Government/Policy

September 8, 2016

DOC CTL Plate Determination Affirmative for China but Not Korea

Written by Sandy Williams

The Department of Commerce announced an affirmative preliminary determination in the countervailing duty investigation of cut-to-length steel plate from China but a negative determination in the CVD investigation of imports of CTL plate from Korea.

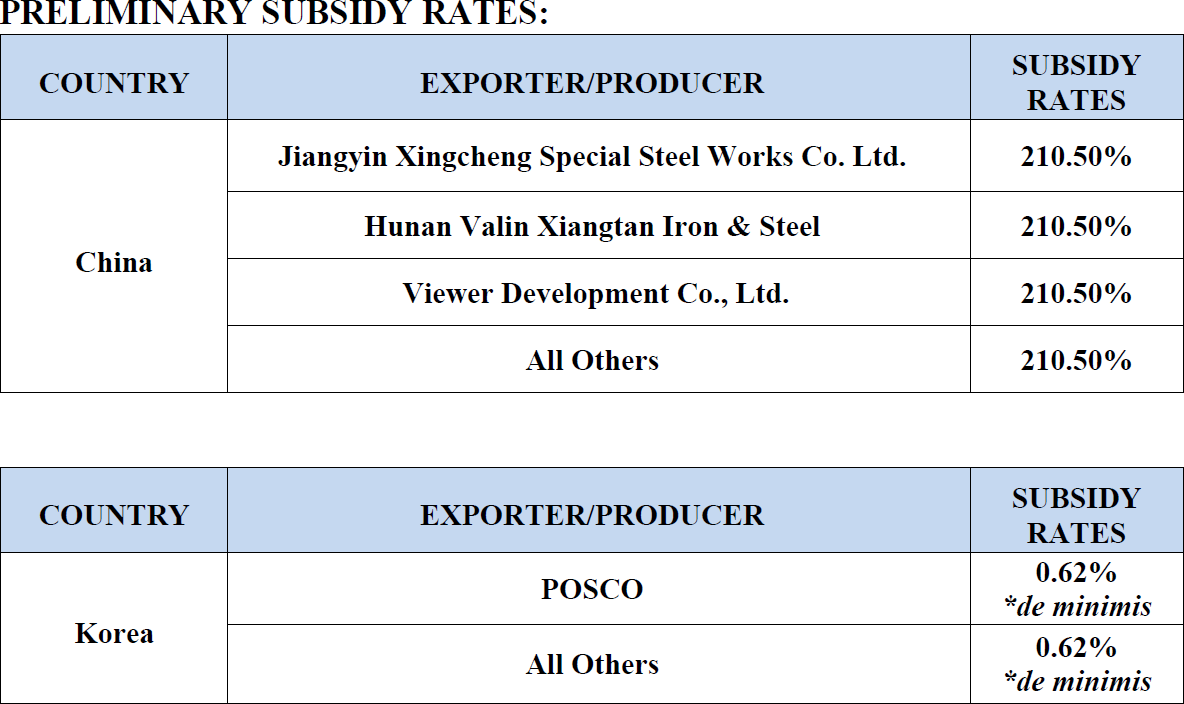

Exporter and producers in the China investigation received subsidy rates of 210.5 percent based on available adverse facts (they did not participate in the DOC review process). A de minimis rate of 0.62 was determined for Korean steelmaker POSCO and all other imports of plate from Korea. A de minimis rate means Korea will not have to pay any cash deposit on CTL plate exported to the United States.

A preliminary decision by Commerce on the antidumping CTL plate investigation for the other ten countries named in the original suit is expected by November 7, 2016. A total of twelve countries are named in the AD investigation: Austria, Belgium, Brazil, China, France, Germany, Italy, Japan, South Korea, South Africa, Taiwan and Turkey.

ArcelorMIttal USA, Nucor, and SSAB filed the petition on April 8, 2016 and the investigation was initiated by the Department of Commerce on April 28.

The products covered by these investigations are certain carbon and alloy steel hot-rolled or forged flat plate products not in coils, whether or not painted, varnished, or coated with plastics or other non-metallic substances (cut-to-length plate). Subject merchandise includes plate that is produced by being cut-to-length from coils or from other discrete length plate and plate that is rolled or forged into a discrete length

The final determination by Commerce is due on or about January 19, 2017 followed by a final determination on injury to the domestic industry by the International Trade Commission on March 6, 2017. If either Commerce or ITC makes a negative final determination, then a CVD order will not be issued.