Market Data

July 15, 2016

Empire State Manufacturing Survey Slips in July

Written by Brett Linton

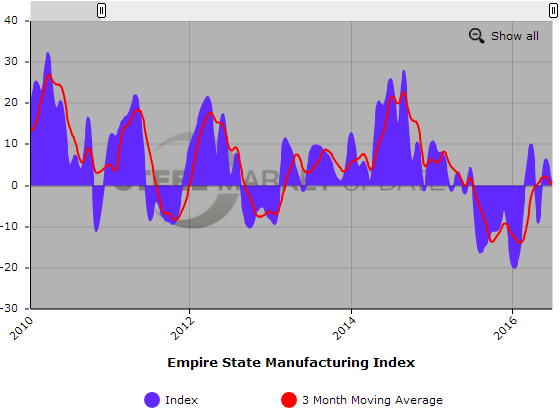

New York manufacturers reported flat general business conditions in the July Empire State Manufacturing Survey. The headline index fell from +6.01 points to +0.55, following the seesaw pattern seen over the past few months. The indexes for shipments and new orders both fell significantly to +0.70 and -1.82, respectively. In June they were +9.32 and +10.90, respectively.

The three month moving average (3MMA) of the index declined from +2.18 in June to +0.18 in July. This time last year, the 3MMA was +1.66.

The input prices index remained nearly the same at +18.68, whole while the selling prices index changed course from -1.02 to +1.10. somewhat. The inventory index suggests inventories were lower but recover from June, from -15.31 to -8.79.

Labor market conditions worsened with the number of employees index falling from 0 in June to -4.40, and the average workweek hours index just slightly declining from -5.10 to -5.49.

In the six month outlook, respondents remained optimistic about future business conditions, although not as strong as in June. The future business conditions index declined 6 points to +29.24. Indexes for future new orders and shipments were at similar levels.

The Empire State Manufacturing Survey is conducted monthly by the Federal Reserve Bank of New York.

Below is a graph showing the history of the Empire State Manufacturing Index. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.