Logistics

September 13, 2016

Ocean, Barge, Rail & Truck Update

Written by Sandy Williams

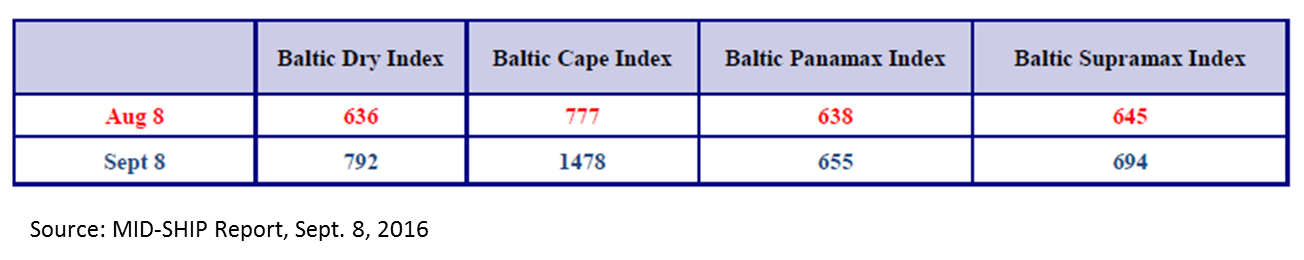

MID-SHIP Group expressed optimism in its first report of the fall season. The Sept. 8 MID-SHIP Report said the group is “cautiously optimistic” about better dry bulk shipping demand in the second half of 2016. Oversupply of vessels continues to be a problem but as the seasonal grain shipments begin late in September demand should be stronger in October. Short term volatility is expected as rate levels increase into first quarter 2017.

The Baltic Dry Index was at 796 on Sept. 13 after reaching 800 the day before. The index has improved significantly from its historic low of 290 in February. Oil prices in August were around $45/barrel pushing vessel fuel prices up to $251PMT. Bunker prices are expected to be between $230 and$260 as the year finishes.

The bankruptcy of Hanjin Shipping Company has resulted in half a million cargo containers being denied port entry as uncertainty prevails over who will pay dockage, storage and handling fees, said MID-SHIP. Samsung Electronics is reported to have $38 million of cargo stranded on Hanjin vessels causing container freight rates from Asia to the U.S. to increase 40-50 percent last week.

Vessel scrapping continues with 64 cape size vessels scrapped in the first half of 2016 compare 95 vessels for the entire year 2015. Improved market conditions have slowed the scrapping rate significantly in recent months says MID-SHIP.

Rivers: Conditions on U.S. rivers have been good so far despite being in the peak of hurricane season. Hermine had little effect on barge activity. In preparation for winter closure of locks on the Upper Mississippi, barge companies have been given deadlines for loadings headed to the upper end of the river. The deadline for release of barges in the New Orleans areas to St. Paul and McGregor, IA is September 28. Barges headed to the middle of the upper Mississippi between Clayton, IA and Quincy, IL have until October 5 to be booked.

The detour around the Industrial Locks at New Orleans will continue until the end of November when the gate replacement and improvements are expected to be completed. The Kentucky Lock on the Tennessee River will be intermittently closed from October 4 through October 9 and then completely closed to navigation until October 13. Delays are expected.

Corn and soybean crops are expected to be at record levels but rates for barges have not yet reacted to the forecast. Loadings are currently down 85 percent from year-ago levels due to low prices causing farmers to hold their harvests.

Trucking: The trucking industry continues to struggle with finding qualified drivers. Diesel fuel last week was at 2.407 per gallon down 40 cents from the same week in 2015. Fuel surcharges are expected to range from $.30 to $.32 per one way mile.

DAT Trendlines reports spot market loads were up 0.5 percent from July to August while capacity during the period increased 14 percent. Average flat-bed rates dropped 3 cents to $1.90 from July to August with the national average down 17 percent compared to August 2015. Flatbed rates per mile ranged between $1.67 on the West Coast to $2.91 in the Northeast. Flatbed load availability fell 18 percent in August and capacity increased 12 percent compared to July, said DAT Trendlines. The national load to truck ratio declined from 14.4 loads per truck to 10.7, a drop of 26 percent from July and 6 percent from August 2015.

The American Trucking Associations most recent report on truck tonnage shows the seasonally adjusted For Hire Truck Tonnage Index was down 2.1 percent in July following a 1.6 percent decline in June.

“On a monthly basis, tonnage has decreased in four of the last five months and stood at the lowest level since October during July,” said ATA Chief Economist Bob Costello. “This prolonged softness is consistent with a supply chain that is clearing out elevated inventories.

“Looking ahead, expect a softer and uneven truck freight environment until the inventory correction is complete. With moderate economic growth expected, truck freight will improve the further along the inventory cycle we progress,” he said.

Railway: The Association of American Railroads reported August carload traffic totaled 1,347,989 carloads, a 5.5. percent drop from August 2015. Intermodal unit were down 4.8 percent to 1,327,274 containers and trailers.

Total carloads for the week ending September 3 were 273,117 carloads, down 4.9 percent compared with the same week in 2015, while U.S. weekly intermodal volume was 265,709 containers and trailers, down 5 percent compared to 2015.

Great Lakes: Iron ore shipments on the Great Lakes and St. Lawrence Seaway increased 2.9 percent year-over-year in August to 6,408,409 tons, according to data from the Lake Carriers’ Association. Shipments from U.S. ports were up 7.7 percent to 5.3 million tons but were down 23 percent from Canadian ports. As of the end of August iron ore shipments totaled 32.8 million tons, a decrease of 2 percent from the same period in 2015.