Market Data

September 1, 2016

Manufacturing Declines in August, Says ISM

Written by Sandy Williams

Manufacturing contracted in August after five consecutive months of growth, according to the latest Manufacturing Report on Business from the Institute of Supply Management.

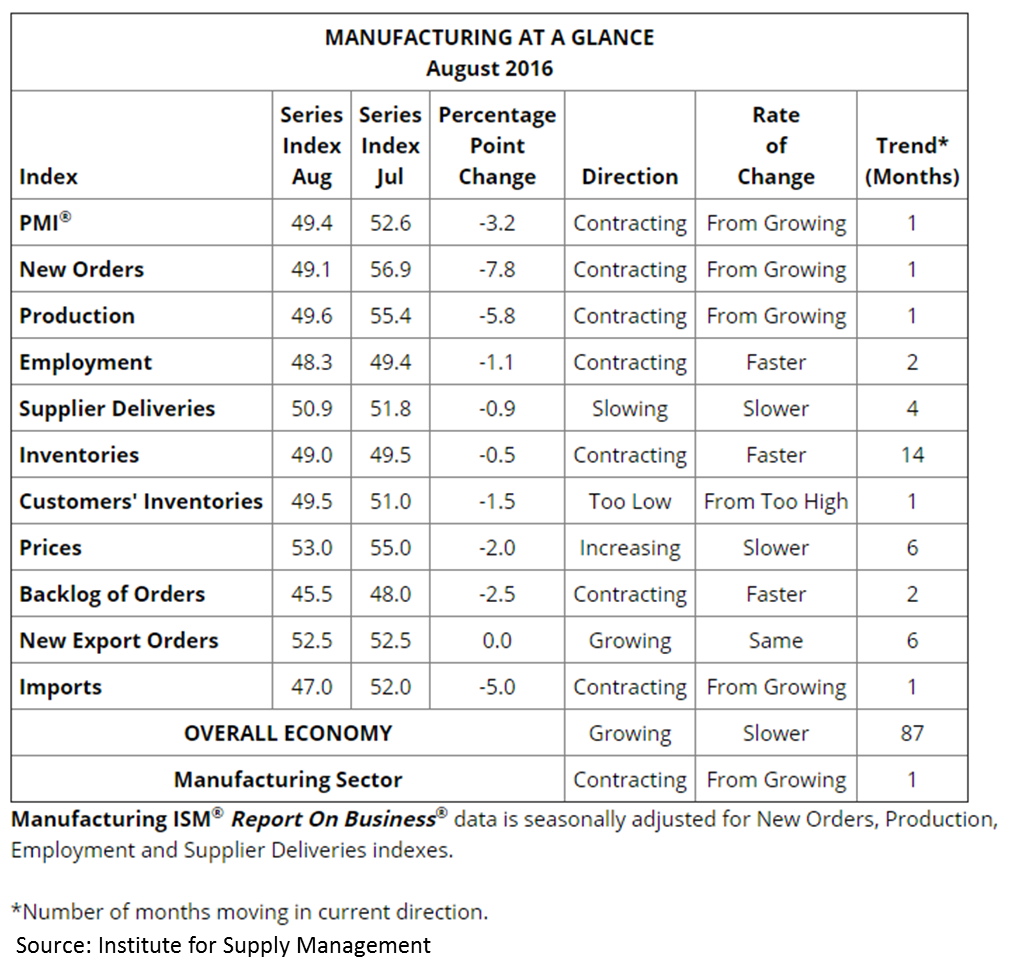

ISM reported the August PMI at 49.4, down 3.2 points from July at 52.6 percent. It was the first time the index has slipped since February of this year. New orders and production were down 7.8 percent and 5.8 percent, respectively. Order backlogs decreased at a faster rate.

Employment levels registered an index reading of 48.3, down 2.1 percent from July. Raw material inventories were slightly tighter as prices for preproduction material increased for the sixth month. Customer inventories were down as well, contracting from 51.0 to 49.5.

Imports decreased from June, falling 5 points. New export orders were unchanged at 52.5.

The report indicated that the overall economy grew at a slower rate and the manufacturing sector contracted in August.

Primary metals and fabricated metal products were among the 11 industries reporting contraction in August.

Some of the comments by survey respondents were:

- “Commercial construction continues to be strong, and therefore our business is very good.” (Fabricated Metal Products)

- “This past month, sales increased over the trend from the first half of the year. There seems to be a general, albeit slight, loosening of capital purse strings.” (Machinery)

- “Business conditions are generally flat.” (Transportation Equipment)

- “Oil prices continue to seek a ‘footing’; rig count slowly increasing.” (Petroleum & Coal Products)

- “We have been getting lots of inquiries, but not a lot of sales order placements.” (Chemical Products)

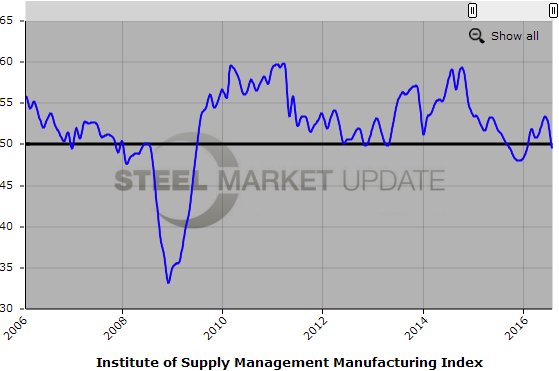

Below is a graph showing the history of the Institute of Supply Management Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.