Prices

August 4, 2016

Hot Rolled Futures Rally as Physical Price Remains Above $600

Written by David Feldstein

The following article on the hot rolled coil (HRC), busheling scrap (BUS), and financial futures markets was written by David Feldstein. As Flack Steel’s director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Steel website www.FlackSteel.com.

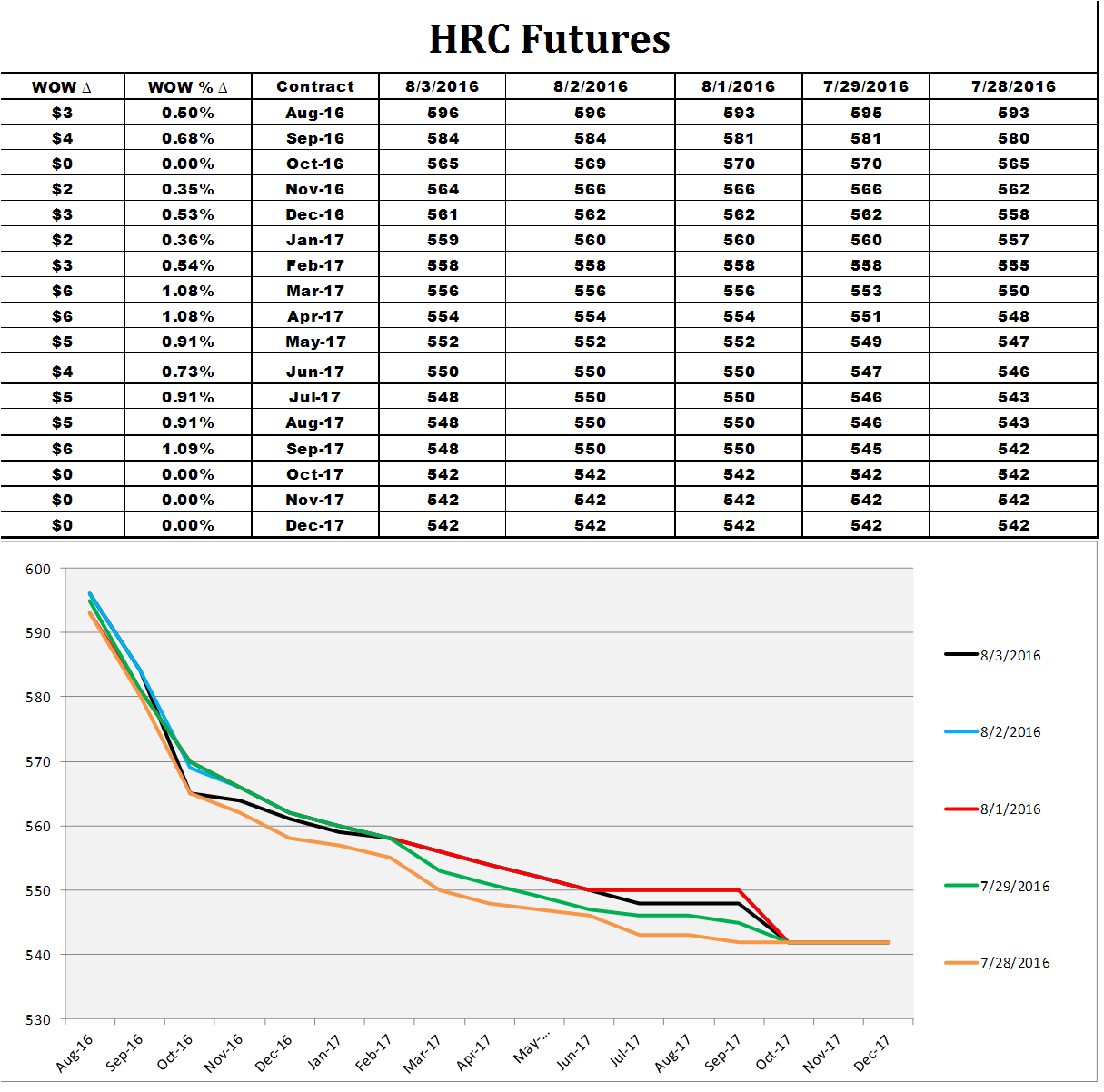

CME HRC futures continue to rally as the Midwest HRC physical price remains above $600.

The curve has been backwardated by as much as $100 below spot in the past few months. For those that locked in Q4 purchases when the curve was trading $540, they look to have made a good move thus far. The bulk of the gains over the past 10 days have come farther out in the curve, especially in first half of 2017. Every day that passes by, the curve is literally pulled toward the spot price. The conveyor belt below is a good way to think about how the mechanism works.

Another way to think about it is the way a roller coaster is pulled up a steep slope, which is even more appropriate when discussing HRC price!!!

Over the past couple months, prices have settled into a tight range. HRC prices tend to flatten for a while before having a sharp and violent move. It seems (from the shape of the curve alone) many feel that the violent move will be to the downside, but here are two major issues that could send prices much higher:

1) Risk of a major supply disruption to the already tight domestic supply.

