Government/Policy

September 6, 2016

ITC Announces Final Determinations for Cold Rolled, Russia Dropped from Case

Written by John Packard

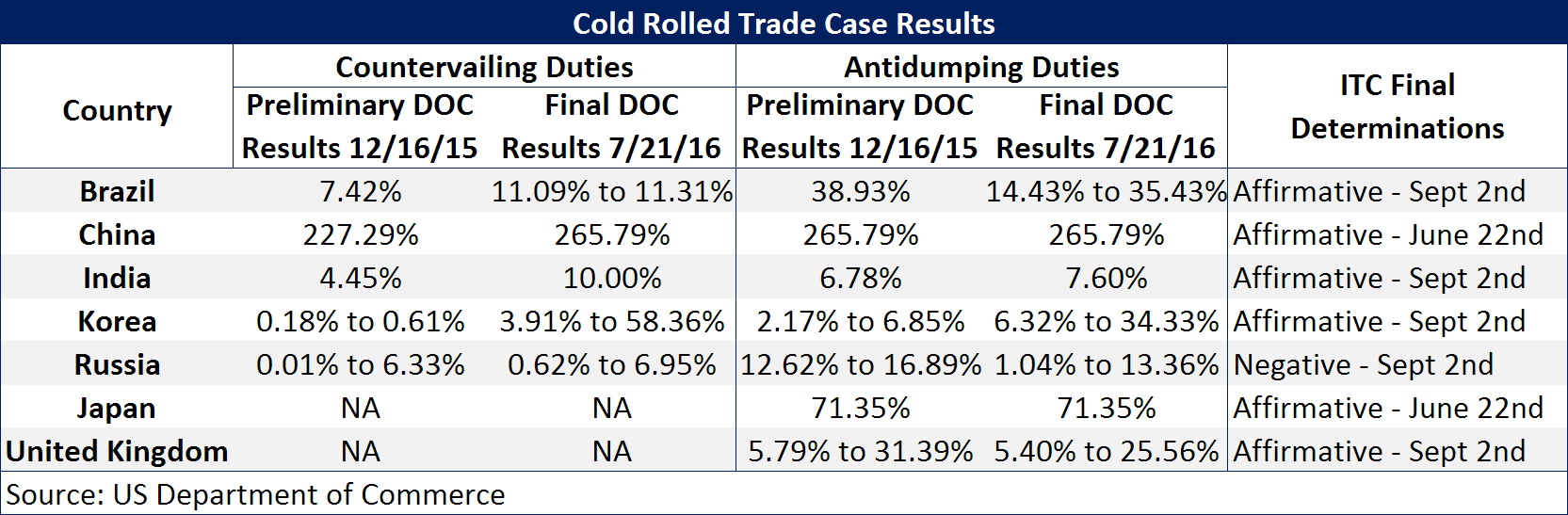

The U.S. International Trade Commission (ITC) reported their Final Determinations in the antidumping and countervailing duty investigation on cold rolled steel from Brazil, India, Korea, United Kingdom and Russia. The ITC affirmed injury from all of the countries with the exception of Russia. Imports of cold rolled out of Russia were determined to be negligible and as a result there will be no order issued against Russia (they are free to export cold rolled to the United States).

The cases against China and Japan cold rolled were announced separately (June 22, 2016) as both countries did not participate in defending themselves and were found to have injured the U.S. steel industry. A complete look at each country and their projected cash deposit rates is shown at the end of this article.

Over the past 14 months Russia has shipped a total of 59,200 net tons of cold rolled to the United States. The bulk of those shipments were made during the months of September and October 2015 when a total of 45,918 net tons of Russian cold rolled were received in the U.S. More than likely the September and October orders were placed prior to the AD/CVD case was filed in July 2015.

Prior to the ITC ruling Russia was looking at cash deposits of slightly more than 1 percent to as high as 20 percent when taking into consideration the US Department of Commerce antidumping and countervailing duty rulings. However, the ITC ruling is the last say in the process and those US DOC findings against Russia are effectively wiped out and no deposits or duties are owed.

Here is the original press release from the International Trade Commission:

The United States International Trade Commission (USITC) today announced its determinations in its antidumping and countervailing duty investigations concerning imports of cold-rolled steel flat products from Brazil, India, Korea, Russia, and the United Kingdom that the U.S. Department of Commerce (Commerce) has determined are sold in the United States at less than fair value and subsidized by the governments of Brazil, India, Korea, and Russia.

The Commission determined that an industry in the United States is materially injured or threatened with material injury by reason of imports of these products from Brazil, India, Korea, and the United Kingdom.

Chairman Irving A. Williamson, Vice Chairman David S. Johanson, and Commissioners Dean A. Pinkert, Meredith M. Broadbent, and Rhonda K. Schmidtlein voted in the affirmative with respect to imports of these products from Brazil, India, Korea, and the United Kingdom. Commissioner F. Scott Kieff voted in the affirmative with respect to imports from Brazil, Korea, and the United Kingdom and with respect to imports sold at less than fair value from India; he found that imports subsidized by the government of India are negligible.

All six Commissioners further found that imports of these products from Russia are negligible. As a result of the Commission’s finding of negligibility, no orders will be issued on imports of these products from Russia.

As a result of the USITC’s affirmative determinations, Commerce will issue countervailing duty orders on imports of these products from Brazil, India, and Korea and antidumping duty orders on imports of these products from Brazil, India, Korea, and the United Kingdom.