Prices

August 16, 2016

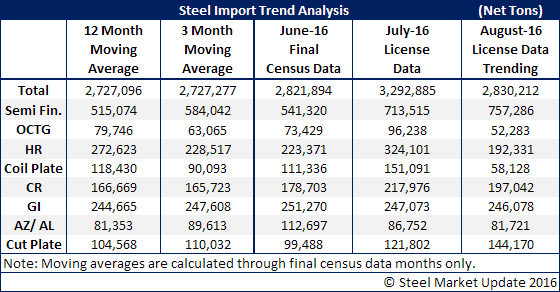

August Imports Trending Toward 2.8 Million Tons

Written by John Packard

Foreign steel imports are trending toward once again coming in above both the 3 month and 12 month moving average. The U.S. Department of Commerce released license data earlier today and, based on that information, we are on pace for a 2.8 million ton (net tons) month. This would be lower than the 3.2 million tons seen in July and about even with June data.

License data only provides an indication and can vary widely from the final numbers. So, the numbers shown in August in the chart below are based on the daily license rate and expanded to account for the entire month.

Slab imports, which are for the domestic steel mills, continue to be trending at more than 700,000 tons. We are seeing a drop in hot rolled which surged during the month of July to 300,000+ tons. All of the other flat rolled items appear to be in line with what was received in prior months.