Prices

September 20, 2016

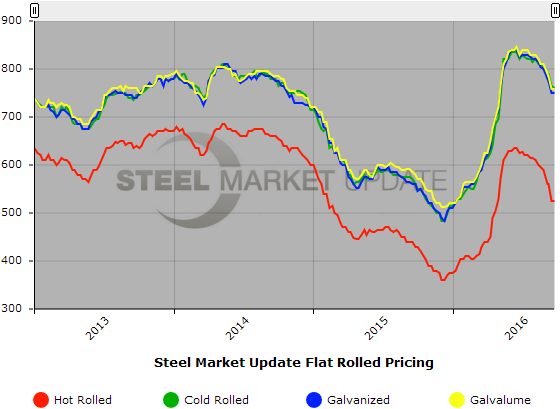

SMU Price Ranges & Indices: Digesting Changes

Written by John Packard

After making a big move this past week, spot flat rolled steel prices out of the domestic steel mills remained range bound with only minor adjustments as steel buyers try to digest what they need to do next. Steel buyers have been telling Steel Market Update that there is a disparity between the mini mills (electric arc producers) vs. the fully integrated mills. The cost parameters have been changing for both but, unfortunately for the integrated mills, a number of their costs have been rising (coking coal and iron ore) compared to earlier this year while the EAF mills are catching lower scrap prices.

The question on everyone’s mind is how long will flat rolled prices trend lower from here. There are a number of buyers who think hot rolled may be close to a bottom as foreign offers (which are few and far between) are no long compelling to most buyers as the spread between domestic and foreign has shrunk. Cold rolled and coated may have a ways to go due to the wider than normal spreads and there still being an active foreign market.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $500-$550 per ton ($25.00/cwt- $27.50/cwt) with an average of $525 per ton ($26.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our ranges as well as our average remain the same as what we reported last week. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days. SMU Note: buyers should be aware that HRC extras/freight may be negotiable depending on product, location and competitive situation. When taking extras and freight into consideration our average may be over-stated by $10 to $20 per ton.

Hot Rolled Lead Times: 2-4 weeks

Cold Rolled Coil: SMU Range is $740-$780 per ton ($37.00/cwt- $39.00/cwt) with an average of $760 per ton ($38.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same while the upper end dropped by $10 per ton compared to last week. Our overall average is down $5 per ton over one week ago. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $36.00/cwt-$39.00/cwt ($720-$780 per ton) with an average of $37.50/cwt ($750 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago while the upper end increased by $10 per ton. The net result being our overall average remained the same as last week. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $780-$840 per net ton with an average of $810 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $36.75/cwt-$39.00/cwt ($735-$780 per ton) with an average of $37.875/cwt ($757.50 per ton) FOB mill, east of the Rockies. The lower and upper end of our range remained intact as did our average compared to this past week. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1026-$1071 per net ton with an average of $1048.50 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks