Government/Policy

July 26, 2016

China Fights Back Against Trade Restrictions

Written by Sandy Williams

China is fighting back on trade restrictions imposed on export of its steel products. On July 22, Baosteel requested the U.S. International Trade Commission to uphold the suspension of the 337 investigation brought by US Steel to block all Chinese carbon and allow steel products from the US market.

Baosteel accused US Steel of trying to obtain relief on products that have already had AD/CVD duties leveled against them.

“U.S. Steel has not — and cannot — disclaim any overlap between its exceedingly broad scope of relief and the dozens of AD/CVD claims — past, present and future,” according to Baosteel’s filing. “First, U.S. steel has already received relief for dozens of categories of carbon and alloy steel products for which AD/CVD proceedings have been completed. It should not be allowed now to get a second bite at the apple it already ate.”

In another backlash to trade restrictions, China’s Ministry of Commerce said on Sunday it would impose antidumping duties on imports of grain-oriented electrical steel from Japan, South Korea, and the European Union. China claims that underpriced steel from the three countries is causing injury to domestic steel producers. Duties ranging from 37.3 percent to 46.3 percent will be imposed, said the Ministry.

These responses, and others, have come as a result to an onslaught of trade duties levied on steel products China exports to numerous countries. In just the last few weeks, Brazil imposed duties steel tubes from China, Mexico extended tariffs on cold rolled coil from China, and India mills filed petitions against dumping of Chinese wire rod.

US steel manufacturers have successfully petitioned and won AD/CVD cases on imports of corrosion resistant steel and cold rolled steel in the past month.

In 2015, 37 investigations were initiated against Chinese steel exports worldwide. China claims it is not trying to subvert market rules but that lower production costs allow it to offer its products at lower prices.

Following the final determination of duties on cold-rolled and corrosion resistant steel the China Ministry of Commerce said, “With regard to the United States’ mistaken methods that violate WTO rules, China is and will continue to take all measures, including filing suit at the WTO, to strive for fair treatment for enterprises and safeguard their export interests.”

The Ministry has said that U.S. protectionist measures will make the U.S. steel industry less competitive, and thus may harm the economy.

Said trade attorney Lewis Leibowitz in an email to SMU, “The Chinese are essentially correct–while we read a lot about Chinese violation of trade rules in this country, the press does not write about U.S. violations, which are probably more numerous than the Chinese. Most have to do with the administration of trade remedy laws (antidumping and countervailing duties). The Chinese are also correct in that closing the U.S. market to international competition (not just from China) will do lasting damage to U.S. manufacturing of products made from steel and will keep the steel industry from making necessary changes to modernize.”

The World Trade Organization is called on to intervene in many trade case disputes. The WTO lists China as a primary respondent in 35 trade disputes and as a third party respondent in 131 disputes (not exclusive to steel).

