Prices

October 30, 2016

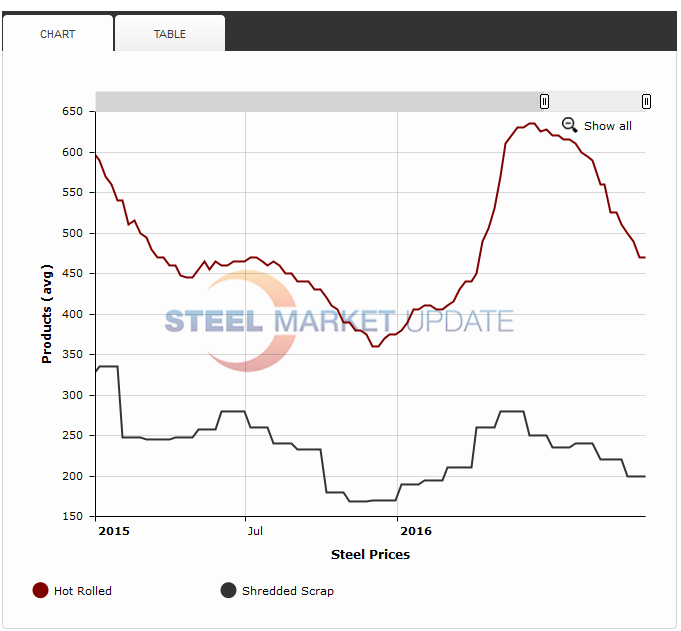

Ferrous Scrap Negotiations Point Toward Higher Steel Prices

Written by John Packard

All eyes this week will be on the scrap dealers and their steel mill customers as they haggle over where ferrous scrap prices will trade for the month of November. The opinion of many in the steel industry is that as scrap prices increase, it will both support the flat rolled steel price announcements already made and pressure the domestic steel mills and their efforts to continue to raise flat rolled steel prices in the coming weeks.

SMU received the following text message this morning (Sunday) from a steel buyer at a large steel service center, “Big story this week will be scrap, it’s very strong from reports I am getting.”

There are a number of factors which will impact scrap prices in November and in the coming months. The export markets for U.S. produced ferrous scrap are heating up, there may be less prime (Busheling/bundles) grades available due to weakness in the manufacturing sector (i.e. auto companies like Ford are taking some downtime to balance inventories), metallic input prices are raising (iron ore, coking coal, pig iron), the combination of exports along with winter weather will reduce the amount of scrap available for the steel mills. As flows slow, scrap prices will increase.

One of the large national scrap companies told SMU in an email about scrap negotiations, “Negotiations will likely be spirited and extended.” They went on to say, “The scrap markets are taking the recent activity in scrap exports and the improving steel price environment as bullish signals for November. That said, it’s too early to determine how strong and/or sustainable an upside move may be. As most recognize, the scrap pipeline is quite lean already given price declines over the past several months and Q4 seasonality will further constrain replenishment. I wouldn’t be surprised to see a $50+/GT [gross ton] rebound by early Q1.”

One of our Mid-Atlantic/Ohio Valley dealers agreed that the ferrous scrap markets could well move $40-$50 per gross ton before topping out. “We will see the usual seasonal factors as we move into the winter months: lower inbound scrap flows, dealers holding scrap, etc. However if mills need to reach out because of these factors it will be more expensive due to higher export numbers. Opinions are that the market has $40-50gt in it before topping.”

Steel buyers need to be aware of price pressures to come. You should also be aware of the relationship between scrap price and steel prices. Steel prices have a tendency to over-shoot on the high side once Momentum has been established.

By the way, for those who don’t go to our website very often, the above graphic came directly from the Interactive Steel Pricing Tool on our website. Once you log into the website go to the “Prices” tab. A drop down menu will appear and you click on “Steel Prices” to get to the Interactive Steel Pricing Tool. There, you can click on the product (or products) you wish to see prices for. You can also adjust the length of time you want to see. In the graphic above I clicked on Hot Rolled and then I added Shredded Scrap by using the Control (Ctrl) button and clicking on the item at the same time. I then set the data to be used as “Weekly” even though we only produced our scrap numbers on a monthly basis. I set the time frame using the bar at the top of the graphic. If you want to see the actual data you can hover over the lines on the graphic and the numbers will be exposed. You can also go to a “Table” version of the data which shows all of the data behind the chart.

If you have any questions about how to better use our website please contact Brett Linton in our office. He can be reached by email at Brett@SteelMarketUpdate.com or by phone at 706-216-2140.