Prices

August 18, 2016

Hot Rolled Futures Come Under Pressure

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

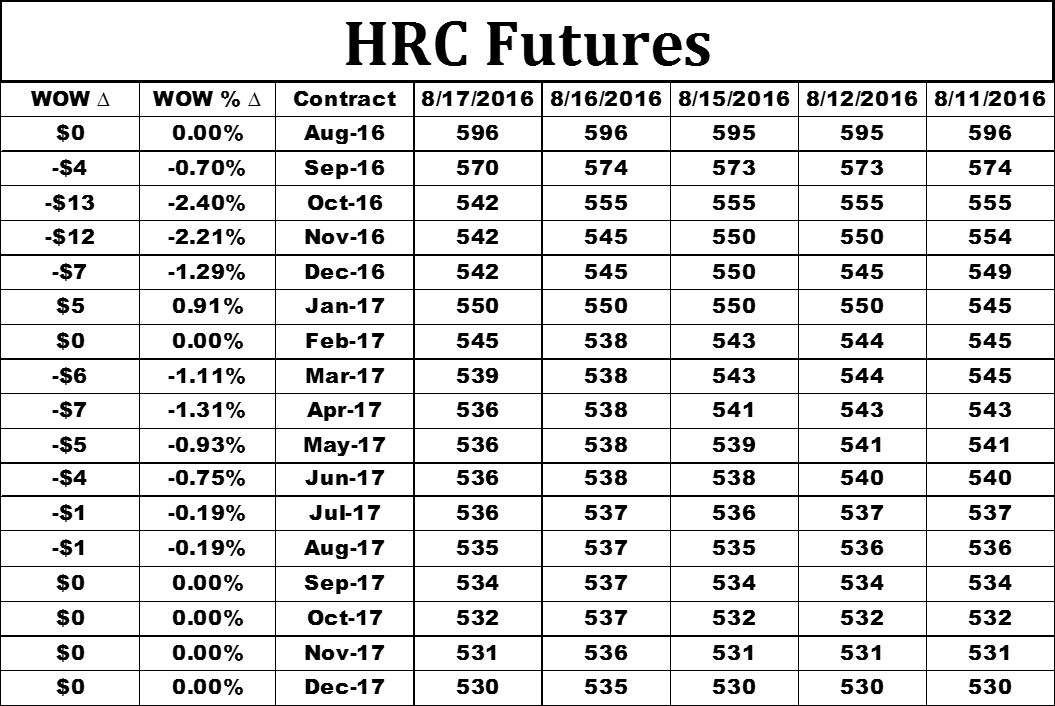

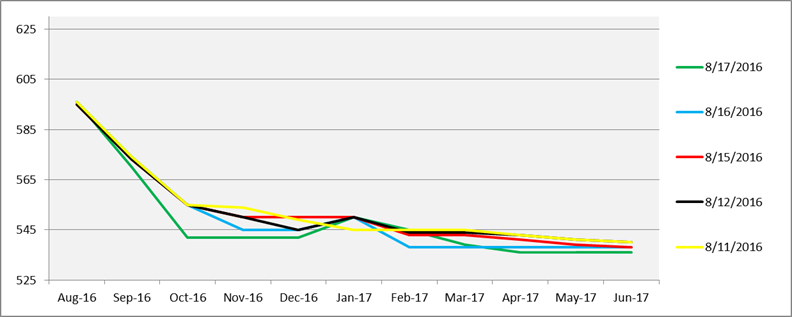

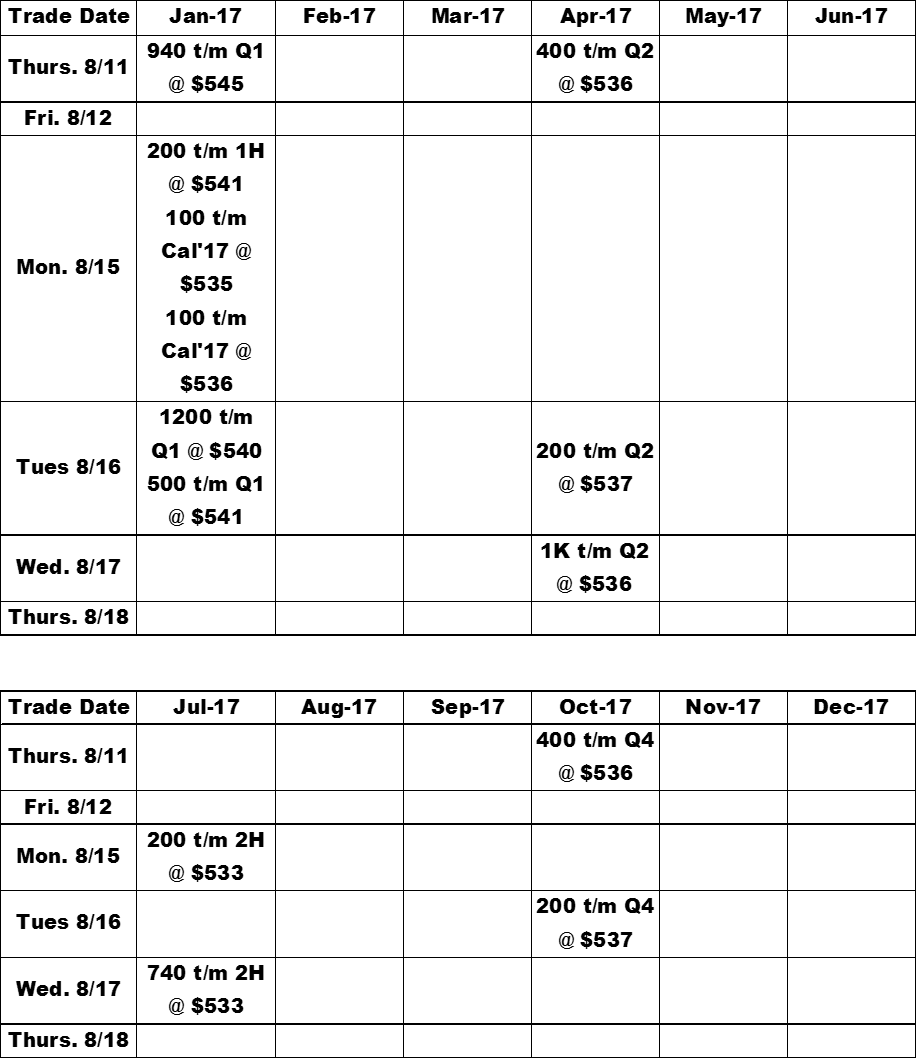

CME Midwest Hot Rolled Coil (HRC) futures have come under pressure again this week, especially in Q4. 31,760 short tons (st) have traded hands since last Thursday. Open interest is currently at 385,740 st

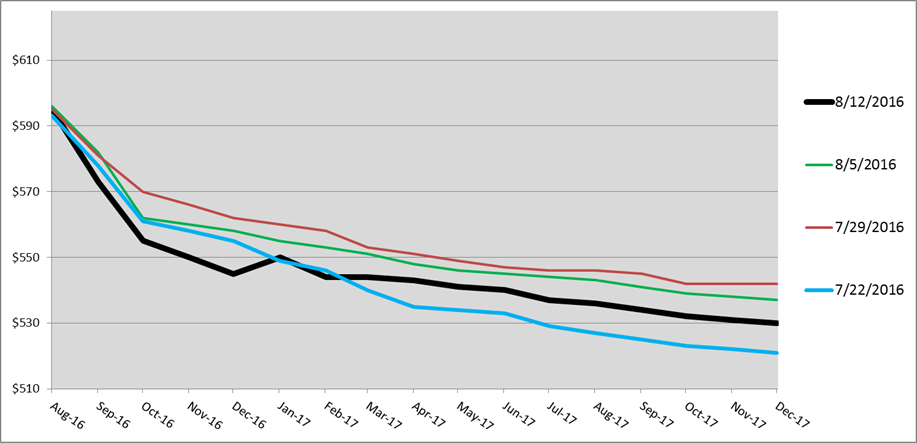

Looking back to mid-July, we can see that Q4 2016 and Q1 2017 are down about $20 in four weeks, but there has yet to be any major volatility. Also notice the curve has flattened somewhat. That being said, the curve is still far below current physical spot prices.

While the fundamental picture looks strong on the supply side (low inventory, imports, etc.). the “buyer’s strike” now in its third month has had a dramatic effect resulting in a steep drop in lead times. Are these deflationary expectations finally taking hold and forcing prices lower?

With Big River expected to start producing by year end and the surprising announcement that the hot strip at the former Wheeling Pitt mill will be opening to roll imported slabs as soon as November, the bull case is somewhat tarnished. However, strong auto sales, continued momentum in construction and a decent ISM PMI combined with the solid supply side fundamentals addressed above could provide some push back. At these low inventory levels, a supply disruption could turn the market around in a heartbeat. Post Labor Day developments will be interesting, especially if domestic mills attempt a price increase to bolster current prices.

Below are the trades executing since last Thursday.