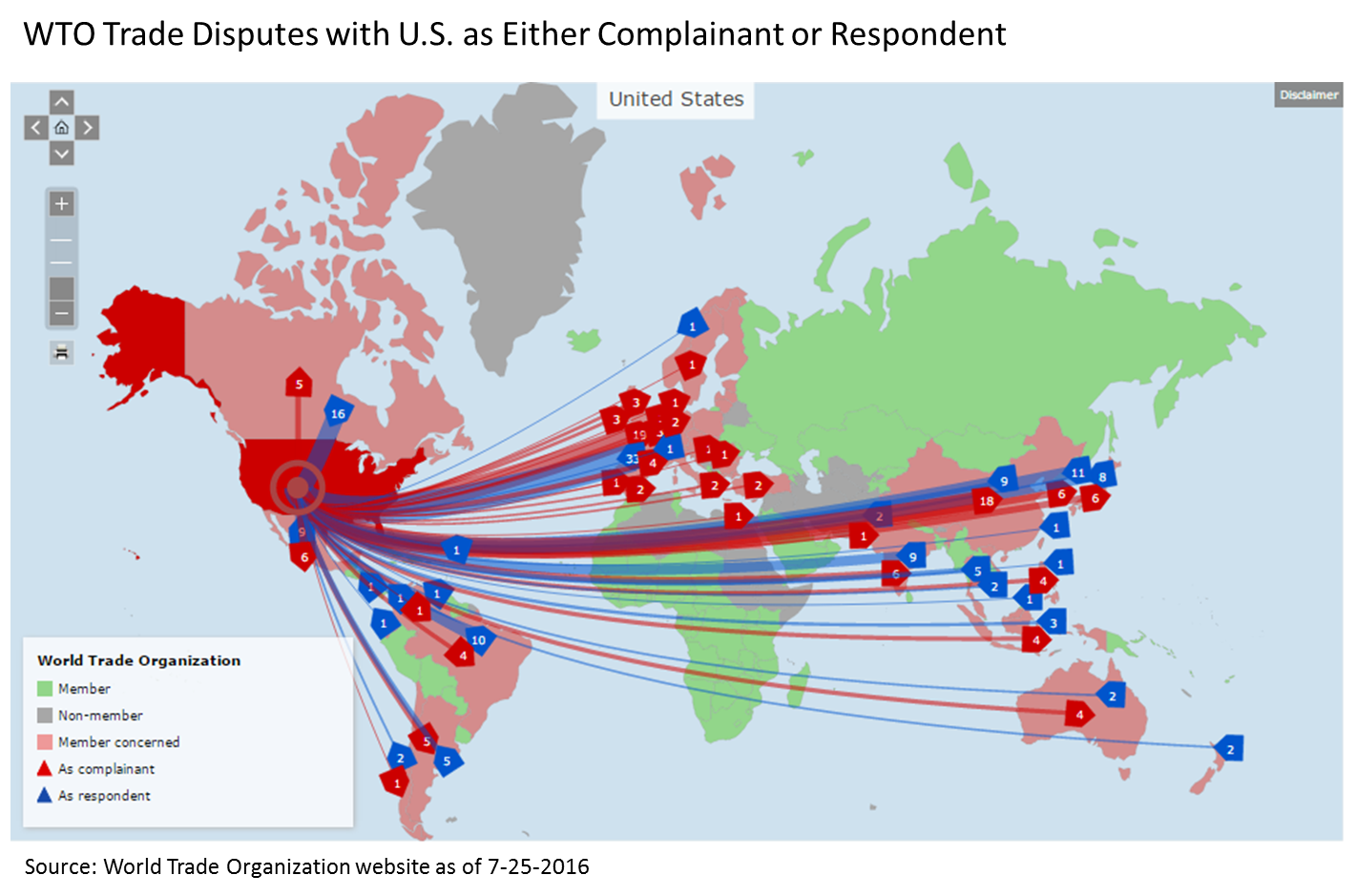

Interestingly, the U.S. is a primary respondent in 126 disputes and a third party in 132. The U.S. is currently a complainant in 110 disputes compared to China’s 13.

The chart below illustrates disputes the U.S. has either filed with the WTO or is a recipient of. As you can see, the U.S. has issues with almost every manufacturing nation on the map.

Whether trade suits are a product of protectionism or legitimate remedies to correct unfair trade practices depends on how the resulting duties impact affected industries. To the steel industry, it is a necessary step to protect domestic industry interest and level the playing field. To the downstream manufacturer it can be viewed as an unwelcome restriction on available raw materials to make the products it sells in or exports from the U.S.

In a recent comment on the cold-rolled steel case determination, AISI president and CEO Thomas Gibson said, “The U.S. trade remedy laws are the only means by which domestic industry can begin to mitigate the devastating impact from dumped and subsidized foreign imports.” His sentiment is echoed by U.S. steel producers, politicians and the United Steelworkers.

The American Institute for International Steel says the proliferation of antidumping duties is protectionism that comes at a cost to the U.S. economy. In September 2016, Lawrence Hanson, an attorney for AIIS told an ITC hearing on proposed duties for hot-rolled steel flat products would “would result in a negative effect upon the steel supply chain and, as a result, inhibit economic growth.”

A correlation has been found between improvements in trade facilitation and increased trade volume, said Hanson, and added that the inverse is also true.

“A decrease in trade translates directly into stunting economic growth,” said Hanson. “Those are precisely the kind of problems that barriers to free trade can produce. Within the steel industry, fewer restrictions upon the international steel supply chain mean greater efficiency and, therefore, increased growth.”

Trade attorney Lewis Leibowitz will discuss these issues and more at the 2016 Steel Summit in Atlanta, Georgia on August 29-31.