Prices

October 11, 2016

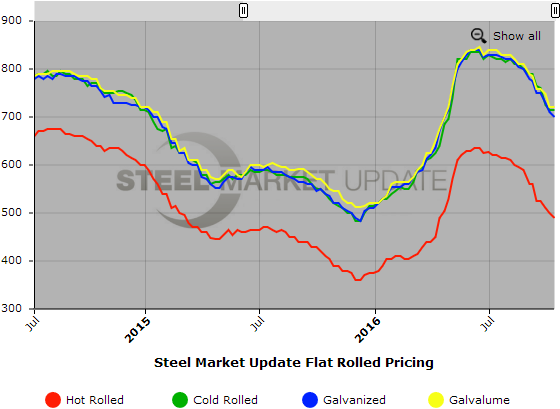

SMU Price Ranges & Indices: Hot Rolled Average Breaks Thru $500 Barrier

Written by John Packard

Flat rolled steel prices continue to move lower as benchmark hot rolled broke through $500 per ton and is now averaging $490 per ton. We were relatively conservative in our range this week as we did capture at least one order placed for moderate tonnage at $440 per ton and we are hearing that the integrated steel mills are trying to hold prices at, or slightly above, $500 per ton.

We heard from a couple of companies today about prices coming out of Mexico. One large service center told us, “Import offerings from Mexico currently reflect a “normal” $5.00/cwt spread with HR at equivalent US domestic fob (and/or US port) price of $23.50 and CR at $28.50. Not sure why they aren’t accounting for the higher spread in the US market. For what it’s worth, the most recent Mexican CR price offerings are now under what the lowest Vietnamese prices were just prior to the circumvention cases….”

SMU is asking the question: Will foreign offers, like the Mexican offers discussed above, begin to impact the spread between HRC and CRC and coated steels? We will continue to work on answering that question in the coming days and weeks.

Another buyer told us about foreign offers, “Off-shore offers are still competitive (CRC & HDG) for a forward ‘sell’ that’s locked in – I sure as heck would not speculate on off-shore tons.”

Short lead times continue to be one of the main drivers, “The mills we work with (both EAF & integrated) have very short lead times, shorter than normal right now,” is what a service center buyer told us this morning.

Besides short lead times we also have lower scrap prices for delivery to the domestic mills during the month of October. Scrap prices are down $15 to $30 per gross ton depending on product and location with prices in the Chicago area being the weakest and the east coast faring much better due to export prices rising.

Both the short lead times and scrap prices will help pressure prices over the next 30 days.

Steel buyers are beginning to talk about “the bottom” and making predictions as to when it will be achieved. A large national service center told us, “Most important is lack of volumes and short lead-times at the EAF mills. Last week, one could still get Oct for any sheet product, including Galv, at multiple EAF locations. Also contributing of course are the lower Scrap prices, which have made a bad situation worse. Last year, CRU HR averaged $412/ton in Oct, and averaged $364/ton in Dec, when it bottomed, or a monthly difference of $48/ton. Assuming we’re in a current market of around $490/ton, if we saw a similar drop before we bottom this year, it would be around $440/ton or so, and I think that’s as good a guess as any for now for calling a bottom range.”

An east coast service center provided their insights into how they think prices will fare from here, “I will say it… We are not too far from the bottom. Imports will ease now thru early 1st Q. Mills will start with extended maintenance outages now thru end of year. The holidays will reduce production. Then pricing will firm.”

Another service center told us what needs to happen before steel prices beginning to change course, “Typical lack of demand and year end slowdown over the next month or two and continued downward pressure until contracts are locked up and restocking starts to take place for the first quarter.”

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $460-$520 per ton ($23.00/cwt- $26.00/cwt) with an average of $490 per ton ($24.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end decreased $20 per ton. Our overall average is down $10 over one week ago. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $680-$740 per ton ($34.00/cwt- $37.00/cwt) with an average of $710 per ton ($35.50/cwt) FOB mill, east of the Rockies. The lower end of our range is down $10 per ton while the upper end of our range remained the same as one week ago. Our overall average is down $5 per ton over last week. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$36.00/cwt ($680-$720 per ton) with an average of $35.00/cwt ($700 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end decreased $20 per ton. Our overall average is down $10 over one week ago. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $740-$780 per net ton with an average of $760 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.00/cwt ($700-$740 per ton) with an average of $36.00/cwt ($720 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged over last week. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $991-$1031 per net ton with an average of $1011 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.