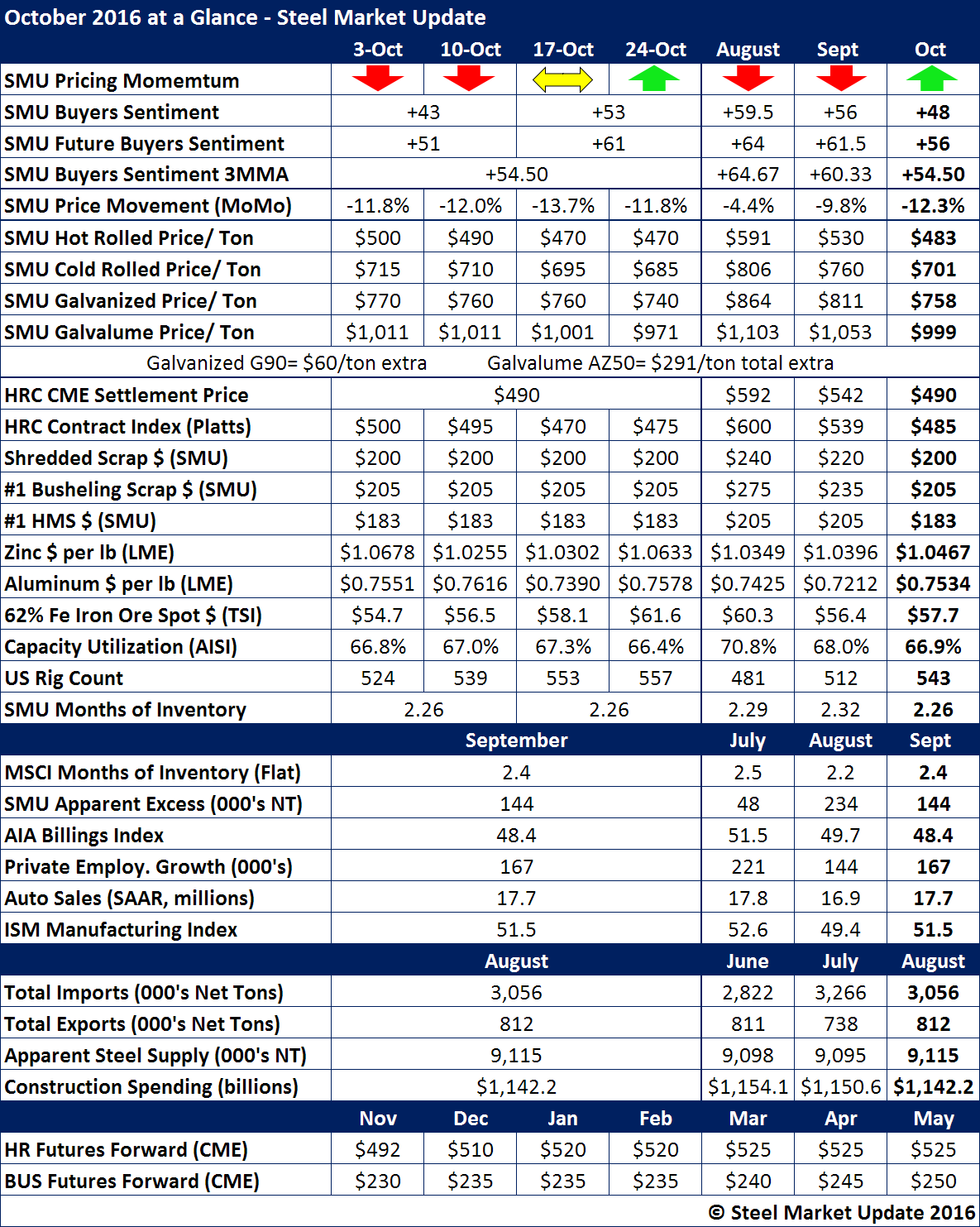

A Closer Look at October 2016

Written by John Packard

Steel Market Update (SMU) reported a shift in steel pricing “Momentum” at the end of October as our Steel Price Momentum Indicator was adjusted first to Neutral and then to Higher. Our expectation is for domestic flat rolled steel prices to increase over the next 30-60 days.

Sentiment, however, has been trending lower with our three month moving average (3MMA) now lower for the second month in a row. It will be interesting to see if higher steel prices will result in a more optimistic steel community.

Benchmark hot rolled prices ended the month at $470 per ton with our average for the month of October coming in at $483 per ton ($24.15/cwt). We were slightly lower than Platts ($485 per ton) and the CME HRC settlement number for October which was $490 per ton.

Zinc and Aluminum prices continue to increase as the month of October progressed with zinc ending the month at $1.0633 per pound and aluminum at $0.7578 per pound.

Iron ore prices continue to move higher and they actually ended the month at $64.00/dmt on 62% Fe.

The domestic mills capacity utilization rates continued to suffer with the average of the four weekly numbers being 66.9 percent. We expect those rates to rise as the increases spur orders.

Here is how the month of October ended: