Prices

September 18, 2016

Letters to the Editor: CR/Coated to Return to Norms

Written by John Packard

Late on Thursday evening we received the following letters to the editor, both from executives with flat rolled steel service centers:

Great articles tonight, full of very useful info.

There was a lot of space dedicated to HR imports, spreads to domestic, etc. With HR having been in excess for some time, it’s not surprising import price spreads aren’t attractive.

However, I believe the action and area needing attention is CR and Galv for the following reasons:

1). Tightness in these products in 1H 16 was due to reduction of imports (trade case effect), reduced domestic mill production (in place prior to 1H). Lack of supply drove prices of these products at rates well above HR, creating historic spread to HR in domestic terms, as well as to foreign CR/Galv prices

2). Given # 1, we’ve seen imports of these products accelerate and they now appear to be holding at high levels continuing into Sept data. This pattern is likely to hold as many buyers have concentrated more of their buys to imports.

3). Domestic lead-times for these products have pulled way back, especially EAF with 4-6 weeks pretty common.

Summary: we could see a more dramatic fall in CR and Galv in near term (more than HR), as spread to domestic HR closes to more historical range, driven both by increased imports and excess domestic capacity in near term. At today’s scrap prices, EAF mills have LOTS of room to lower prices and still make nice conversion spreads…

Lastly, I think we should assume spreads “return to norm” with the only question being over what period of time will it be.

The second letter to the editor said:

John

Just read the September 15th newsletter and as usual good timely information which is valuable as we enter, what I believe will be a nail biting 4th qtr.

As a primarily cold roll and coated service center I am watchful of the spread between HRC and Cold Roll. Your final thoughts comment indicated your opinion that the spread was “a tad high” With HRC at $500 – $520 / ton and the latest cold roll numbers at $740 – $760 / ton I believe the spread is more that a tad high.

With traditional spreads of $100 – $120 / ton between HRC and CR how long can a $200 – $240 spread be maintained? My concern is that the mills will do a sudden “reset” on CR and cause a dramatic decrease in service center current and purchased but not received inventories. Anyone remember 2014?

So the following questions.

Do you believe the spread between HRC and CR will return to traditional levels? If not, why?

Do you believe we will see a soft landing for CR pricing relative to HRC or will it be a thud?

Thanks for all your information and keep up the good work!

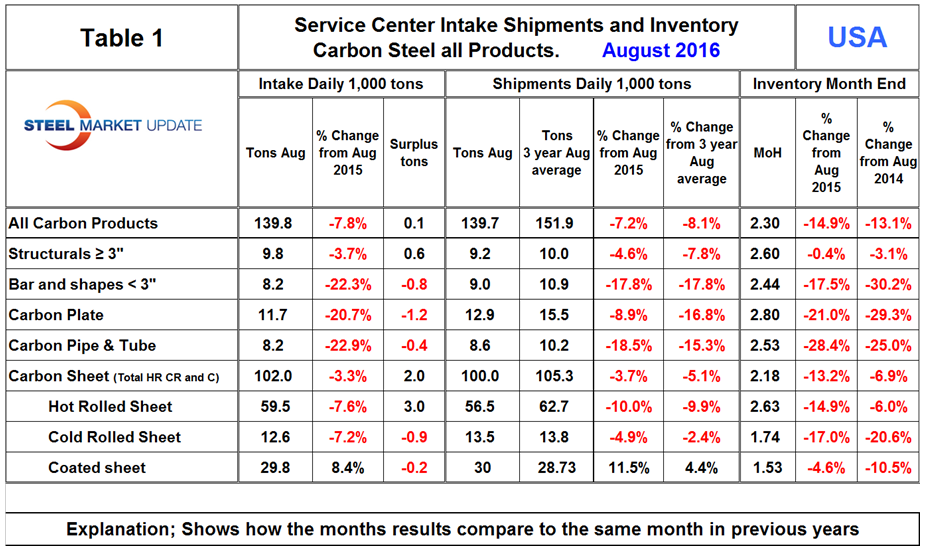

SMU Note: There is a large amount of discussion within the steel buying community on the subject of “price spread” both between domestic and foreign as well as domestic hot rolled base prices to those of cold rolled and coated (galvanized, Galvalume, aluminized, galvanneal, etc.). It is SMU opinion that the $200+ spreads between HRC and CRC/GI/AZ base pricing is not sustainable. The question is how quickly will it revert to the norm? The MSCI data just released is showing the number of month’s on hand for cold rolled to be 1.73 months and galvanized is even lower at 1.53 months (see Table 1 below). These low inventory levels are helping to support the wider than normal price spreads between HR and CR/coated. The worry we have (again our opinion) is that buyers are looking to Vietnam, Turkey, Europe, South America and elsewhere to offset this discrepancy between HR and CR/coated. Our worry (from past experience when we were selling steel) is, if the domestic mills allow foreign to supplant domestic tons, the domestic mills will be hard pressed to get those tons back without driving prices down further than they would have had the spreads remained more normal…