Prices

September 13, 2016

Foreign Steel Imports: Is 3 Million Net Tons/Month the New Normal?

Written by John Packard

We don’t think the domestic steel mills would have envisioned winning virtually all of their antidumping (AD) and countervailing duty (CVD) suits and still have foreign steel imports at, or above, 3 million net tons per month. Unfortunately for the domestic mills that is the reality that is sinking into the market (and probably a factor in sinking domestic prices at this time).

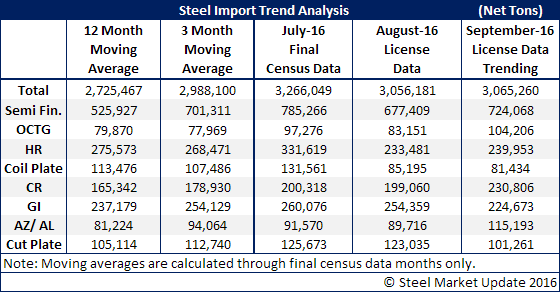

Foreign steel imports totaled 3,266,049 net tons for the month of July 2016. August license data collected through today (September 13, 2016) has imports just breaking the 3.0 million net ton mark. September licenses collected through the 13th of the month has the month trending toward a similar number as August, just over 3.0 million net tons.

What is driving the numbers?

Semi-Finished Steels

The first culprit is semi-finished steels. These are the slabs and billets being brought into the United States by the domestic steel mills themselves (the vast majority of the tons being slabs). Industry sources are telling us that some of the slabs produced off the IH3 blast/BOF operations at ArcelorMittal may be destined for Calvert. Maybe this will help bring the slab numbers down.

On the flip side we have USS/POSCO with a problem at their hot rolled supplier. One of the options USS/POSCO is probably considering is having California Steel or another mill in the U.S. (or world) take POSCO slabs and then convert them to hot rolled coil. We don’t have any direct information saying this is going to happen but if we see a jump in Korean slabs into the U.S. you will understand why. So, there is a possibility we could see imports of slabs actually jump come 4th Quarter and into next year.

Hot Rolled

The hot rolled numbers are beginning to drop. When looking at the individual country numbers we are seeing fewer tons coming from Korea (as POSCO deals with the HRC decision). Italy requested 15,600 net tons of licenses for the month of August but, other than that there doesn’t seem to be anything out of the ordinary on HRC for now.

Cold Rolled

Cold rolled import tons are growing with Vietnam leading the way but by no means is Vietnam the only major player in the CR market.

Cold rolled imports are exceeding 200,000 net tons per month for July, August and the trend so for for September. Other major exports of CRC to the U.S. include: Canada, Mexico, Turkey, Korea, Germany (doubled their normal shipping in August to 11,200 net tons) and Australia (which has all of a sudden become a major supplier).

Galvanized

Import tonnage has remained around 225,000-250,000 net tons over the past few months. Vietnam exports are still growing with 39,000 net tons of license requests having already been made for the month of September (as of the 13th). Brazil has returned to the market (filling old orders not necessarily taking new orders for deliver now). Korean tons seem to be in decline. Turkey is exporting more galvanized and our friends in the UAE (United Arab Emirates) are also grabbing more market share.