Prices

August 9, 2016

June & July Foreign Steel Imports

Written by John Packard

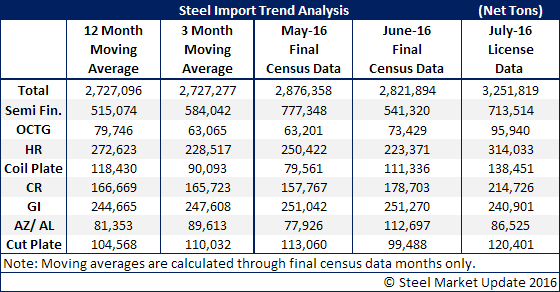

The U.S. Department of Commerce released Final Census Data for June as well as an update on July import license data earlier this week. Foreign steel imports came in at 2,821,894 net tons during the month of June. This is essentially unchanged from the prior month’s 2,876,358 net tons of imports.

July imports, based on licenses data which everyone has to remember can be somewhat suspect, is still showing imports as breaking through the 3.0 million ton mark and the data is suggesting imports could be as high as 3.2 million net tons.

As you look at the data below you will notice that there is once again a large increase of imported semi-finished steels (slabs and billets but mostly slabs) during the month of July. Semi’s are only used by the domestic steel industry.

We also are seeing a rise in hot rolled imports just as the U.S. Department of Commerce announced their final determination on the hot rolled AD/CVD trade cases. Korea continues to be the largest exporter of HRC with 116,800 net tons of license requests. Three other countries hit with AD/CVD also were major exporters of HRC exports in July: Japan, which had minimal shipments in the March through June timeframe all of a sudden requested 53,400 net tons of HRC licenses; Turkey requested 26,600 net tons and the Netherlands requested 19,600 net tons.

In cold rolled we continue to see Vietnam as the largest exporter as they requested 51,500 net tons of licenses for July. Australia came out of the woodwork with 21,400 net tons of license requests. Thailand is another country that is coming in and out of the CRC market as they requested 4,870 net tons. Argentina requested their first cold rolled licenses in over 18 months with 5,400 net tons. There were 16 countries requesting CR licenses for tonnage of 3,000 tons or greater.

In galvanized one of the most interesting numbers was the 18,150 net tons of licenses requested by India (which was hit by AD/CVD). Our expectation/opinion is this is from Uttam as they received the smallest duty rate of the Indian steel mills.