Market Segment

October 20, 2016

Nucor Values Improved Profit Margins over Capacity Utilization

Written by Sandy Williams

Nucor Corporation reported net earnings of $270 million for third quarter, up from 233.8 million in Q2 and 227.1 in Q3 2015.

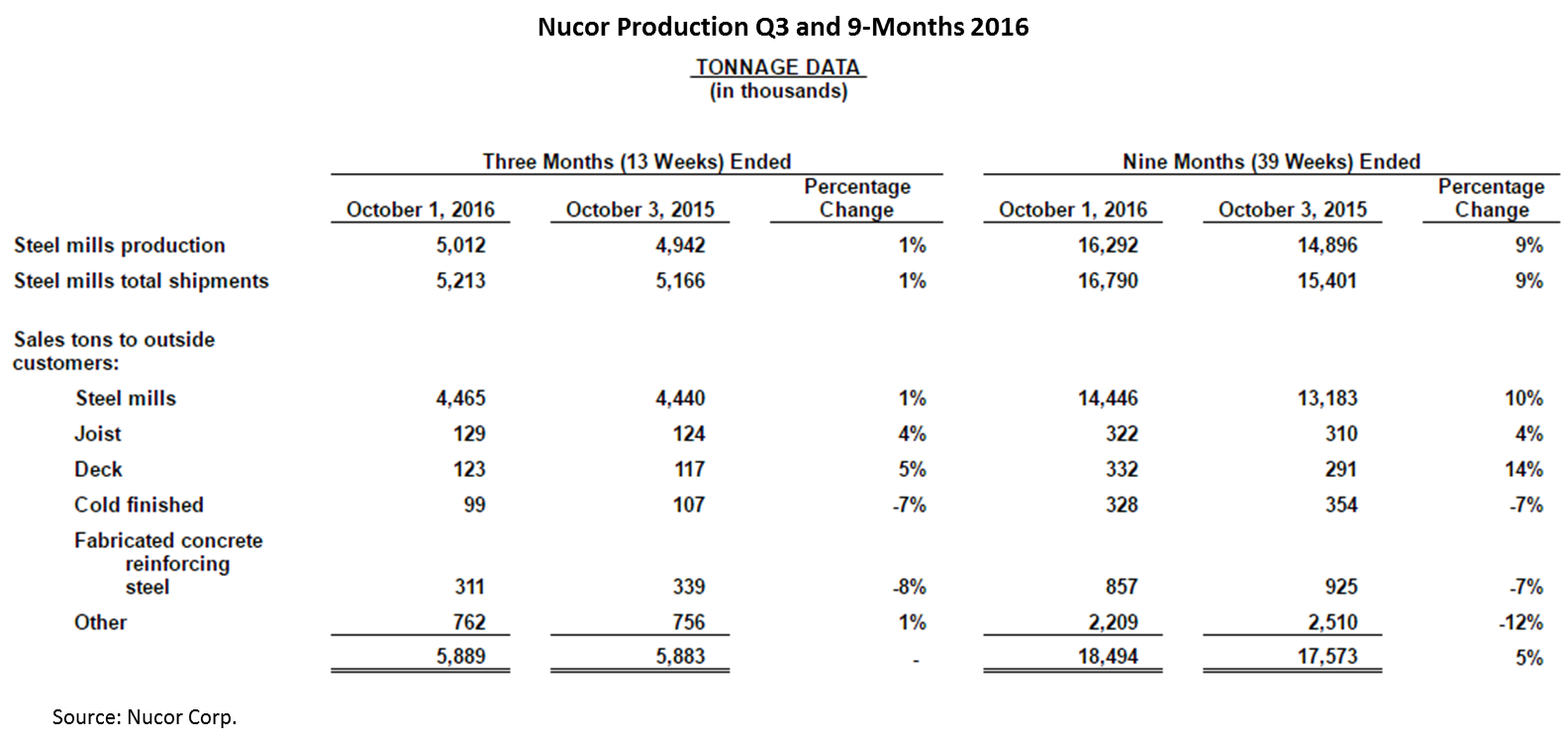

Consolidated net sales in third quarter increased 1 percent to $4.29 billion from the previous quarter and 2 percent from a year ago. Average sales price per ton increased 11 percent QoQ. Tons shipped to outside customers fell 9 percent to 5,889,000 tons and total third quarter steel shipments were down 12 percent from second quarter.

Nucor’s operated at 72 percent capacity in Q3 compared to 83 percent in second quarter and 69 percent in Q3 2015. The nine month operating rate was 76 percent compared to 69 percent in 2015.

Sales for the first nine months of 2016 decreased 6 percent to $12.25 billion. Total tons shipped to customers in the period increased 5 percent while average sales price per ton decreased 10 percent.

During the earnings conference call, Chairman, CEO and President John Ferriola said global steel overcapacity resulting from trade distorting practices from some governments, continues to be the steel industry’s great challenge. Nucor believes the trade case against circumvention of China steel products through Vietnam is very strong and they are also anxious to prosecute the case against rebar imports from Turkey. The disregard of commitments made by Turkey in previous trade cases to not increase imports to the U.S is expected to provide “tremendous ammunition” in the case, said Ferriola.

In answer to a question regarding order rates in Q4, Ferriola said there has been an uptick in order entry rates, particularly in sheet, and expects to see higher orders for tonnage in the new year.

Commenting on declining utilization rates, Ferriola said Nucor values improved margins and profitability over capacity utilization rates. Higher value products usually have a negative impact on run rates but are more profitable. At the end of the year, Nucor looks at how product mix shift has influenced capacity utilization but Ferriola said “we feel good at how we are shipping our product mix.”

Recent pricing of plate below hot-rolled is rarely seen and is not sustainable, said executives on the call.

When asked what the arrival of Big River Steel means for Nucor, Ferriola said, “It is just another competitor, and we’ve never shied away from competition. As long as it is fair and legal we love it. And we are confident we can take it on without it having an impact on our business. Well certainly it is going to hurt the market; certainly it’s going to have an influence on the market. But given what we have been doing, particularly in the Southeast and the markets we have targeted as we move up the value chain, certainly it will be a while before they can move up to the same areas where we are producing, particularly the high strength and the automotive markets we are moving into.”

Ferriola added a comment on the upgrade underway at Nucor Hickman, “We are confident the unique mill equipment that we are putting in there is going to give us ability to produce products that we can’t produce today, and products that certainly BRS can’t produce today, and that will give us another edge over them as they come up with more commoditized products.”