Government/Policy

October 9, 2016

EU Imposes AD Duties on Chinese HR and Plate

Written by Sandy Williams

The European Union, on Friday, placed provisional tariffs on imports of hot-rolled flat steel and heavy plate steel from China.

Steel association Eurofer lodged the antidumping complaint with the European Commission in January on behalf of European steel producers representing 90 percent of the region’s hot-rolled flat rolled steel production. Eurofer alleged in its complaint that the steel products were being sold at unfairly low prices.

![]() The European Commission said the investigation “confirmed that the Chinese products had been sold in Europe at heavily dumped prices.” Provisional duties were imposed ranging between 65.1 percent and 73.7 percent for heavy plate and 13.2 percent and 22.6 percent for hot-rolled steel.

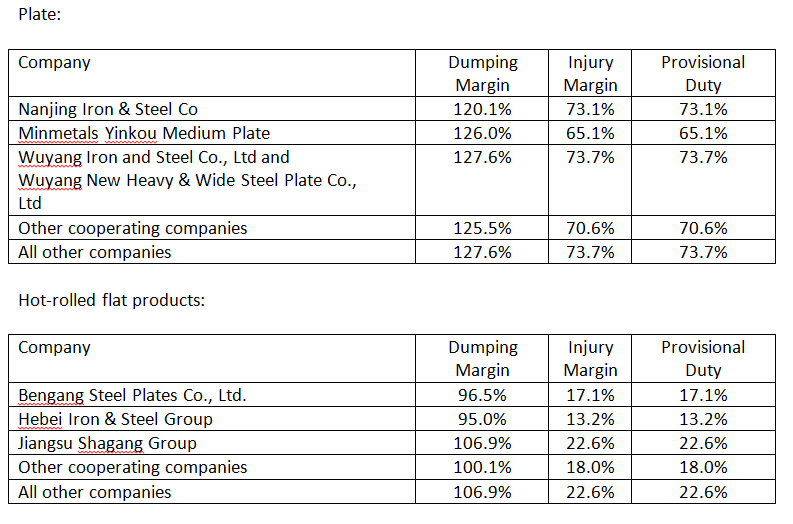

The European Commission said the investigation “confirmed that the Chinese products had been sold in Europe at heavily dumped prices.” Provisional duties were imposed ranging between 65.1 percent and 73.7 percent for heavy plate and 13.2 percent and 22.6 percent for hot-rolled steel.

The provisional measures concerning hot-rolled flat steel and heavy plates of steel were returned almost five weeks earlier than the procedural deadline. Wrote the Commission in its findings, “In the case of hot-rolled steel, the imposition of duties results from an investigation initiated even before the dumping-related damage could materialise, based on the so called ‘threat of injury’. As for the heavy plates, imports are subject to registration since August and duties can be applied retroactively at the definitive stage.”

Eurofer communications manager Charles de Lusignan commented, “It’s positive that the commission has been able to implement these provisional measures faster than usual, after about eight months rather than the usual nine.” He added, “It shows taking seriously the need to more quickly defend the industry against unfair dumping of steel.”

The Commission will decide within six months whether to reconfirm and extend the tariffs for the next few years. At that time, the Commission will also decide whether to retroactively collect the duties on heavy steel plates imported from China between August and October 2016.

The EU currently has 37 antidumping and anti-subsidy measures in place on imports of steel products, 15 of which concern China directly. Twelve more investigations are ongoing including the two provisional measures announced last week.

In its findings, the Commission reiterated the need to strengthen trade defense instruments:

“The Commission has been using the available toolbox of trade defence instruments to the full extent possible, but it’s necessary to strengthen these mechanisms to bring them up to the reality of the current state of globalisation. The Commission reiterates the call for Member States’ support for the 2013 proposal on the modernisation of the EU’s trade defence instruments, notably on the lesser duty rule. This would allow the EU to impose higher duties on dumped products.

“At the same time, the Commission keeps delivering on its action plan for addressing the overcapacity issue in the steel sector, through bilateral and multilateral contacts with our partners. It is crucial that China accepts to set up a mechanism to monitor over-capacity and that the Global Forum on steel excess capacity, agreed at the last G20 summit, becomes a reality, to increase information sharing and cooperation at global level.”

The duties imposed are: