Prices

August 25, 2016

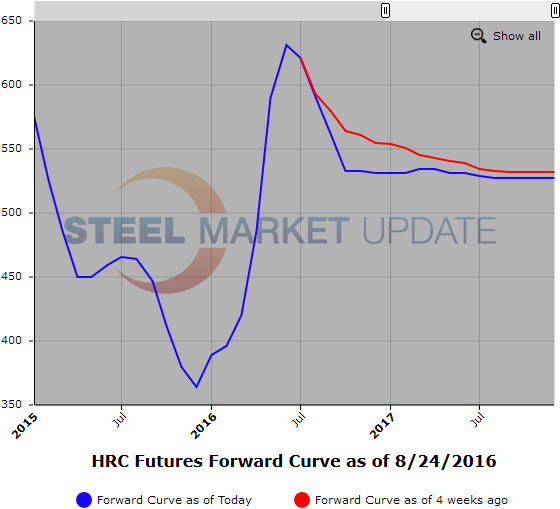

Hot Rolled Futures: Fear Takes Hold

Written by Jack Marshall

The following article on the hot rolled coil (HRC) and financial futures markets was written by Andre and Jack Marshall of Crunch Risk LLC. Here is how they saw trading over the past week:

Steel

We traded 961 lots of hot rolled coil (HRC) futures in the week or 19,220 short tons (ST). With the almost a penny decline in HR prices by some indexes to $575 zone, the HR futures also traded down a bit further with Q4 trading as low as $532 by end week and Q1 trading as low as $528. We also saw the back end of 2017 trade in the low 530’s earlier in the week. It looks like trade related selling in the nearby months and some speculative bearish short selling in the back end months. Lack of nearby demand has some questioning ability of market to hold up and that skepticism is rolling into the futures. A good buy for some here, and a relief for others.

Scrap

For some many weeks Turkish CFR 80/20 scrap has held $229/GT (gross ton) on the back of improved demand in MENA, but also curtailed Chinese Billet supply, and a more competitive European scrap market (in part due to East Coast US mill purchases). We have just recently seen a slight easing in that benchmark to $225/GT, but still relatively stable.

In the domestic market it’s a mixed bag with some regions very tight certain grades in obsolete and some regions with better demand due to inventory replenishment. Expectations are for a down market in primes and shred, albeit modest. With mills clearly having reached on steel orders of late, and the still anemic flows in certain grades, it may not end up being a continued declining market. At some point when steel demand revives even slightly, scrap dealers will be asking for significantly higher prices. Outages are a factor, but so is Big River, who hasn’t even entered the market yet.

Below is a graph showing the history of the hot rolled and busheling scrap futures forward curve. You will need to view the graphs on our website to use their interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.