Prices

October 6, 2016

SMU Analysis of August and September Foreign Steel Imports

Written by John Packard

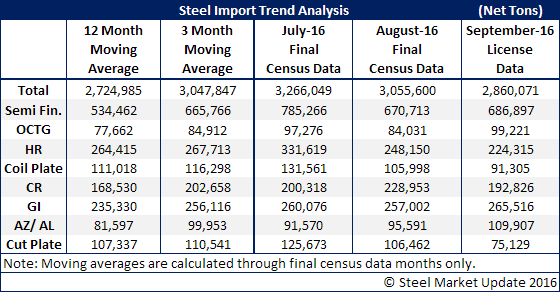

The U.S. Department of Commerce (DOC) reported final census data regarding foreign steel imports for the month of August and revised new license data regarding the month of September. The DOC reported August imports of 3,055,600 net tons and September license data has the month below 3.0 million tons to approximately 2.8 million tons.

The 3 million ton number for August is 210,000 tons lower than the 3.2 million tons reported for the month of July. The biggest changes between August and the previous month were due to 115,000 fewer tons of semi-finished steels (slabs & billet) and 83,000 fewer tons of hot rolled coil.

Looking at the August data areas that need to be watched:

Cold rolled at 228,953 net tons was well above both the 3 month and 12 month moving averages with Vietnam being the main culprit with 82,195 net tons coming from that one country. One year earlier Vietnam exported less than 100 net tons to the USA. Germany doubled the amount of cold rolled they had been shipping over the past twelve months moving up to 12,828 net tons. Other countries shipping at least 10,000 net tons were: Canada, Mexico, South Korea and Australia.

Galvanized was also at, or slightly above, the 3MMA and 12MMA at 257,002 net tons. We are seeing a number of new countries becoming part of the monthly mix: Pakistan, Guatemala (didn’t even know they had a steel mill…), Columbia, Belgium, United Arab Emirates (9,020 net tons), Turkey (9,310 net tons) with the major players being: Canada, Brazil, Taiwan and Vietnam (all over 20,000 net tons).

September imports are looking like they will be less than 3 million tons moving down to 2.8 million tons. Semi-finished imports remained at similar levels as August as is hot rolled. Cold rolled imports are trending slightly lower than August but are still projected to be above the 12MMA.

Looking at the September data here are areas that peaked our interest:

Galvanized: Vietnam is due to double their exports as there have been 54,000 tons of licenses requested. One year ago Vietnam shipped less than 1500 net tons of GI to the USA. Other unusual countries which were negligible one year ago: United Arab Emirates (UAE) and Pakistan. We also are seeing more tonnage coming out of Japan.