Prices

September 6, 2016

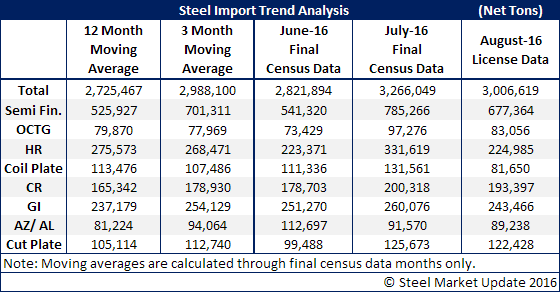

Final July Imports at 3.27 Million Tons

Written by John Packard

The U.S. Department of Commerce announced Final Census data for July foreign steel imports. July imports surprised to the upside at 3,266,049 net tons. At the same time, based on data through the 2nd of September, August imports are trending toward another 3.0 million net ton month.

Both July and August saw a surge in semi-finished imports. SMU is aware that ArcelorMittal is starting back up their IH3 blast furnace at Indiana Harbor and our understanding is part of the production is for slabs to go to their Alabama operations. Maybe the IH3 is not such bad news for the domestic steel industry? We will have to wait a few months to see if semi-finished imports shrink but if they do you know the reason why/how.

Hot rolled imports were quite high in July but fell off in August. Cold rolled imports are higher than they have been averaging both on a 3 month and 12 month moving average. This may get worse with Russia now coming back to the mix (but they will not be a huge tonnage supplier). The issue with cold rolled is the wide variance between foreign (mostly Vietnam and Turkey) and domestic prices. The U.S. mills need to get more competitive in the coming months on cold rolled.