Government/Policy

October 24, 2016

Commerce Finds Dumping of Circular Welded Steel Pipe

Written by Sandy Williams

On Monday, the U.S. Department of Commerce (Commerce) announced its affirmative final determinations in the antidumping investigations of imports of circular welded carbon-quality steel pipe from Pakistan, Oman, the United Arab Emirates, and Vietnam, and the countervailing investigation of imports of the same merchandise from Pakistan.

The investigations cover welded carbon-quality steel pipe and tube, of circular cross-section, with an outside diameter not more than 16 inches, regardless of wall thickness, surface finish, end finish, or industry specification. The products are generally known as standard pipe, fence pipe and tube, sprinkler pipe, and structural pipe and are intended for the low-pressure conveyance of water, steam, natural gas, air and other liquids and gases in plumbing and heating systems, air conditioning units, and automatic sprinkler systems. The products may also be used for light load-bearing and mechanical applications, such as for fence tubing.

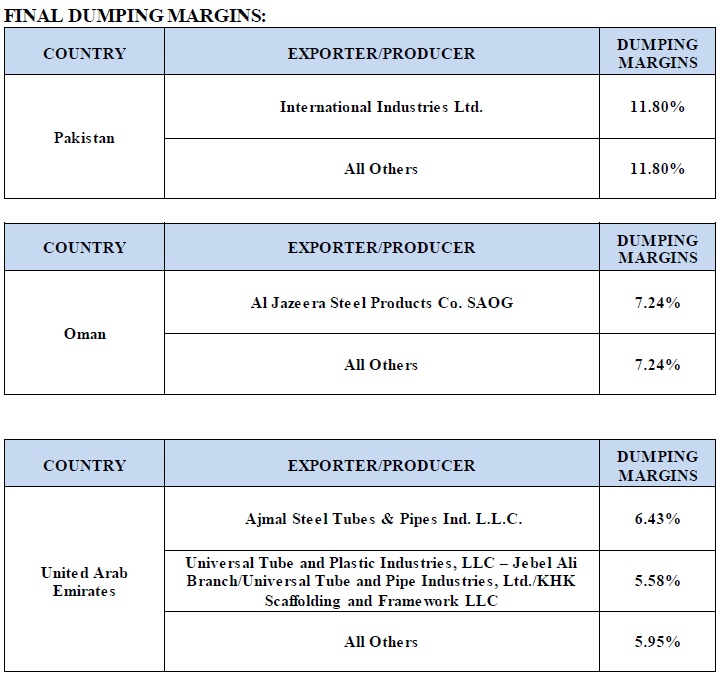

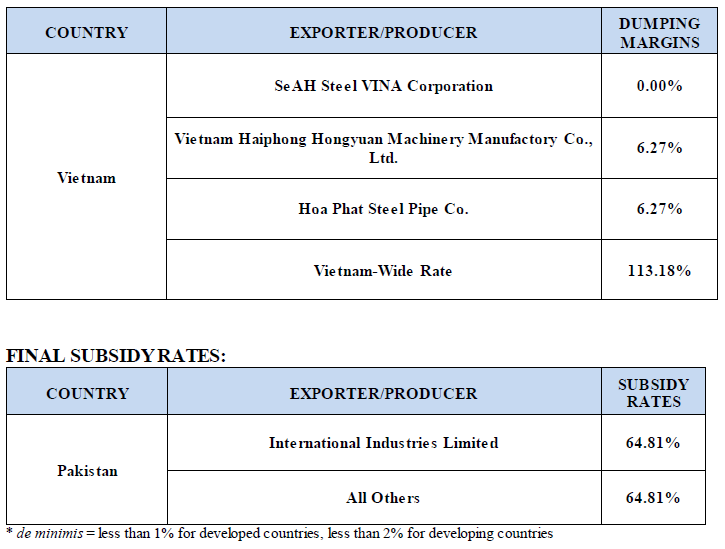

Commerce determined that imports of circular welded carbon-quality steel pipe from Pakistan, Oman, the United Arab Emirates, and Vietnam have been sold in the United States at dumping margins of 11.80 percent, 7.24 percent, 5.58 percent to 6.43 percent, and 0.00 percent to 113.18 percent, respectively. Commerce also determined that imports of circular welded carbon-quality steel pipe from Pakistan received countervailable subsidies of 64.81 percent.

The petitioners for these investigations are Bull Moose Tube Company (Chesterfield, MO), EXLTUBE (N. Kansas City, MO), Wheatland Tube Company (Chicago, IL), and Western Tube & Conduit (Long Beach, CA).

Next Steps: The U.S. International Trade Commission will make its final determination regarding injury on December. 5. If the ITC finds in the affirmative, orders will be issued in the AD/CVD cases on December 12.