Prices

October 18, 2016

September/October Foreign Steel Imports

Written by John Packard

The U.S. Department of Commerce updated foreign steel import license data earlier today. SMU analyzes the license data through the 18th of October, produces a daily import license request rate and then we make an assumption that if the daily rate continues by the end of the month we will have “X” number of tons to potentially be received into the United States during the month.

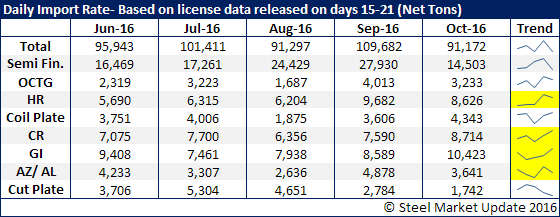

So, what does that look like? As you can see from the table provided below, the daily license rate is 91,172 net tons per day (based on 18 days – not just work days). The trend is for the month to be lower than what we saw in September and more in line with what was received during the month of August.

The trend right now is for semi-finished steels to be lower (which makes sense with the mills order books having suffered over the past few months) but most of the other products are in line with the past few months. The one exception is cut-to-length plate (CTL) which is suffering due to the dumping suits filed against the largest exporters of CTL plate into the United States.

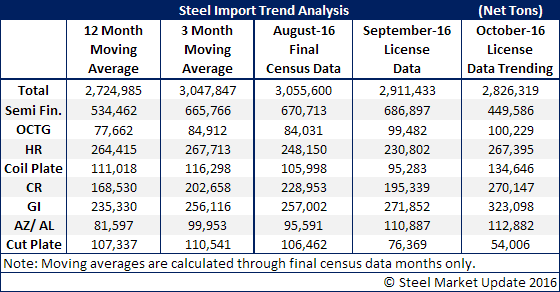

In the table below we show our 12 month and 3 month moving averages as well as August (Final Census Data), September (license data updated through today) and October (license data). October is trending toward a 2.8 million net ton month with the largest decreases being semi-finished and CTL plate as described above.

Hot rolled is in line with both the 12 and 3 month moving averages trending toward 267,000 tons.

Cold rolled is trending toward an expansion at 270,000 tons. When looking at the data on the U.S. Department of Commerce website we see Vietnam as the largest importer despite the recent circumvention suit (which was expected as there was not enough time for them to react to the suit). Australia is becoming a larger supplier of CR as are Turkey and Sweden.

Galvanized license data is also high compared to the 12MMA and 3MMA. GI is trending above 300,000 tons with Canada, Vietnam, Taiwan, Turkey, India and Brazil being the biggest players. Korea has pulled back a bit.

The table below shows license data collected between the 15th and 21st days of each respective month. It has been broken down by daily tonnage amounts for an apples to apples comparison.