2) A major inventory restocking to replace depleted flat rolled inventory levels as evidenced in the MSCI, ISM PMI, Durable Goods Report and GDP report.

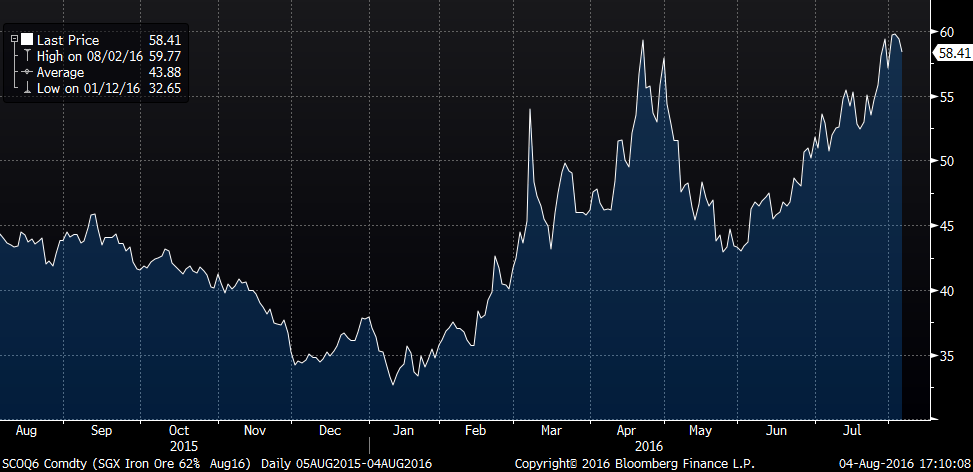

Speaking of upside surprises, how about iron ore?

Singapore Exchange August Iron Ore Futures

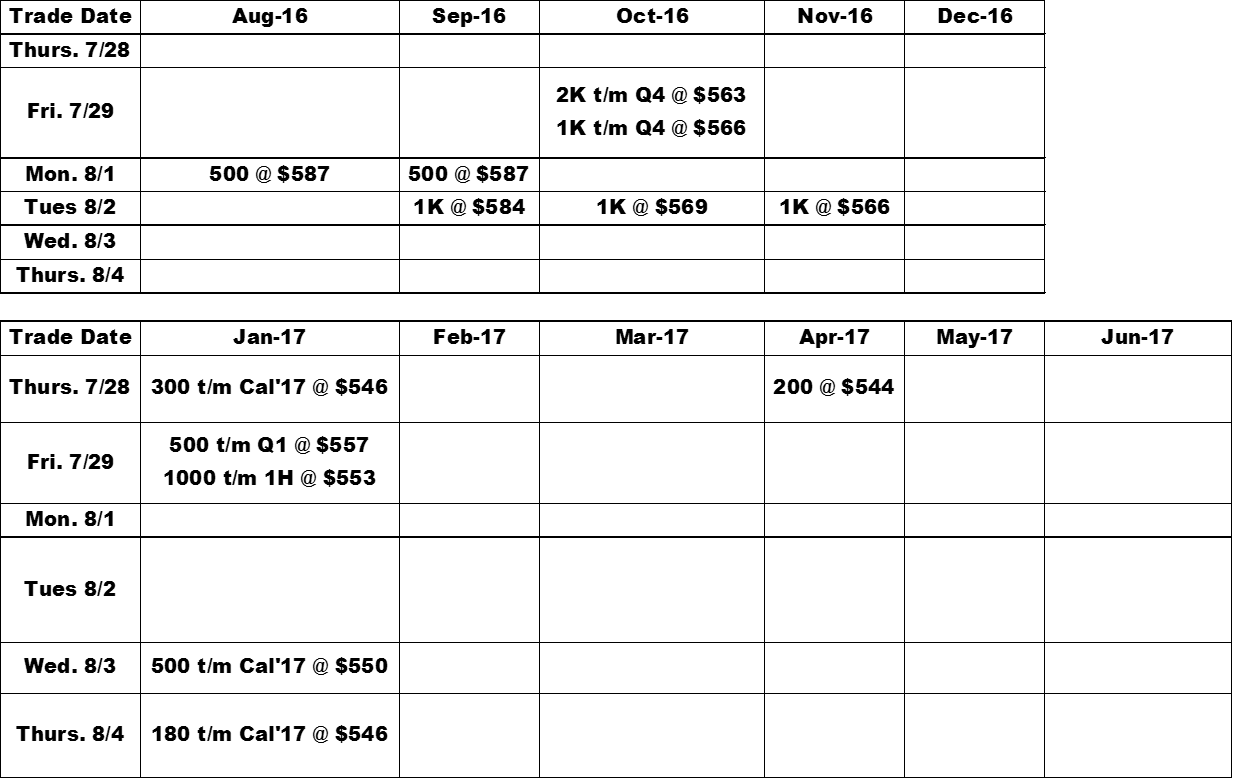

A total of 32,460 short tons traded on the CME last week with trades occurring in every months through Dec 2017. Currently, CME HRC futures open interest stands at 361,560 st. Below is a recap of trades executed since last Thursday.