Prices

September 8, 2016

Hot Rolled Futures: Here We Go Again!

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Andre Marshall of Crunch Risk LLC. Here is how he saw the financial markets as well as HRC and scrap trading over the past week:

The Financial Blah Blah:

The U.S has been the bright spot. Just look at the stock market, it‘s a “roofer” once a month (no end in sight for now, although a good pull back would sure be welcome to calibrate the sanity). We dealt with the issue early back in ‘09/’10 and took care of our balance sheets, while Europe and China tried to curtail spending. We have led the recovery since, albeit not what we expected. We have eventually replaced the jobs, and we have eventually replaced the housing values, and we have eventually replaced the equity values, all thanks to printing money ;).

What we haven’t replaced are the growth in wages, and we have pockets of troubling debt still, education and autos. However, energy has lowered the cost of living by an historical amount, and the reduced expectations of millennials have likely curtailed demand growth (little interest in single family suburban homes for instance – probably the biggest driver of labor and thus jobs in the U.S, and little interest in autos – Uber anyone?) so wage inflation may not carry the weight it used to! I think actually that the Millenials have a lot of pent up demand that will eventually materialize (babies concept), most likely in that single family housing growth sector, maybe not until the 2020’s, but probably sooner (they’re actually getting on in age if you think about it). So I say watch out! It won’t do anything for your concern about tomorrow and the timing of the Q4/Q1 trough cycle in steel values in the U.S., but it should concern you as relates to your purchasing price risk, even as early as 2017. And let me point out, maybe again, that China, recently, and Europe, for about a year plus, are in monetary easing mode (and we the U.S. hasn’t stopped since 2009). In case you can’t tell, I’m arguing for the long “recession hangover” scenario and not for the “New Economic Paradigm” scenario , I can’t help but be the contrarian. Inflation will come eventually as cycles always prevail. If only we knew when exactly. Go Millennials!

Steel:

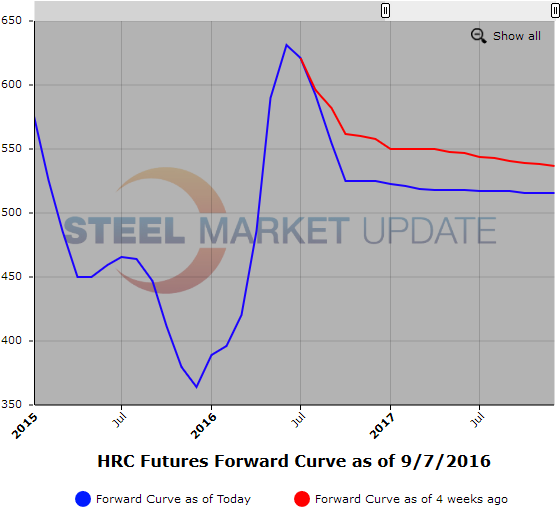

It was a decent week in steel futures with 1184 lots or 23,680 ST trading. The precipitous spot price decline has bled into the futures markets causing speculative and hedger sellers to hit next bids below.

We started the week off with small Calendar ’17 trades in the 520 zone with subsequent trades at 518 and 515 later in the week. And in Q4 16, we have traded 532 a week back and as low as 525 mid-week.

Spot levels have demonstrated an approximately $18-22/ST drop in the week depending on the index you follow. Mills seem eager to find orders as the finished product lead time cushion comes in. No one bothered to tell them there were no HR orders to be had with energy not recovered yet, and voila, panic! Feels like lack of demand led, which still likely short term, but effect nonetheless. Unfortunately with Metal Margins so wide it was inevitable at some point that steel prices would have to tank or scrap would have to rise precipitously. Shutdowns in Q4 probably killed the scrap rising scenario, although Big River eventual entry could well change that. Bearishness had been pervasive, but the rate of decline has surprised most.

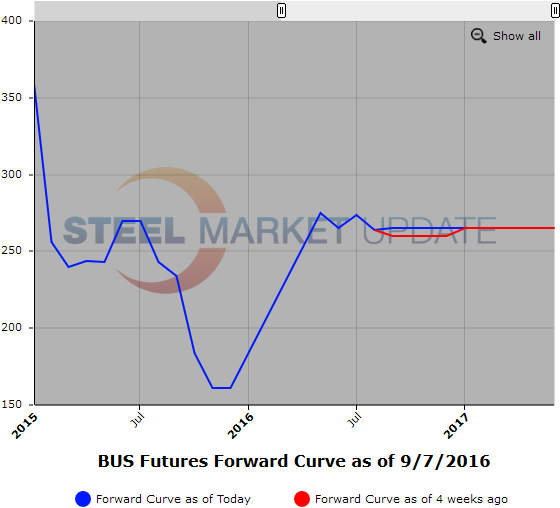

Scrap

In scrap, flows are frankly anemic in obsolete, August orders that weren’t cancelled are still in the process of being filled. That said scrap is dropping because the mills don’t have the appetite particularly as relates to inventory with upcoming outages. At $200/MY CFR Turkey for 80/20, $230/GT Bush and $220/GT Shred, the spigot just got tightened some more. Ok for now with an absent steel demand, but not sustainable over any length of time.

Below is a graph showing the history of the hot rolled and busheling scrap futures forward curve. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.